According to the Hanoi Stock Exchange (HNX), Idico Group Joint Stock Company (Idico, Stock Code: IDC) has issued an official announcement regarding the Board of Directors’ Resolution related to its branch operations in Hanoi.

Specifically, the Idico Board of Directors has decided to cease operations of its Hanoi branch, located on the 40th floor of Pearl Tower, No. 1 Chau Van Liem Street, Tu Liem District, Hanoi.

The decision to terminate the branch’s operations is attributed to a shift in business strategy and the elimination of the need to maintain its activities.

Regarding personnel, all employees of the branch will be transferred to the Administrative Department – Human Resources Division of the parent company for reassignment.

Conversely, the Idico Board of Directors has approved Resolution No. 68/NQ-TCT dated November 10, 2025, endorsing the additional investment of VND 800 billion into the charter capital of Idico Urban Development and Industrial Zone Company (Idico Urbiz).

The Board has tasked the General Director with overseeing the implementation of the approved contents, signing all relevant documents and legal papers, including but not limited to correspondence with Idico’s capital representative at Idico Urbiz. This ensures the execution of necessary procedures to increase Idico Urbiz’s charter capital in compliance with the Board’s regulations and approvals.

It is noted that Idico Urbiz is a wholly-owned subsidiary of Idico, with a 100% voting ratio as per the consolidated Q3/2025 financial statements.

Illustrative image

Previously, the Idico Board of Directors also made a decision regarding the capital contribution to establish VTA Global Port Joint Stock Company (VTA Global Port) and appointed an authorized representative.

Specifically, Idico plans to contribute VND 306 billion as a founding shareholder of VTA Global Port, equivalent to 30.6 million ordinary shares, representing 51% of VTA Global Port’s charter capital.

In another development, Idico has announced a Board of Directors Resolution on the first interim cash dividend payment for 2025 to its shareholders.

Specifically, Idico will distribute an interim cash dividend at a rate of 15%, meaning shareholders holding one share will receive VND 1,500. The final registration date for shareholders eligible for dividend payment is December 4, 2025, with the expected payment date on December 23, 2025.

With approximately 379.5 million IDC shares outstanding, Idico is estimated to allocate over VND 569.2 billion for this interim dividend payment.

As of September 30, 2025, S.S.G Group holds 22.5% of Idico’s charter capital, equivalent to nearly 85.4 million IDC shares, and is expected to receive over VND 128 billion in dividends.

Additionally, Bach Viet Production and Trading Company holds approximately 45.3 million IDC shares (11.93% ownership), and is projected to receive nearly VND 68 billion in dividends from Idico.

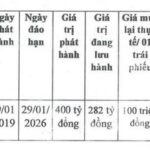

Trung Nam Solar Repurchases Bonds Ahead of Maturity

Trung Nam Solar has successfully executed an early partial repurchase of its TSP119001 bond series, valued at 30 billion VND. This strategic move reduces the outstanding value of the bond series to 252 billion VND.