I. FUTURE CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

Most VN30 futures contracts declined during the trading session on November 25, 2025. Specifically, VN30F2512 (F2512) dropped by 0.15% to 1,908.1 points; 41I1G1000 (I1G1000) rose by 0.01% to 1,906.2 points; 41I1G3000 (I1G3000) fell by 0.04% to 1,904 points; and 41I1G6000 (I1G6000) decreased by 0.42% to 1,903 points. The underlying index, VN30-Index, closed at 1,909.6 points.

Additionally, all VN100 futures contracts declined during the same session. Notably, 41I2FC000 (I2FC000) fell by 0.12% to 1,807.8 points; 41I2G1000 (I2G1000) dropped by 0.41% to 1,800.6 points; 41I2G3000 (I2G3000) decreased by 0.47% to 1,790.4 points; and 41I2G6000 (I2G6000) slipped by 0.06% to 1,789.9 points. The underlying index, VN100-Index, closed at 1,803.41 points.

During the November 25, 2025 session, VN30F2512 opened with prolonged sideways movement around the reference level, despite Long traders’ efforts to push it higher. By the end of the morning session, the contract failed to break out. In the afternoon, selling pressure intensified, giving sellers the upper hand and causing F2512 to plummet below the 1,910-point mark. It closed at 1,908.1 points, nearly 3 points lower than the previous session.

Intraday Chart of VN30F2512

Source: https://stockchart.vietstock.vn/

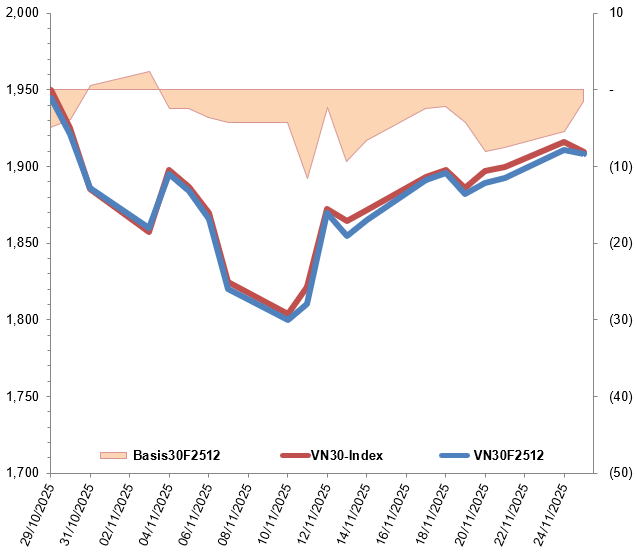

By the close, the basis of the F2512 contract narrowed compared to the previous session, reaching -1.5 points. This indicates that investor sentiment has become less pessimistic.

Fluctuations of VN30F2512 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

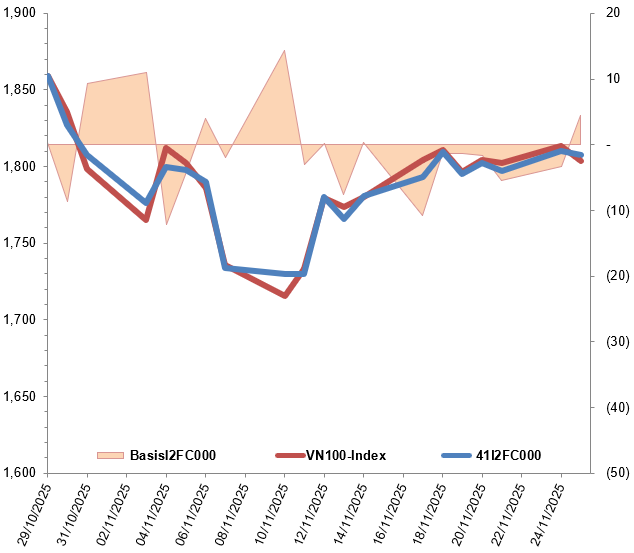

Meanwhile, the basis of the I2FC000 contract reversed from the previous session, reaching 4.39 points. This suggests that investor sentiment has turned more optimistic.

Fluctuations of 41I2FC000 and VN100-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN100-Index

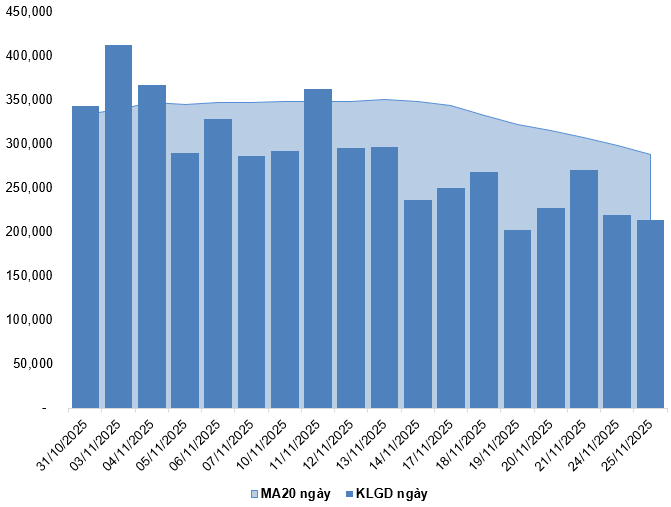

Trading volume and value in the derivatives market decreased by 2.25% and 2.64%, respectively, compared to the November 24, 2025 session. Specifically, F2512 trading volume fell by 2.12%, with 213,824 contracts matched. I2FC000 trading volume dropped by 66.27%, with only 56 contracts traded.

Foreign investors resumed net selling, with a total net sell volume of 659 contracts during the November 25, 2025 session.

Daily Trading Volume Fluctuations in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

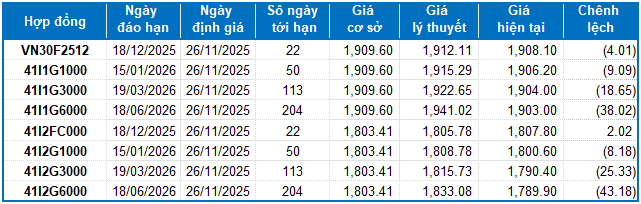

I.2. Valuation of Futures Contracts

Based on the fair pricing method as of November 26, 2025, the reasonable price range for actively traded futures contracts is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the valuation model have been adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each futures contract.

I.3. Technical Analysis of VN30-Index

During the November 25, 2025 session, VN30-Index reversed after three consecutive up sessions, forming a small-bodied candlestick pattern. This was accompanied by increased trading volume, surpassing the 20-session average, indicating less optimistic investor sentiment.

Additionally, the Bollinger Bands are narrowing, while the ADX indicator continues to weaken, remaining in the gray zone (20 < adx < 25).

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

II. FUTURE CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of November 26, 2025, the reasonable price range for actively traded bond futures contracts is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the valuation model have been adjusted to suit the Vietnamese market. Specifically, the risk-free rate (government treasury bills) is replaced by the average deposit rate of major banks, with maturity adjustments for each futures contract.

According to the above valuation, contracts GB05F2512, 41B5G3000, 41B5G6000, and 41BAG6000 are currently attractively priced. Investors should focus on and consider buying these futures contracts in the near term, as they offer excellent value in the market.

Economic Analysis & Market Strategy Division, Vietstock Consulting Department

– 18:28 25/11/2025

Derivatives Market Update: Investor Sentiment Continues to Strengthen on November 25, 2025

On November 24, 2025, both the VN30 and VN100 futures contracts surged in a synchronized rally. The VN30-Index marked its third consecutive day of gains, closing above the 50-day SMA, signaling sustained investor optimism.