Technical Signals of VN-Index

During the morning trading session on November 25, 2025, the VN-Index experienced modest growth, fluctuating around the 50-day SMA line.

Trading volume consistently remained below the 20-day average, indicating investor caution.

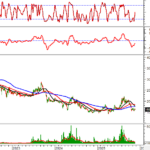

Technical Signals of HNX-Index

In the morning session on November 25, 2025, the HNX-Index entered its sixth consecutive declining session and is currently trading below the Middle line of the Bollinger Bands.

The Stochastic Oscillator has reissued a sell signal, and the MACD has followed suit, heightening risk levels.

HAG – Hoang Anh Gia Lai Joint Stock Company

On the morning of November 25, 2025, HAG shares rose for the third consecutive session, forming a Three White Soldiers candlestick pattern. Increased trading volume, surpassing the 20-session average, reflects investor optimism.

HAG prices continued to rebound after retesting the upper boundary (17,200-17,700 range) of the previously broken Ascending Triangle pattern. The MACD indicator’s higher highs and higher lows further support the current upward momentum.

If positive conditions persist, the potential price target is the 21,600-22,000 range.

KBC – Kinh Bac Urban Development Corporation

KBC shares rebounded during the morning session on November 25, 2025, with trading volume exceeding the 20-session average, indicating increased investor activity.

The MACD indicator maintains a buy signal, crossing above the zero line, while prices have moved above the 50-day SMA. Sustained positive signals will strengthen the recovery trend.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Signals and conclusions are for reference only and may change after the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 12:10, November 25, 2025

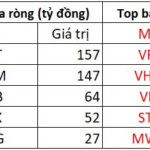

Pham Nhat Vuong Closes in on the Top 100 World Billionaires List

The Vingroup stock cluster continues to soar to new heights, propelling the VN-Index upward despite intense market polarization. In a single day, Pham Nhat Vuong’s wealth surged by $784 million, edging him closer to joining the ranks of the world’s 100 wealthiest individuals.