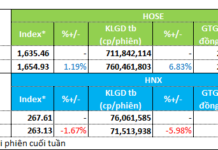

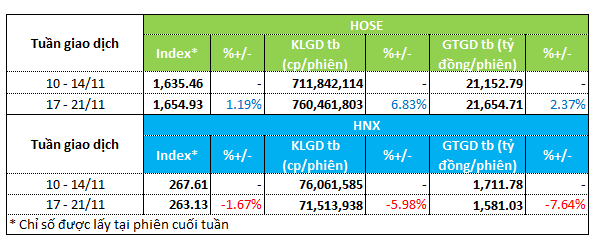

The VN-Index showed a notable improvement during the week of November 17–21. The benchmark index of the Ho Chi Minh Stock Exchange (HOSE) rose by 1.2%, closing at 1,654.93 points. In contrast, the Hanoi Stock Exchange (HNX) index declined by 1.7%, ending at 263.13 points.

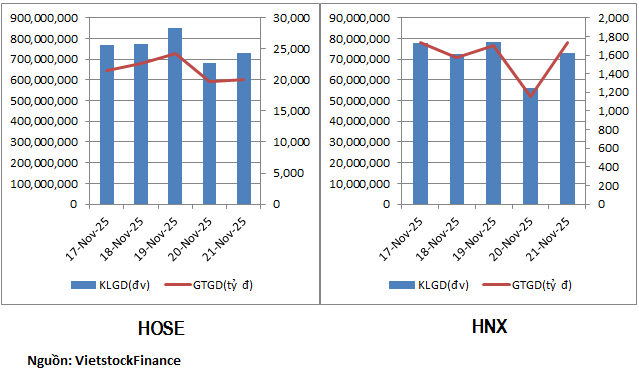

Trading activity mirrored these index movements. On the HOSE, trading volume increased by nearly 7% to over 760 million units per session, while trading value saw a modest 2.4% rise to VND 21.6 trillion. Conversely, the HNX experienced a 6% drop in average trading volume to 71.5 million units per session, and trading value fell by 7.6% to nearly VND 1.6 trillion per session.

|

Liquidity Overview for the Week of November 17–21

|

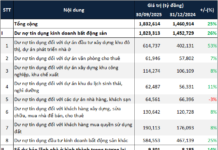

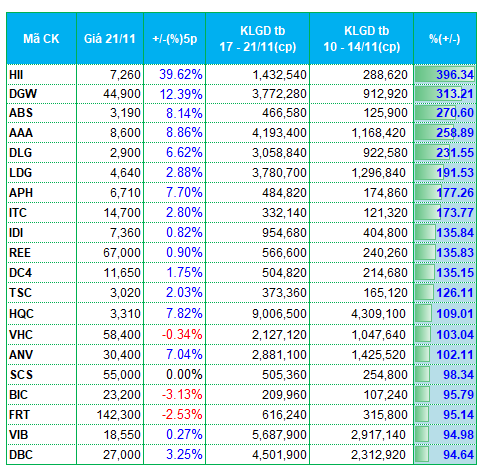

Last week’s liquidity was concentrated in seafood and food stocks. Among the top performers in liquidity were seafood stocks such as IDI, VHC, and ANV, each seeing over 100% growth in trading volume compared to the previous week.

Food stocks also saw significant liquidity increases, including CTP, BNA, VHE, and SVN. In the livestock sector, DBC stood out with strong liquidity gains.

The An Phat Group’s stocks—HII, AAA, and APH—experienced a liquidity surge. HII’s trading volume soared by nearly 400% to 1.4 million units per session, while AAA and APH saw increases of 260% and 180%, respectively, reaching 485,000 units per session.

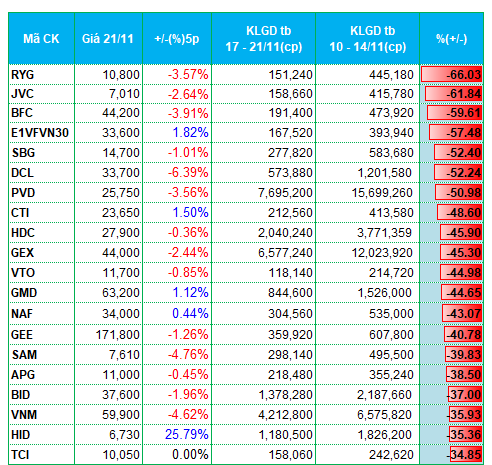

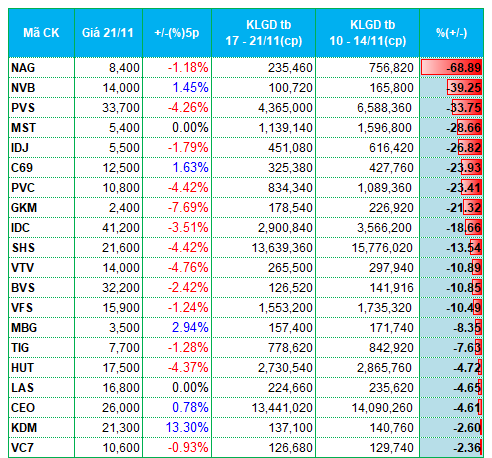

On the decline side, electrical equipment stocks dominated the list of liquidity losers. Gelex Group’s GEX and GEE saw trading volumes drop by 45.3% and 41%, respectively. SAM also recorded a nearly 40% decline. On the HNX, electrical equipment stocks NAG and MBG were among the top decliners in liquidity.

The energy sector also faced mild outflows, with PVD, PVS, and PVC reporting declines ranging from 23% to 50%.

|

Top 20 Stocks with Highest Liquidity Gains/Losses on HOSE

|

|

Top 20 Stocks with Highest Liquidity Gains/Losses on HNX

|

The list of stocks with the highest liquidity gains/losses is based on average trading volumes exceeding 100,000 units per session.

– 19:30 24/11/2025

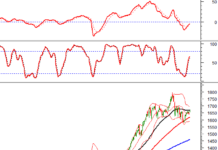

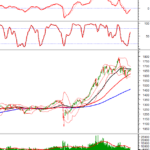

Technical Analysis Afternoon Session 24/11: Re-testing the 50-Day SMA

The VN-Index is experiencing growth, retesting the 50-day Simple Moving Average (SMA). Conversely, the HNX-Index reflects a bearish sentiment, having dipped below the middle band of the Bollinger Bands, while the Stochastic Oscillator signals a sell indication.

The Strategic Move by Chairmen of Bà Rịa – Vũng Tàu’s Top Two Real Estate Giants

Mr. Doan Huu Thuan, Chairman of the Board of Directors at Ba Ria – Vung Tau Housing Development JSC, plans to invest approximately VND 49 billion in acquiring over 492,000 HDC bonds. Meanwhile, Mr. Nguyen Hung Cuong, Chairman of DIC Corp’s Board of Directors, will purchase 6.7 million newly issued shares of DIG.

VNDirect Launches Public Offering of VND 2.000 Billion in Bonds

VNDirect is offering a total of 20 million bonds, divided into two lots, with a face value of VND 100,000 per bond, aiming to raise up to VND 2,000 billion.