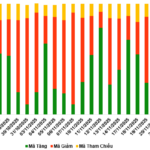

Last week, the VN-Index rose by 19.47 points to reach 1,654.93. The total trading value across the market hit 108.274 trillion VND. Conversely, the HNX-Index closed at 263.13, a decline of 4.48 points from the previous week. Liquidity on the HNX continued to shrink, with the total weekly trading value amounting to 7.906 trillion VND.

On the HoSE, foreign investors net sold 80.9 million units, with a net value exceeding 1.904 trillion VND. On the HNX, foreign investors net bought 1.48 million units, with a net value of nearly 70 billion VND.

On the Upcom market, foreign investors net sold for five consecutive sessions, totaling 3.34 million units, with a net value of over 378 billion VND. Overall, during the trading week from November 17 to 21, foreign investors net sold 82.7 million units across the market, with a total net value of 2.213 trillion VND.

Shifting Capital Flows

Mr. Đoàn Hữu Thuận, Chairman of the Board, and Mr. Lê Viết Liên, CEO of Bà Rịa – Vũng Tàu Housing Development Corporation (Hodeco – stock code: HDC), have registered to exercise their rights to purchase convertible bonds issued by HDC to the public.

Mr. Đoàn Hữu Thuận plans to invest approximately 49 billion VND in HDC bonds.

The offering includes nearly 5 million bonds, priced at 100,000 VND each. Existing shareholders are entitled to purchase bonds at a ratio of 35,671:1,000, with the purchase rights transferable only once. The bonds can be freely traded after acquisition.

Mr. Lê Viết Liên, holding 3.68% of HDC’s capital, is eligible to purchase around 184,000 bonds, equivalent to 18.4 billion VND. Mr. Đoàn Hữu Thuận, with a 9.85% stake in Hodeco, has registered to buy over 492,000 bonds, requiring approximately 49 billion VND. The purchase period runs from November 24 to December 10.

Notably, Mr. Thuận’s family also holds a significant portion of HDC shares. His wife owns 3.37%, his son Đoàn Hữu Hà Vinh, Deputy CEO of HDC, holds 2.18%, and his son Đoàn Hữu Hà An owns 1.02% of Hodeco’s capital. Other relatives also hold hundreds of thousands to millions of shares. Collectively, the group associated with Mr. Đoàn Hữu Thuận holds approximately 18% of HDC’s capital.

The convertible bond issuance was approved at the 2025 Annual General Meeting. HDC aims to raise around 500 billion VND. The bonds offer a fixed interest rate of 10% per annum for two years, with semi-annual interest payments and mandatory conversion into shares in two phases: 40% after one year and the remainder at maturity. The primary goal is to restructure bank debt by year-end.

DIC Corporation (DIC Corp – stock code: DIG) recently announced the transaction report for the exercise of stock purchase rights by insiders.

Specifically, between November 3 and 14, Mr. Nguyễn Hùng Cường, Chairman of DIC Corp’s Board, purchased only 6.7 million additional DIG shares. The transaction was incomplete due to failure to register the purchase rights within the specified period.

Mr. Nguyễn Hùng Cường acquired 6.7 million additional DIG shares.

Based on the issuance price, the Chairman invested over 80 billion VND in these shares. Following the transaction, he holds nearly 71 million DIG shares.

During the same period, Mrs. Lê Thị Hà Thành purchased 1.86 million DIG shares. The reason for the incomplete transaction was similar to Mr. Cường’s. This transaction totaled 22.4 billion VND, bringing her holdings to 18.46 million DIG shares.

Similarly, Mrs. Nguyễn Thị Thanh Huyền, Vice Chair of the Board, acquired 1.6 million additional DIG shares, valued at 19.25 billion VND. After the transaction, she holds over 16 million shares.

DIC Corp is offering 150 million shares to existing shareholders. The rights ratio is 1,000:232, meaning shareholders owning 1,000 shares will receive an additional 232 new shares. The issued shares are freely transferable. The issuance price is 12,000 VND per share, with a maximum expected raise of 1.8 trillion VND.

Two Western Enterprises List on HoSE

The Ho Chi Minh City Stock Exchange (HoSE) has announced the receipt of listing applications from An Giang Fruit and Foodstuff Corporation (Antesco – stock code: ANT). The company plans to list over 24 million shares.

Over 24 million ANT shares of An Giang Fruit and Foodstuff Corporation will be traded on HoSE.

The plan to list on HoSE was approved by Antesco shareholders through a written poll concluding on November 4. Antesco originated from the An Giang Agricultural Supply Company, established in 1975.

An Giang Agricultural and Foodstuff Import-Export Corporation (Afiex – stock code: AFX) will sell a 15% stake in Saigon – An Giang Trading Company, following approval for trading on HoSE. Afiex has appointed Mr. Đặng Quang Thái, Chairman of AFX, to handle the transfer procedures.

As of September 30, Afiex had invested 6.9 billion VND in Saigon – An Giang Trading Company, representing a 15% stake. Previously, on November 14, the Ho Chi Minh City Stock Exchange approved the listing of 35 million Afiex shares on HoSE.

Expert Insight: Sudden Market Correction Looms, Re-Testing 1,580 Support Level a Distinct Possibility

In this context, investors are advised to trade cautiously, steering clear of FOMO-driven impulses, and instead focus on observation to make informed decisions.