Market Recovery Amidst Volatility: A Cautious Outlook

Following a sharp decline below the 1,600 mark, the market has shown a robust recovery in terms of index points, albeit with persistent volatility and significant intraday fluctuations. Notably, trading volume has significantly decreased, reflecting investors’ cautious sentiment as many opt to remain on the sidelines.

Key Signals Indicating the Next Market Wave

Mr. Huỳnh Anh Huy, CFA – Director of Industry Analysis at Kafi Securities, observes that the decline in trading volume compared to the previous month indicates a cautious investor sentiment. Investors are adopting a wait-and-see approach, refraining from large-scale transactions in the absence of strong supportive market information.

However, a positive trend is that capital has not exited the market but has instead shifted towards mid-cap and small-cap stocks with attractive valuations and strong growth potential. These include sectors with solid fundamentals or those benefiting from the broader economic recovery cycle.

Given this capital structure, the market is expected to continue trading sideways. While caution may trigger unexpected corrections, current valuations are not excessively high to precipitate a significant downturn.

Should selling pressure push the VN-Index below 1,600, bottom-fishing demand is likely to re-emerge swiftly, particularly from value-oriented investors, before the index returns to the 1,600-1,700 accumulation range.

VN-Index Trends: Navigating Uncertainty

The current phase is characterized by a lack of new macroeconomic catalysts, with global factors largely reiterating familiar narratives. This has led investors to adopt a more observational stance, awaiting clear signals before increasing their market exposure. Despite the emergence of “supply exhaustion” with weakening selling pressure and narrowing volatility, experts believe the market lacks sufficient momentum for a significant uptrend. Meanwhile, liquidity has not yet contracted deeply enough to establish a solid foundation for a breakout.

According to Mr. Huỳnh Anh Huy, the stock market outlook for the year-end is expected to improve. Typically, by late December, the market receives preliminary business results, new year plans, and macroeconomic policy directives. This period also marks the economy’s final sprint, with accelerated production and consumption indicators.

Thus, this juncture is anticipated to initiate a new market wave, supported by improved information flow and increased investor participation.

Recent capital movements reveal a pronounced shift, with banking, securities, and real estate sectors facing significant profit-taking pressure, driving their stock prices to more attractive levels. This temporary capital withdrawal has inadvertently created favorable price zones, enabling many large-cap stocks to establish new accumulation bases—a critical signal for the emergence of the next market wave.

Spotlight on Promising Sectors

During this accumulation phase, investors have an opportune moment to rebalance their portfolios, prioritizing investments in companies with strong fundamentals, clear growth prospects, and significant discounts to their intrinsic value. Such stocks often become market leaders when substantial capital re-enters the market.

Additionally, technical indicators and capital flows support the scenario of market bottom formation. Declining liquidity indicates weakening selling pressure, while bottom-fishing demand intensifies whenever the VN-Index approaches critical support levels.

These support levels act as psychological buffers, stabilizing the market and mitigating deep correction risks. Therefore, deploying capital as the index nears “hard” support levels offers enhanced portfolio safety while capitalizing on attractive valuations ahead of the market’s entry into a new growth cycle.

