Today, November 24th, Bao Tin Minh Chau adjusted the price of gold rings downward to 147.5 – 150.5 million VND per tael, a decrease of 100,000 VND compared to the closing session of the previous week.

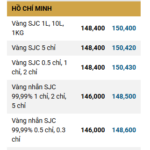

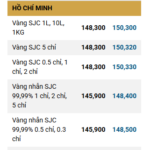

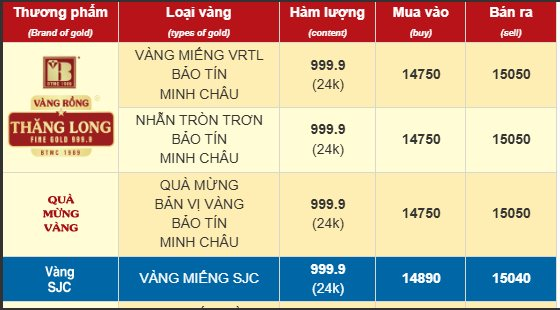

Gold ring and SJC gold prices listed at Bao Tin Minh Chau today, November 24th.

Several other brands maintained their prices from the weekend. Notably, PNJ and DOJI both listed gold ring prices at 146.1 – 149.1 million VND per tael. SJC continued to list gold ring prices at 146 – 148.5 million VND per tael.

Meanwhile, the price of gold bars at companies like Bao Tin Minh Chau, PNJ, and DOJI remained unchanged from the previous week’s closing session. The selling price of gold bars remained at 150.4 million VND per tael, while the buying price was generally around 148.4 – 148.9 million VND per tael.

In the international market, the spot gold price fell to $4,045 per ounce, a decrease of approximately $20 compared to the previous week’s closing session.

A weekly gold survey by an international financial platform revealed that analysts’ sentiment is becoming more cautious: among 13 Wall Street experts surveyed, only 2 (15%) predicted a rise in gold prices, 4 (31%) expected a decline, and more than half anticipated prices to remain sideways.

According to Barbara Lambrecht (Commerzbank), the gold market at this point is almost entirely dependent on the Fed’s interest rate expectations. If expectations for rate cuts do not recover, gold prices are likely to continue trading in a narrow range.

TD Securities’ analysts also noted that investment flows into gold are slowing down, although central banks’ net buying remains a significant supporting factor—but not enough to drive strong gains as before.

Lukman Otunuga (FXTM) forecasted that gold will continue to trade within a narrow range this week. Key economic reports such as U.S. retail sales and PPI will play a decisive role.

If the data is weak, expectations for Fed rate cuts could rise again, potentially pushing gold above $4,100 per ounce. Conversely, strong data could cause prices to fall below $4,000 per ounce, opening up a decline to $3,970 – $3,930 per ounce.

Some experts maintain a positive outlook. Colin Cieszynski (SIA Wealth Management) believes gold has reacted positively at the $4,000 support level and is trending within the $4,000 – $4,200 range.

Adrian Day, Chairman of Adrian Day Asset Management, stated that gold needs more time to build a base before making a sustainable breakout, while sideline money remains outside the market.

Kevin Grady (Phoenix Futures and Options) emphasized that all developments revolve around the Fed’s interest rates but affirmed that the long-term trend remains upward.

According to him, gold has risen 50% since the beginning of the year, and gold mining stocks have surged by 125%. Central banks’ buying activity will continue if prices adjust, and they have no intention of selling.

Gold Market Outlook Next Week: Experts Predict Price Drop, Investors Remain Optimistic

Amidst widespread predictions from analysts forecasting a decline in gold prices next week, investors remain steadfast in their optimism, anticipating a continued upward trajectory.

Exclusive Gold Sale: November 20th – Massive Discounts on Gold Bars & Rings

Domestic and global gold prices experienced a synchronized decline during the trading session on November 20th.