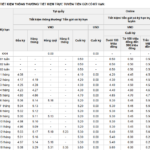

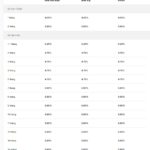

On November 23, a survey by reporters from the Labor Newspaper revealed that deposit interest rates at state-owned commercial banks such as Vietcombank, BIDV, Agribank, and VietinBank range from 4.6% to 4.7% per annum for 12-month terms.

The highest deposit interest rate at these banks is 4.8% per annum, offered by VietinBank, BIDV, and Agribank. Meanwhile, Vietcombank offers a maximum rate of 4.7% per annum for deposits of 24 months or more.

Major banks have not yet rushed to increase interest rates but have adopted alternative strategies to attract savings deposits during the year-end period.

Agribank, for instance, has launched the “Save Today, Win Gifts Instantly” savings lottery program, featuring over 3,300 prizes totaling 9.7 billion VND. Customers can participate at any Agribank transaction point nationwide.

From now until March 31, 2026 (or until promotional codes run out), individual customers depositing as little as 8 million VND for 6 months, 10 million VND for 9 months, or 15 million VND for 12 months will receive lottery codes for a chance to win attractive prizes.

The more customers save, the greater their chances of winning exciting rewards, including a grand prize of a 1 billion VND savings account.

Similarly, from now until January 16, 2026, Vietcombank customers depositing 30 million VND or more for 6, 9, 12, or 13 months via VCB Digibank or at branches will receive lottery codes for the “Spin to Win” program.

With 101 prizes totaling 4.4 billion VND, the program’s grand prize is also 1 billion VND.

State-owned commercial banks are offering promotional programs instead of raising interest rates to attract year-end savings deposits.

Vietcombank is also awarding Loyalty points until the end of 2025 for customers depositing for 6, 9, 12, or 13 months via VCB Digibank or at branches.

These points can be redeemed directly on VCB Digibank for shopping vouchers, dining, phone top-ups, and more.

VietinBank offers a special promotion for term deposit customers, including attractive gifts, cash rewards, and premium digital account numbers valued up to 5 million VND. Customers also earn double Loyalty points when depositing via iPay.

Deposits of 200 million VND or more for 1 to 36 months qualify for gifts ranging from 50,000 VND to 800,000 VND. The larger and longer the deposit, the greater the reward.

Experts note that the year-end capital mobilization drive by banks is a response to rising credit demand and slower deposit growth compared to lending.

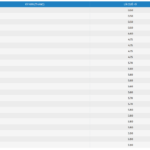

According to the State Bank of Vietnam, credit growth reached approximately 15% in the first 10 months of the year, while deposit growth remained below 10%.

State-owned commercial banks maintain stable deposit and lending rates to support businesses and economic growth.

With stable input interest rates, many banks are enhancing promotional programs to boost competitiveness and attract savings deposits.

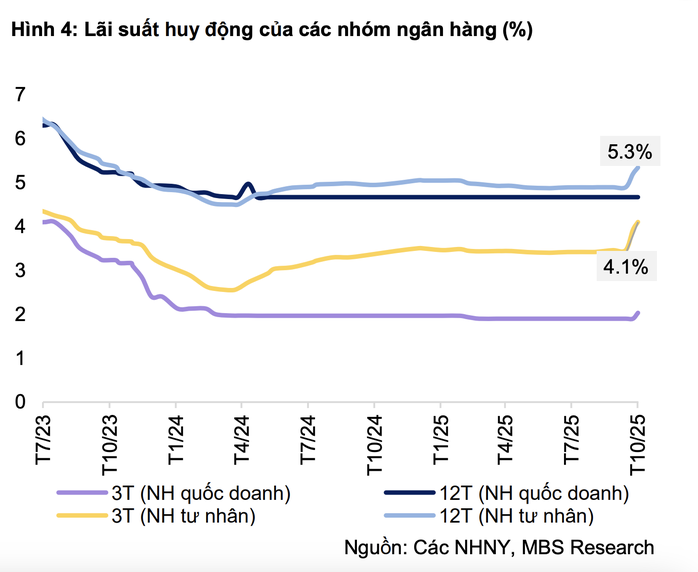

State-owned commercial banks have maintained stable deposit interest rates in recent times.

Latest Savings Interest Rate Update on November 20th: Two More Banks Raise Rates, OCB Hits Maximum Limit

Previously, approximately 20 banks had increased their deposit interest rates, including major players such as Sacombank, VPBank, MB, HDBank, and Techcombank.