DSC Securities Corporation (stock code: DSC, listed on HoSE) has recently released a report detailing the results of its rights issue to existing shareholders.

As of November 21, DSC successfully allocated all 35.3 million shares to 1,129 shareholders. Among these, 35.12 million shares were distributed to 1,128 shareholders between October 13 and November 11, with no transfer restrictions.

The remaining 209,624 shares, allocated to shareholder Ta Van Manh on November 20-21, are subject to a one-year transfer restriction.

During this offering, 1,121 domestic investors acquired 35.3 million shares, while 8 foreign investors purchased 6,303 shares.

At the offering price of VND 10,000 per share, DSC raised VND 353.4 billion, increasing its chartered capital to nearly VND 2,750 billion. The company plans to allocate VND 203.4 billion to proprietary trading and the remaining VND 150 billion to margin lending activities.

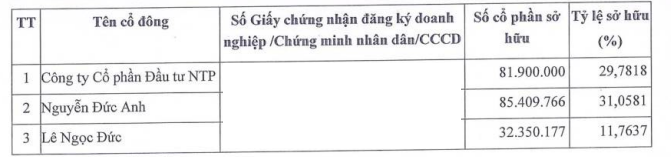

Following the offering, DSC’s shareholder structure underwent significant changes. Notably, Le Ngoc Duc emerged as a major new shareholder. According to transaction reports, on November 11, 2025, Duc acquired 32.35 million DSC shares, securing an 11.76% stake in the company.

Prior to this, Duc held no DSC shares, and no related parties held any DSC shares either.

Source: DSC

Conversely, Chairman Nguyen Duc Anh and the affiliated entity NTP Investment JSC reduced their ownership stakes due to non-participation or partial exercise of their rights in the offering.

Chairman Nguyen Duc Anh retained his 85.4 million shares but saw his ownership percentage decrease to 31.05%. NTP Investment JSC holds 81.9 million shares, representing a 29.78% stake.

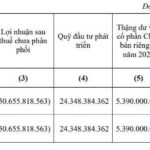

Following the completion of dividend payments and the rights issue, DSC will launch an Employee Stock Ownership Plan (ESOP) by issuing 5 million shares at VND 10,000 per share.

This issuance represents 1.82% of the total outstanding shares post-dividend and rights issue.

ESOP shares are subject to transfer restrictions: 40% after 1 year, 30% after 2 years, and 30% after 3 years. Proceeds from this issuance will be used to supplement margin lending activities.

Upon completion of the ESOP, DSC’s outstanding shares will increase to nearly 280 million, with chartered capital approaching VND 2,800 billion.

Shocking Market Volatility: CRV Offers 16.8 Million Shares to the Public

CRV Real Estate Group Joint Stock Company (HOSE: CRV) has announced a public offering of additional shares to raise capital for the development of a real estate project in Hai Phong City.

CTX Seeks Exit from Market Following Sale of Prime Triple-Frontage Land Project in Hanoi

CTX Holdings’ move to delist from its public company status comes on the heels of its Q3 earnings report, which revealed an nearly eight-year high in net profit, driven by the sale of a prime, triple-frontage land project in Hanoi. The stock market reacted negatively, with shares hitting the lower limit for two consecutive sessions.

Ladophar Aims to Utilize Investment Fund and Surplus Capital to Address Accumulated Losses

At the upcoming extraordinary shareholders’ meeting, Ladophar will present a plan to utilize its development investment fund and surplus share capital from the 2025 private placement to reduce accumulated losses from nearly VND 50.7 billion to over VND 20.9 billion.