VNDirect Securities Corporation (stock code: VND, listed on HoSE) has announced a public bond offering under the Certificate of Registration No. 421/GCN-UBCK, issued by the Chairman of the State Securities Commission on November 17, 2025.

Specifically, VNDirect will issue a total of 20 million bonds in two tranches, with a face value of VND 100,000 per bond, aiming to raise up to VND 2,000 billion.

The first tranche consists of 10 million bonds with the code VNDL2527001, a 2-year term, and an initial fixed interest rate of 8% per annum. Subsequent interest periods will have a floating rate equal to the reference rate plus a 2.8% margin. Interest will be paid semi-annually.

The second tranche includes 10 million bonds with the code VNDL2528002, a 3-year term, and an initial fixed interest rate of 8.3% per annum. Subsequent interest periods will have a floating rate equal to the reference rate plus a 3% margin. Interest will also be paid semi-annually.

These bonds are non-convertible, unsecured, and do not come with warrants, establishing a direct debt obligation for the issuer.

Individual investors can purchase a minimum of 100 bonds, equivalent to VND 10 million, while institutional investors must buy at least 10,000 bonds, equivalent to VND 1 billion.

The subscription and payment period for the bonds is from November 21 to December 12, 2025. The bondholder representative is Saigon – Hanoi Securities Corporation (SHS).

With the expected VND 2,000 billion proceeds, VNDirect plans to allocate VND 1,200 billion for margin lending and VND 800 billion for investing in securities. The disbursement is scheduled for Q4/2025 or Q1-Q2/2026.

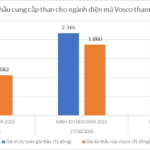

As of September 30, 2025, VNDirect reported short-term debt of VND 31,800 billion, an increase of VND 5,600 billion compared to the previous quarter. This includes VND 250 billion in short-term bond issuance.

In terms of business performance, VNDirect recorded a 9-month cumulative operating revenue of VND 5,213 billion, a 27% increase year-on-year. Pre-tax profit reached VND 2,131 billion, and post-tax profit was VND 1,680 billion, up 18% and 15% respectively compared to the same period last year.

As of September 30, 2035, VNDirect’s total assets grew by 27% since the beginning of the year, reaching VND 56,061 billion.

The FVTPL asset portfolio has a principal value of VND 24,417 billion, currently yielding a profit of approximately VND 200 billion. This includes over VND 14,300 billion invested in bonds and over VND 7,900 billion in deposit certificates.

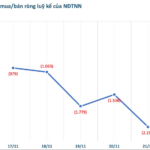

The listed equity investment portfolio totals VND 1,362 billion, with HSG holding the largest share, while MSN, MWG, and REE have increased their allocations to over VND 100 billion each. All these equity investments are currently profitable.

In the unlisted equity and fund certificate portfolio, VNDirect significantly reduced its investment in TNRE from VND 1,350 billion at the beginning of the year to less than VND 300 billion.

VNDirect increased its lending debt by VND 4,500 billion, bringing the total to VND 14,843 billion. Held-to-maturity (HTM) investments also rose from VND 5,561 billion to nearly VND 10,485 billion.

MBS to Issue Over 342 Million Shares in Capital Expansion Move

Having recently completed two successful share issuances, MBS is now presenting shareholders with a capital increase plan involving the issuance of over 342 million shares through an ESOP program and a rights offering.

Hodeco Chairman and CEO Register to Purchase Convertible Bonds

Chairman of the Board of Directors Doan Huu Thuan and CEO Le Viet Lien have registered to exercise their rights to purchase convertible bonds issued by Hodeco.