The stock market kicked off the final week of November 2025 with a positive session. The VN-Index opened higher, albeit with low liquidity, targeting the 1,670-point mark before facing some volatility and adjustments. However, the market gained momentum in the afternoon session, with liquidity improving. At the close, the VN-Index rose by 13.05 points (+0.69%) to 1,667.98 points, comfortably above the 1,645-point support level.

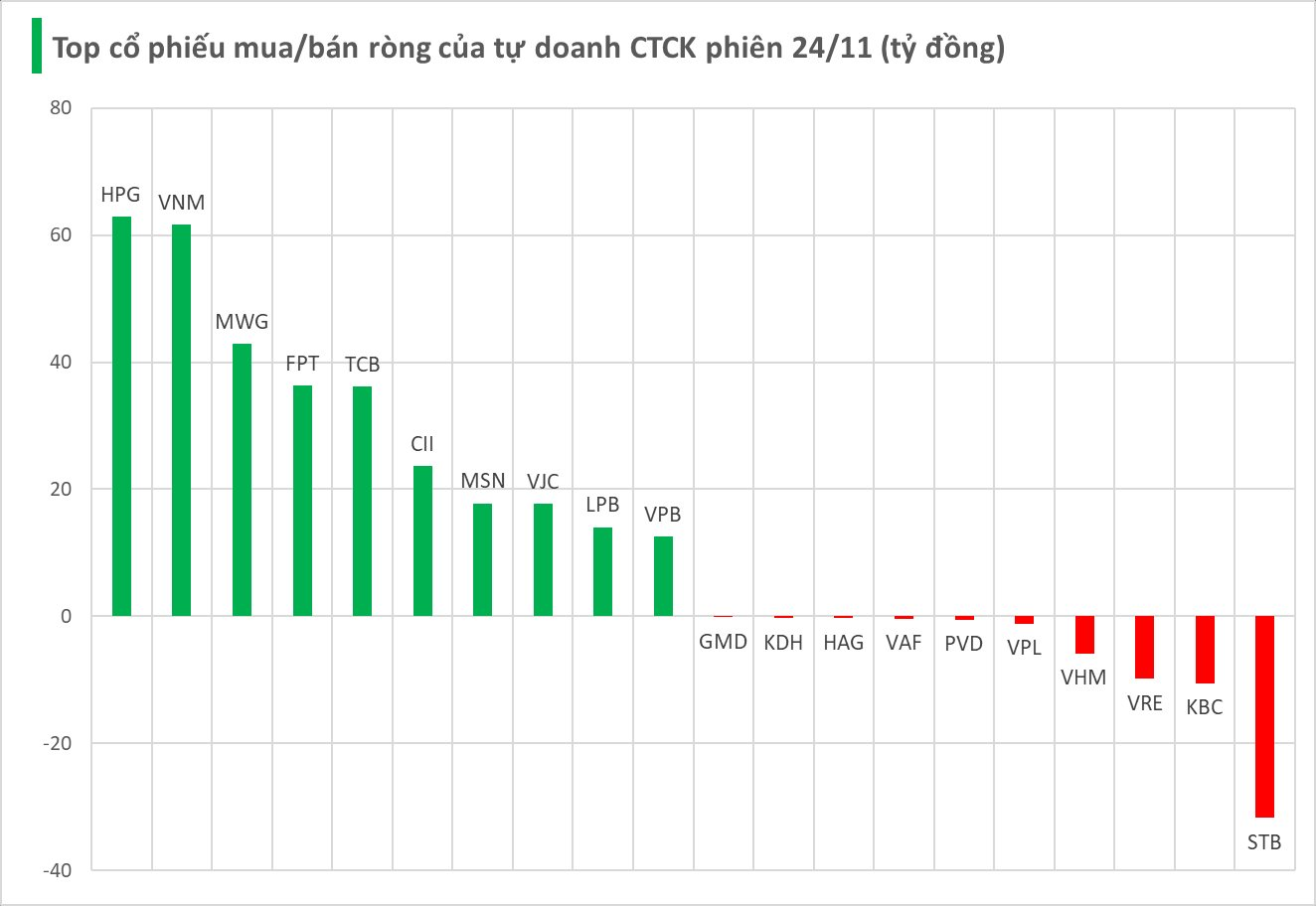

Securities firms’ proprietary trading desks net bought VND 364 billion on HOSE.

Specifically, HPG saw the strongest net buying at VND 63 billion, followed by VNM (VND 62 billion), MWG (VND 43 billion), FPT (VND 36 billion), TCB (VND 36 billion), CII (VND 24 billion), MSN (VND 18 billion), VJC (VND 18 billion), LPB (VND 14 billion), and VPB (VND 13 billion) – all among the actively net-bought stocks by proprietary trading desks.

Conversely, the strongest net selling was observed in STB, with a value of -VND 32 billion, followed by KBC (-VND 11 billion), VRE (-VND 10 billion), VHM (-VND 6 billion), and PVD (-VND 1 billion). Other stocks also recorded net selling pressure, including VPL, GMD, KDH, and HAG…

Stocks Rise Amid Uncertainty: Latest Forecast for Next Week

The stock market has closed in the green for two consecutive weeks, fueling optimism for a continued recovery in the upcoming week.

Market Pulse 24/11: Divergence Persists as Vingroup Stocks Continue to Shine

At the close of trading, the VN-Index climbed 13.05 points (+0.79%) to reach 1,667.98, while the HNX-Index dipped 1.91 points (-0.73%) to 261.22. Market breadth tilted toward decliners, with 370 stocks falling and 298 advancing. The VN30 basket saw red dominate, as 18 constituents declined, 10 rose, and 2 remained unchanged.

Vietstock Daily 25/11/2025: Cautious Growth on the Horizon?

The VN-Index has resumed its upward trajectory, approaching the 50-day SMA. A decisive break above this level, coupled with trading volume surpassing the 20-day average, would confirm the bullish momentum. The MACD indicator continues its ascent following a buy signal, and a crossover above the zero line in upcoming sessions would further strengthen the short-term outlook.