Rare earth elements are a group of strategic minerals indispensable to modern mechanical technology. From smartphones and medical devices to weapon systems and electric vehicles, all rely heavily on these materials. In the global supply chain, China is not merely a supplier but a dominant force, controlling nearly the entire final product processing pipeline.

China’s Overwhelming Dominance

China controls approximately 70% of the global rare earth production. However, Beijing’s true power lies in its deep processing capabilities, particularly for heavy rare earth elements. The country holds a staggering 99% of the world’s heavy rare earth refining capacity. Heavy rare earths like dysprosium and terbium are crucial for high-temperature resistant permanent magnets with long-lasting magnetic properties.

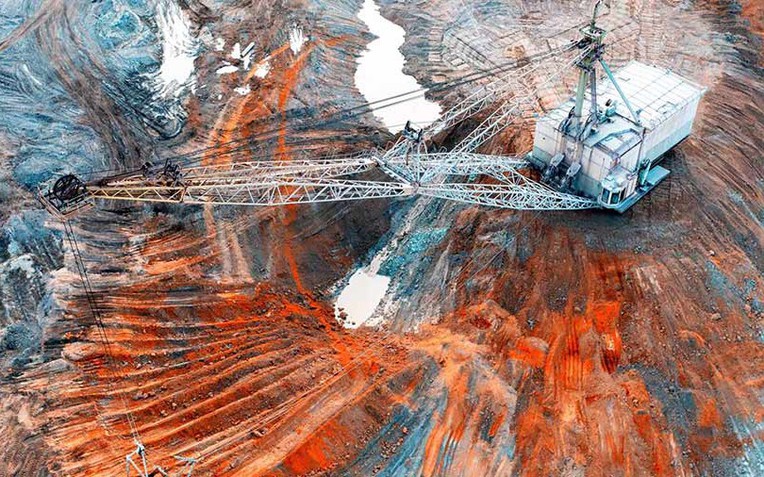

Rare earth mining at a site in China

Currently, China produces 90% of the world’s permanent magnets, totaling 200,000 tons annually. These magnets, typically made from iron and neodymium alloys (a rare earth element), are ten times stronger than conventional magnets and are essential for electric vehicle motors and numerous high-tech devices. An average electric car uses about 0.5 kg of rare earths, while hybrids contain 1-5 kg, valued between $50 and $200.

This absolute control allows China to wield rare earths as a strategic tool. In April 2025, Beijing tightened rare earth exports, citing national security and non-proliferation obligations.

This move caused significant disruptions and delays for international manufacturers, particularly in the automotive industry. Companies seeking to export heavy rare earths and derivatives must obtain individual permits for each foreign customer. Many applications are rejected due to minor administrative errors, highlighting inconsistencies in China’s local procedures.

How Much Rare Earth Does Vietnam Possess?

As the world seeks alternative supplies, Vietnam emerges as a potential candidate due to its significant rare earth reserves. In March, the U.S. Geological Survey (USGS) revised Vietnam’s estimated reserves from 22 million tons (2nd globally) to 3.5 million tons in its 2025 report, dropping Vietnam to 6th place.

This adjustment stems from updated data from Vietnamese government reports. Despite substantial reserves, Vietnam’s actual production remains low, reaching only 300 tons of rare earth oxides last year, with large-scale production yet to commence. This indicates that Vietnam’s ambition to become a rare earth powerhouse faces significant technological and investment challenges.

Rare earth mining in Vietnam is concentrated in the Northwest and Central Highlands, focusing on hydrothermal light rare earth deposits. Key mining sites include Bắc Nậm Xe, Nậm Xe, Đông Pao (Lai Châu), Mường Hum (Lào Cai), and Yên Phụ (Yên Bái).

Smaller deposits are scattered along the coast from Quảng Ninh to Vũng Tàu.

Despite reduced reserve estimates, recent cooperation agreements with the U.S. on critical minerals maintain opportunities for Vietnam to develop this industry, emphasizing deep processing to maximize remaining resources.

Source: Compiled

“Unbelievable Discovery: 64 Shallow Drill Holes Uncover Ultra-High-Grade Rare Earth Deposit, Leaving Mining CEO Stunned: ‘We’ve Never Seen Anything Like This Before’”

This could lay the foundation for the nation to emerge as one of the world’s leading rare earth powerhouses.