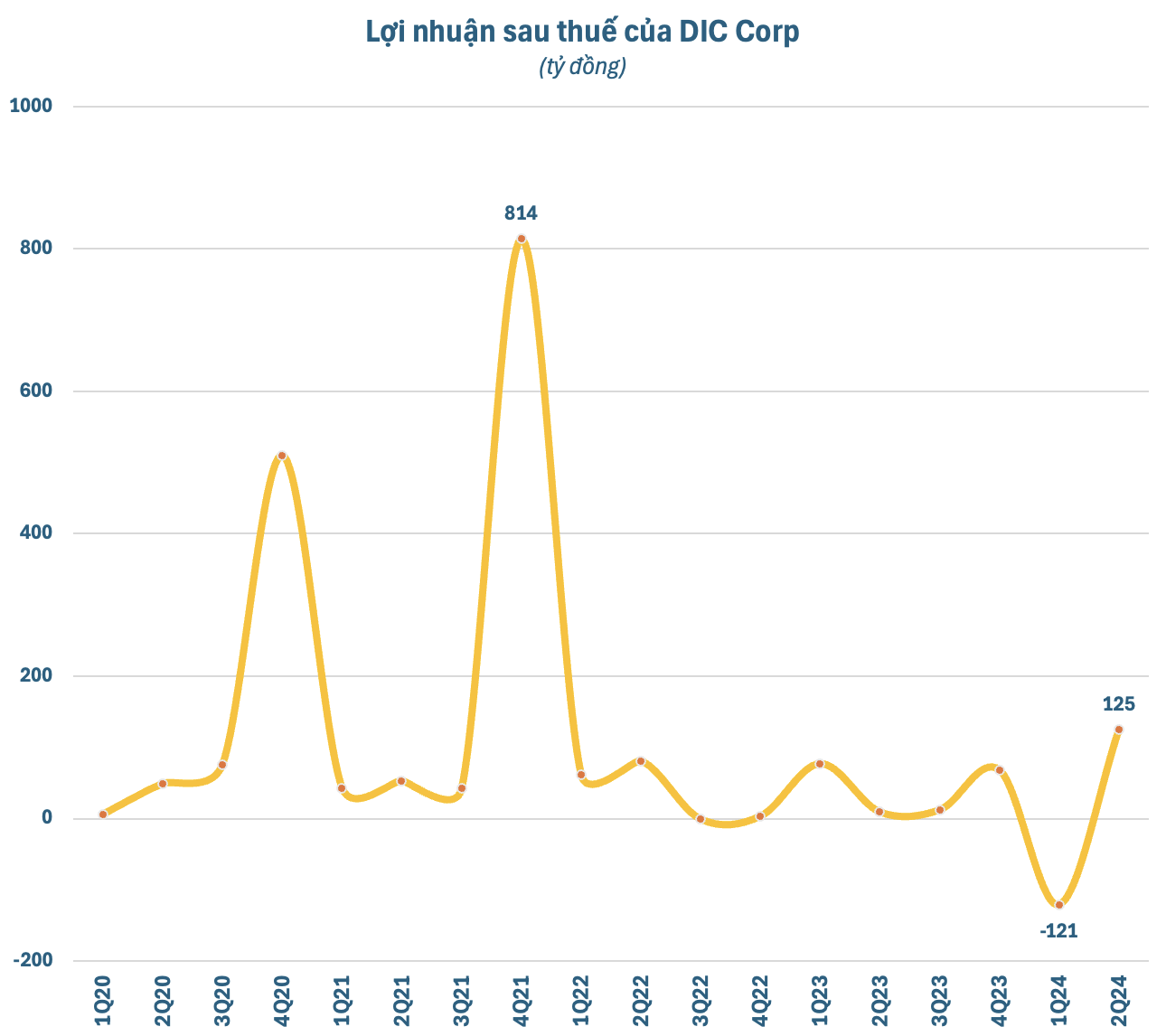

In terms of short-term opportunities, experts highlight the real estate sector as a standout, given its sharply discounted valuations and clear policy support. Legal framework improvements and attractive price levels position this sector for strong growth in the final months of the year, potentially leading the market’s overall recovery.

Other mid-cap sectors such as energy, logistics, retail, infrastructure, and industrial real estate also present reasonable valuations and are attracting capital. These sectors boast stable fundamentals, benefiting from economic cycles or unique growth narratives, making them likely short-term focal points.

The banking sector, with its substantial market capitalization and index weight, is trading at more appealing valuations following recent corrections. However, it requires additional time to stabilize prices and attract new capital before resuming its leadership role. In this context, sectoral divergence will remain a dominant theme in the near term.

Bitcoin Investors’ Worst Fear Materializes on November 18th Midday

Bitcoin’s recent downturn stems from a confluence of factors, including significant outflows from investment funds, substantial selling pressure, and escalating geopolitical tensions.