Integrating Interest Rate Subsidies into Public Investment

The Ministry of Finance is currently seeking feedback on a draft Government Decree regarding payment and settlement of state budget capital to subsidize interest rates for commercial banks (CBs) implementing preferential credit policies. This document is expected to be issued by the Government in January 2026 and take effect from March of the following year.

According to the Ministry of Finance, this draft Decree focuses on significantly reforming the expenditure control mechanism at the State Treasury. The emphasis is on simplifying documentation, accelerating digitalization of processes, and clarifying the scope of the State Treasury’s control. Simultaneously, it enhances the role and responsibility of the State Bank of Vietnam and CBs in appraisal, documentation, and self-accountability for data.

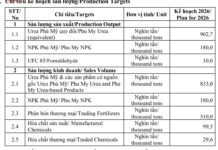

In reality, over the years, the Government has implemented numerous preferential credit policies with interest rate subsidies for CBs, such as Resolution 30a/2008/NQ-CP (on the rapid and sustainable poverty reduction program for 61 poor districts); Decision No. 68/2013/QĐ-TTg (on post-harvest loss reduction loans in agriculture); Decree 67/2014/NĐ-CP (on fishing vessel upgrading and new construction loans); Decree 100/2015/NĐ-CP (on social housing loans); Resolution No. 43/2022/QH15 (on 2% annual support from the state budget for enterprises, cooperatives, and business households); and more.

However, since each program has its own guidelines, the payment and settlement processes remain fragmented and inconsistent, posing risks of overlap and challenges for CBs and beneficiaries. Additionally, many guidelines for these preferential programs were issued before the Public Investment Law 2024 and the State Budget Law 2025 took effect. Therefore, standardizing the allocation mechanism, expenditure control, payment, and settlement for interest rate subsidies from the state budget is an urgent requirement to ensure the continued implementation of preferential policies, avoid overlaps, and enhance policy effectiveness.

Analyzing the draft Decree, experts note that the Ministry of Finance clearly defines “interest rate subsidies for preferential credit as a public investment task under the 2024 Public Investment Law.” This brings interest rate support into the “investment framework,” rather than treating it as an isolated subsidy.

Additionally, the draft Decree specifies the Ministry of Finance’s responsibility for synthesizing and proposing the allocation of subsidy funds to competent authorities, enabling the Ministry to proactively suggest medium-term (5-year) budgets and annual estimates for all preferential credit policies. According to financial experts, these changes will facilitate credit institutions in policy implementation, allowing citizens and businesses to access state budget support more effectively.

This draft Decree focuses on significantly reforming the expenditure control mechanism at the State Treasury

Standardizing Calculation and Payment Procedures

A key feature of the draft Decree is the standardization of the interest subsidy calculation formula, detailed to each day of outstanding debt (Article 6.2). This new formula ensures an accurate reflection of the interest support provided by CBs to borrowers, preventing estimation inaccuracies or discrepancies between banks.

Meanwhile, the quarterly payment mechanism ensures a steady flow of funds for preferential and support programs from the budget. Requiring CBs to submit quarterly reports and payment requests for the interest supported to customers ensures uninterrupted financial support for individuals, businesses, and cooperatives.

Notably, flexible provisions for force majeure events (natural disasters, epidemics) in the draft Decree demonstrate the policy’s humanitarian aspect, enabling timely support from the Government. The introduction of standardized forms (Form 01–05) by the Ministry of Finance is also a significant step, enhancing transparency and auditability of preferential credit data, thereby reducing fraud and losses.

According to the Ministry of Finance, the drafting committee has thoroughly reviewed all relevant legal documents and policies of the Party and State. These have been concretized in the payment and settlement mechanisms for interest rate subsidies to CBs. Contents from Resolution No. 26-NQ/TW, Resolution No. 19-NQ/TW (on perfecting agriculture, farmers, and rural areas policies); and Resolution No. 68-NQ/TW (on institutional improvement to promote private economic development) have been carefully considered and fully integrated into the draft Decree.

Thus, the issuance of this Decree is expected to create a unified, consistent, and transparent legal framework for interest rate subsidies from the state budget. It will enhance accountability among implementing agencies and empower CBs, contributing to the effectiveness of preferential credit programs and supporting sustainable economic development in the coming years.

High-Speed North-South Railway Project: Direct Investment Emerges as the Sole Viable Model

Renowned economist Vu Dinh Anh asserts that the optimal financing model for the North-South high-speed rail project is direct private investment, wherein the state provides 80% of the capital through loans, and private investors contribute the remaining 20%. This approach surpasses both traditional public investment and public-private partnerships (PPPs) in terms of efficiency and feasibility.

A Key Signal That Stocks Have Bottomed Out

In November, DSC identified this region as a promising area with the potential to establish a mid-term bottom, presenting an opportune moment for cash-holding investors to consider entering the market.