Xiaomi Surpasses iPhone in Vietnam’s Smartphone Market

Omdia’s Q3/2025 report on Vietnam’s smartphone market highlights Xiaomi’s strategic leap. The Chinese tech giant secured the second position with a 19% market share by unit shipments, solidifying its status as the second-largest Android manufacturer in the country.

This achievement is particularly notable as Xiaomi outpaced Apple, which held a 17% market share, marking a reversal from Q2/2025 when Apple briefly claimed the second spot.

The 19% market share in Vietnam significantly outstrips Xiaomi’s global share of 13.6% for the same quarter, underscoring Vietnam’s importance as a key Southeast Asian market for the brand.

Vietnam’s 2025 smartphone market operates amidst complex macroeconomic conditions. Economic fluctuations have impacted consumer purchasing power, making middle-class buyers and first-time purchasers more price-sensitive. This has fueled demand for high-value products, particularly in the budget segment (typically under 5 million VND). Xiaomi’s brand positioning perfectly aligns with this market dynamic.

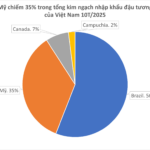

According to Omdia, Xiaomi overtook Apple to secure the second position in unit shipments, while Samsung maintained its lead with a 29% market share, bolstered by its long-standing reputation and popular Galaxy series.

Xiaomi’s edge over Apple (19% vs. 17%) stems from their contrasting strategies and target segments. Apple dominates the premium segment, but Q3 is typically a low point before new product launches, leading to reduced unit sales.

Conversely, Xiaomi focuses on the mass market. By offering feature-rich devices at lower prices, Xiaomi rapidly attracts budget-conscious consumers, driving a surge in unit sales.

What Drives Xiaomi’s Success?

Xiaomi’s success is rooted in its core philosophy: “Affordable – Powerful Specs.” This strategy appeals not only to average users but also to tech-savvy youth who meticulously compare specs before purchasing.

The 19% market share in Q3/2025 was driven by a well-segmented product portfolio. Xiaomi’s impressive lineup spans multiple segments, with the Redmi 15 series (notably the Redmi 15C) significantly expanding its reach among first-time smartphone buyers. Meanwhile, the Redmi Note 14 series remains a steady performer, and the Xiaomi 15T Series saw a 150% increase in sales compared to its predecessor, further boosting market share.

Priced at just over 3 million VND, the Redmi 15C became a 2025 sensation. It exemplifies Xiaomi’s strategy of offering mid-range features in budget devices:

The Redmi 15C features a MediaTek Helio G85 chipset, 6GB RAM (expandable), and 128GB/256GB storage. The G85 chipset delivers stable performance for daily tasks and light gaming, outperforming competitors like the realme C63 and Tecno Spark 20C.

While most budget phones offer a 60Hz refresh rate, the Redmi 15C boasts a 6.74-inch HD+ display with a 90Hz refresh rate. This smoothness significantly enhances web browsing, social media, and gaming experiences.

The device packs a 6000mAh battery (lasting 36-40 hours) and a 50MP AI-powered camera. Eliminating battery anxiety and delivering exceptional camera quality for its price point, the Redmi 15C earned the title of “People’s Smartphone.”

The POCO sub-brand played a pivotal role in boosting unit shipments. POCO’s shipments doubled year-over-year, driven by continuous launches in the budget segment.

POCO focuses on delivering maximum performance within a limited budget, targeting gamers and young users seeking powerful specs without breaking the bank. The surge in POCO shipments is a strategic tool that helped Xiaomi secure the second position in total unit sales. The multi-brand strategy (Xiaomi/Redmi/POCO) maximizes coverage across price points and consumer segments, optimizing market penetration.

Xiaomi’s Q3/2025 success in Vietnam, surpassing Apple, demonstrates the effectiveness of its volume-centric, comprehensive strategy.

The combination of high-value products and strategic investments in official retail channels and e-commerce platforms has converted smartphone users into ecosystem customers.

Moving forward, Xiaomi’s integration of premium features (90Hz displays, 6000mAh batteries, fast charging) into its Redmi and POCO lines will sustain its competitive edge against Android rivals like OPPO and Vivo in the market share battle.

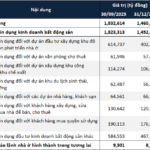

Real Estate Firms’ Listed Debt Surges 37% Since Year-Start

In line with industry trends, numerous publicly traded real estate companies have increased their borrowing in the first nine months of 2025, strategically positioning themselves for the anticipated market recovery ahead.