This information helped DPG shares edge up by 0.11% on November 25, amidst a 0.46% decline in the VN-Index.

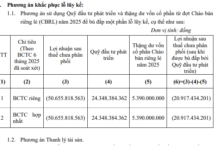

According to the extraordinary shareholders’ resolution announced on October 28, the private placement price per share will be set at no less than 1.5 times the book value. Consolidated financial reports as of Q3/2025 indicate that Dat Phuong’s book value stands at approximately VND 27,827 per share. Consequently, the capital raised by the Group could exceed VND 740 billion.

A portion of this capital is expected to fund Dat Phuong’s ultra-white glass production plant project, through capital contributions to its subsidiary executing the project. On November 24, Dat Phuong’s leadership approved the allocation of nearly VND 128 billion to acquire additional shares from the existing issuance of Dat Phuong Glass JSC. Following these transactions, the Group’s ownership in the subsidiary will increase from 73% to approximately 81%.

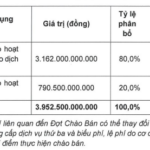

Returning to the capital raised from the private placement, the majority will be allocated to working capital and invested in the integrated resort project in Binh Duong Commune, Thang Binh District, Quang Nam Province (pre-merger) – now part of Da Nang City.

|

Purpose of Capital from Private Placement

Source: Extraordinary Shareholders’ Meeting Minutes of Dat Phuong, announced on October 28, 2025

|

– 15:58 25/11/2025

JVC Invests in New Pharmaceutical Venture

The Board of Directors of Vietnam Investment and Pharmaceutical Joint Stock Company (HOSE: JVC) has approved the establishment of a subsidiary with a chartered capital of 250 billion VND. Named Vietnam Pharmaceutical Investment and Trading Joint Stock Company, this subsidiary will primarily focus on pharmaceutical trading. JVC will hold a 98% stake in the new entity.

VCI Sets Private Placement Price at VND 31,000, Attracting Foreign Institutions Willing to Invest Hundreds of Billions

The Board of Directors of Vietcap Securities Corporation (HOSE: VCI) has recently passed a resolution to issue 127.5 million private placement shares, aiming to increase its charter capital to VND 8,501 billion. The offering has attracted significant interest, with 69 investors, including both institutions and individuals, expressing their intent to purchase tens of millions of shares.

VCI Approves Private Placement of Up to 127.5 Million Shares, Anticipating 10-20% Profit Surge in Annual Plan

On the afternoon of November 7thOn the afternoon of November 7th, Vietcap Securities Corporation (HOSE:On the afternoon of November 7th, Vietcap Securities Corporation (HOSE: VCI) held an extraordinary shareholders’ meeting to discuss and vote on a private placement plan, the establishment of an overseas subsidiary, and amendments to the company’s charter. During the meeting, shareholders expressed keen interest in theOn the afternoon of November 7th, Vietcap Securities Corporation (HOSE: VCI) held an extraordinary shareholders’ meeting to discuss and vote on a private placement plan, the establishment of an overseas subsidiary, and amendments to the company’s charter. During the meeting, shareholders expressed keen interest in the company’s business prospects and changes in executive leadership.