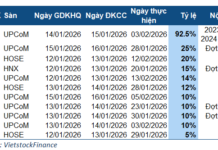

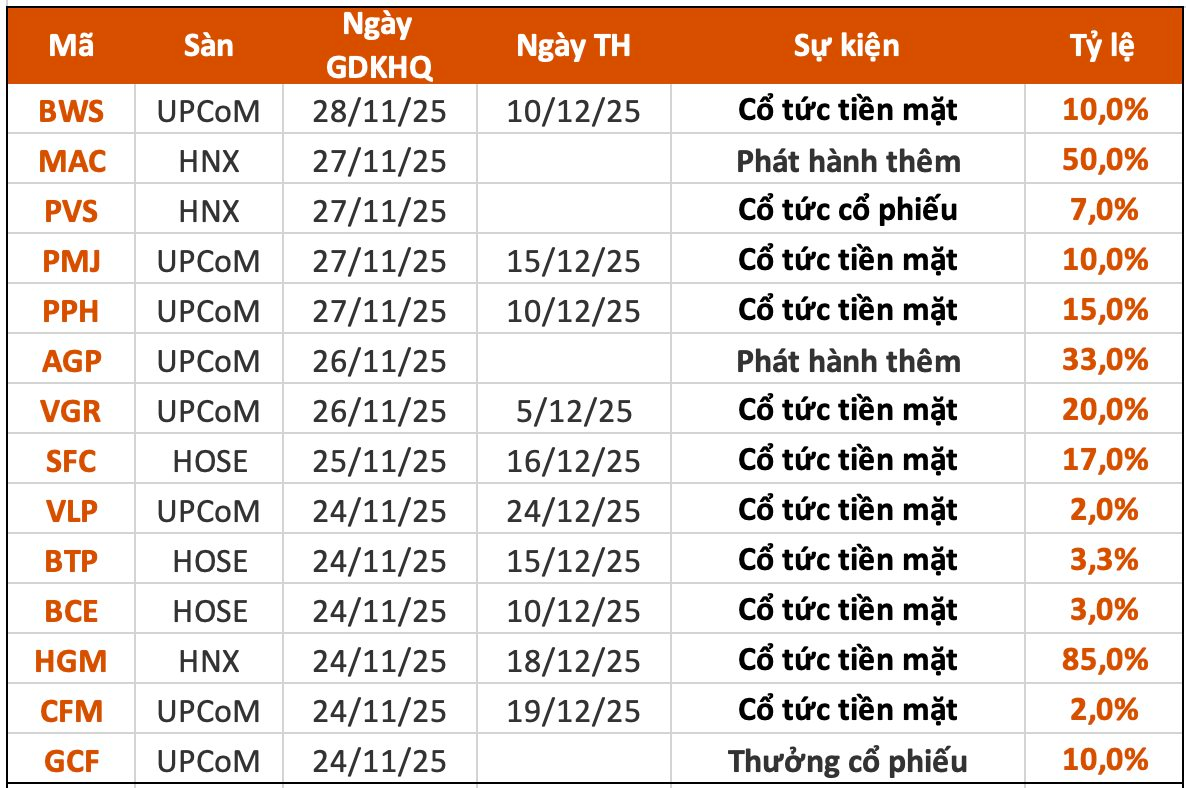

According to recent statistics, 14 companies announced dividend payout schedules for the week of November 24–28. Among these, 10 companies will distribute cash dividends, with the highest rate at 85% and the lowest at 2%. Additionally, one company will issue bonus shares, one will pay cash dividends, and two will conduct additional share issuances during this period.

Petrovietnam Technical Services Corporation (Stock Code: PVS, HNX) announced that November 28 will be the record date for issuing approximately 33.5 million shares as dividends, with a rights ratio of 100:7. This means shareholders owning 100 shares will receive 7 new shares.

The total issuance value, based on the par value, is nearly VND 334.6 billion. Upon completion, PVS’s outstanding shares will increase from nearly 478 million to over 511.4 million, raising its charter capital from approximately VND 4,779.7 billion to more than VND 5,114.2 billion.

VIP Green Port Joint Stock Company (UPCoM: VGR) will finalize the list of shareholders eligible for a 2025 interim cash dividend on November 27, at a rate of 20% (VND 2,000 per share). Payment is scheduled for December 5.

With over 82.2 million outstanding shares, the total dividend payout is expected to exceed VND 164.4 billion. Viconship (HOSE: VSC), holding a 54.4% stake, is projected to receive approximately VND 89 billion.

Ha Giang Mechanical and Mineral Joint Stock Company (Stock Code: HGM) has set November 25 as the final registration date for its second 2025 cash dividend payment, at a rate of 85% (VND 8,500 per share). Payment is expected on December 18, 2025.

With 12.6 million outstanding shares, HGM’s total dividend payout is estimated at over VND 107 billion.

Previously, the company paid a first interim dividend of 45% for 2025. Combined, the total cash dividend for the year reaches 130% (VND 13,000 per share).

The substantial dividend payout follows a significant surge in revenue and profit for the first nine months of 2025. Cumulative net revenue reached VND 606 billion, a 144% increase from the same period in 2024 (VND 248 billion). Net profit after tax stood at VND 422 billion, up 231% from VND 127 billion in 2024.

Navigating Day Trading: Essential Strategies for Investors to Avoid Losses in the Stock Market

As the stock market anticipates the implementation of T+0 settlement, liquidity is surging, offering investors ample opportunities. However, this heightened activity also necessitates robust defensive strategies to mitigate potential risks.

Upcoming Dividend Payout of VND 2,000 per Share Sparks Strong Rally in Stock Price

With over 82.2 million outstanding shares, the total payout for this dividend distribution is estimated to exceed 164.4 billion VND.

Vietstock Daily 20/11/2025: Is Market Volatility Emerging?

The VN-Index has paused its upward momentum, retesting the middle band of the Bollinger Bands. This level serves as a critical support threshold that the index must hold to sustain its short-term recovery. Meanwhile, both the Stochastic Oscillator and MACD continue to signal buying opportunities, supported by gradually improving liquidity. Should trading volume surpass its 20-day average in upcoming sessions, the index’s outlook would turn increasingly positive.