Vietnam Construction and Trading Investment Corporation (CTX Holdings, UPCoM: CTX) announced that its 2025 Extraordinary Shareholders’ Meeting held on November 21 approved the resolution to delist the company (become a non-public company) as per regulations.

CTX is currently a public company. After the shareholders’ approval of the delisting plan, even if CTX no longer meets the criteria for a public company, it will remain a public entity until the State Securities Commission revokes its public status.

The meeting also elected the Board of Directors for the 2025-2030 term, including Mr. Phan Minh Tuan (Chairman), Mr. Ly Quoc Hung, Mr. Tran Anh Hai, Mr. Pham Sy Thiep, and Ms. Hoang Thi Huong Lan. The Supervisory Board consists of three members: Mr. Ly Van Kha, Mr. Bui Hong Quang, and Ms. Phan Thi To Hoa.

CTX Holdings, originally a state-owned enterprise established by the Ministry of Construction in 1982, was privatized in late 2007 and listed on the HNX in 2012. However, by the end of 2023, CTX shares were forcibly delisted and moved to UPCoM due to severe violations of information disclosure obligations.

Following CTX’s announcement of additional materials for the extraordinary meeting proposing the revocation of public company status on November 19, CTX shares experienced four consecutive trading sessions of decline, including two sessions on November 21 and 24 that hit the floor price, with over 1 million shares left unsold.

The price dropped by more than 27% to 11,200 VND per share over four sessions and by 47% over three months. Notably, trading volume on November 21 surged to nearly 657,000 units, 2.5 times higher than the previous session and the highest in the past three months.

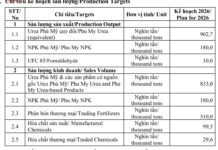

| CTX Share Price Movement Since June |

Massive Profits from Prime Land Sale in Hanoi

CTX Holdings seeks to delist amid a significant surge in Q3/2025 performance, with net revenue exceeding 5.873 trillion VND, 156 times higher than the same period last year, and net profit surpassing 216 billion VND, 98 times higher, marking the highest level in nearly eight years (since Q1/2018).

| CTX Net Profit Since Q1/2018 |

For the first nine months, net revenue reached nearly 5.957 trillion VND, and profit was approximately 217 billion VND, 56 and 59 times higher year-on-year, respectively. With these results, CTX Holdings has achieved 86% of its annual profit target.

The primary driver was the real estate segment, contributing nearly 5.852 trillion VND in revenue and over 290 billion VND in gross profit, thanks to the transfer of the Constrexim Complex project—a commercial, residential, and office development at A1-2, Cau Giay New Urban Area, Hanoi.

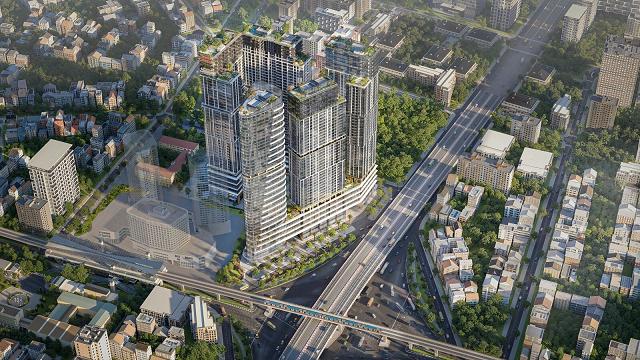

The Constrexim Complex is strategically located, bordering three major roads: Xuan Thuy, Pham Hung, and Tran Quoc Vuong. The 2.5-hectare site, formerly a temporary agricultural market, is planned to feature five towers ranging from 38 to 45 stories.

Constrexim Complex boasts three prime facades in Hanoi

|

CTX Holdings Divests from Prime Three-Facade Project in Hanoi

Project costs were fully recognized by the end of Q3/2025. Earlier in the year, CTX invested over 464 billion VND in the project, increasing it to nearly 5.382 trillion VND by the end of June, coinciding with the receipt of a 4.965 trillion VND deposit for the Constrexim Complex transfer from Vietnam Minh Hoang Investment and Construction JSC (part of Sun Group). Post-transfer, the project was renamed Sun Feliza Suites.

Established in April 2010 in Hanoi, Vietnam Minh Hoang Investment and Construction JSC is led by Ms. Ha Thi Kim Nhung as Director and legal representative. As of late June, the company had a charter capital of 3.480 trillion VND. Its total liabilities exceeded 5.937 trillion VND, 2.8 times higher than the first half of 2024, due to a 3.4 trillion VND bond issuance. The company earned over 20 billion VND in profit in the first half of the year, a 61% decline year-on-year.

Rendering of Sun Feliza Suites. Source: Sun Group

|

Significant Shareholder Structure Changes

Alongside the transfer, CTX’s shareholder structure shifted as several major shareholders and leaders divested in the first half of the year. Ms. Nguyen Thi Kim Xuan sold her entire 24.47% stake; Vietnam Modern Limited Liability Bank reduced its stake from 6.11% to 4.74%, ceasing to be a major shareholder.

Additionally, three Board of Directors members—Ms. Chu Thi Hong Hanh, Mr. Ly Quoc Hung, and Mr. Tran Khanh—divested their holdings. Ms. Hanh sold all 5 million CTX shares (6.42%), Mr. Khanh sold nearly 30,000 shares (0.04%), and Mr. Hung sold over 24,100 shares (0.03%), marking a clear withdrawal of the former leadership.

Conversely, three newly established companies in 2025 became major CTX shareholders: AMAI Investment JSC (14.95%), FTM Investment JSC (14.53%), and PENS Construction JSC (8.38%).

Notably, all three companies share the same registered address as CTX Holdings and are linked to its leadership, including Mr. Phan Minh Tuan (Chairman) and Mr. Ly Quoc Hung (Board Member).

FTM Investment, established in mid-June 2025, focuses on real estate. With a charter capital of nearly 75 billion VND, its founding shareholders include Mr. Nguyen Viet Hung (99%), Mr. Bui Duy Hung (Director and legal representative), and Ms. Ha Thi Kim Nhung (0.5% each). On August 4, Mr. Ly Quoc Hung assumed the role of Director and legal representative.

PENS Construction, also founded in mid-June, operates in the same sector as FTM Investment. With a charter capital of 114.7 billion VND, its shareholders include Mr. Nguyen Hoang Anh Quan (99%), Ms. Vu Hoai Trang, and Mr. Nguyen Phan Giang (Director and legal representative, 0.5% each). On August 4, Mr. Ly Quoc Hung took over as Director and legal representative.

AMAI Investment, established in March, has a charter capital of 81 billion VND. Initially owned by Mr. Pham Thanh Mai, it was acquired by Thang Long Fundings JSC on August 26, with Mr. Tran Anh Hai as CEO and legal representative.

According to the 2025 semi-annual governance report, aside from these new entities, CTX has two other institutional shareholders: Hoa Binh Fundings JSC (15%) and Thang Long Fundings JSC (19.16%), both linked to Mr. Tuan, who directly holds 1.49% of the capital.

Major CTX Shareholders Exit, Making Way for New Entities

– 22:53 24/11/2025

Thanh Xuan Corporation Completes Early Redemption of Entire Bond Issuance

Thanh Xuan Joint Stock Company (TXCC) has successfully repurchased over VND 583 billion worth of bonds ahead of schedule, originally due for maturity in 2030.

Thanh Xuan Corporation Completes Early Redemption of Entire Bond Issuance

Thanh Xuan Joint Stock Company (TXCC) has successfully repurchased over VND 583 billion worth of bonds ahead of schedule, originally due for maturity in 2030.