Sovi is set to undergo a mandatory delisting and withdraw its securities registration from VSDC, marking the end of its 13-year journey on HoSE.

The Board of Directors of Bien Hoa Packaging Joint Stock Company (Sovi, HoSE: SVI) recently convened an extraordinary shareholders’ meeting on December 15 to propose a plan for losing public company status and leaving the Ho Chi Minh City Stock Exchange (HoSE). The shareholder list as of November 18 reveals that TCG Solutions Pte. Ltd, a subsidiary of Thai Containers Group and a member of SCG Group, holds 94.11% of the capital, while the remaining minority shareholders do not meet the minimum regulatory requirements.

Following the approval of the resolution by the shareholders’ meeting, Sovi will proceed with the mandatory delisting and withdraw its securities registration from VSDC, officially concluding its 13-year presence on HoSE.

Established in 1968 as Bien Hoa Packaging Factory, Sovi is one of the oldest industrial packaging companies in Southern Vietnam. After 1975, the factory was nationalized and transformed into a state-owned enterprise. In 2003, it underwent equitization and was renamed Bien Hoa Packaging Joint Stock Company. The company currently operates three factories in Dong Nai, Binh Duong, and Ho Chi Minh City, with a total capacity of approximately 100,000 tons/year, serving major FMCG corporations such as Unilever, Pepsico, Nestlé, and Vinacafé.

Sovi was listed on the Hanoi Stock Exchange in 2008 and moved to the Ho Chi Minh City Stock Exchange in 2012. By 2019, it became a 100% privately-owned public company, with no state capital.

A significant turning point in Sovi’s business history occurred in late 2020 when TCG Solutions invested over 2,000 billion VND to acquire 12.1 million shares, becoming the controlling shareholder. This acquisition was part of SCG’s expansion strategy in Vietnam, which has already invested trillions of VND in various local companies such as Tin Thanh Plastic Packaging and Prime Group. Just days before TCG Solutions’ purchase, Sovi held an extraordinary shareholders’ meeting, where long-standing leaders stepped down, making way for a new management team nominated by SCG. This marked the beginning of a comprehensive restructuring phase.

Before becoming Sovi’s controlling shareholder, SCG had already invested trillions of VND in several local companies such as Tin Thanh Plastic Packaging and Prime Group.

Under Thai ownership, Sovi’s financial performance improved significantly. In 2020, the company achieved a record net profit of 146 billion VND. By 2022, revenue reached nearly 1,900 billion VND, the highest since its establishment.

However, this growth momentum was short-lived. In 2023, revenue declined to approximately 1,500 billion VND. In 2024, net profit fell to 76 billion VND, the lowest in six years. In the first nine months of 2025, Sovi recorded only 26 billion VND in after-tax profit, the lowest in over 15 years and just 26% of the annual target.

SCG began its operations in Vietnam in 1992. Currently, it holds an investment portfolio of approximately 7 billion USD across 28 projects in Vietnam, focusing on three main sectors: petrochemicals, packaging, and cement-building materials.

SCG’s largest project in Vietnam is the Long Son Petrochemical Complex in Ba Ria-Vung Tau province, with a total investment of over 5 billion USD. SCG now owns 100% of this mega-project. Recently, SCG announced an additional investment of 500 million USD in the Long Son Petrochemical Complex, aiming to strengthen its presence in Southeast Asia and curb declining profits.

Mr. Kulachet Dharachandra, SCG’s Director in Vietnam, stated that the expansion of the Long Son Petrochemical Complex is expected to be completed by 2027, increasing the total investment to 5.6 billion USD. He added that the plant’s utilization rate has risen to over 85% since resuming operations in August.

Sovi’s departure from HoSE is seen as the beginning of the next restructuring phase under SCG’s tight control. Amid volatile raw material costs, intense competition, and sluggish consumer demand, reducing reliance on the stock market could provide the Thai conglomerate with greater flexibility in optimizing its supply chain and long-term strategic positioning.

CTX Seeks Exit from Market Following Sale of Prime Triple-Frontage Land Project in Hanoi

CTX Holdings’ move to delist from its public company status comes on the heels of its Q3 earnings report, which revealed an nearly eight-year high in net profit, driven by the sale of a prime, triple-frontage land project in Hanoi. The stock market reacted negatively, with shares hitting the lower limit for two consecutive sessions.

Seafood & Food Stocks Lead the Week in Attracting Investment

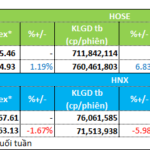

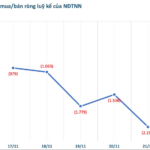

Liquidity trends diverged between the Ho Chi Minh City Stock Exchange (HOSE) and the Hanoi Stock Exchange (HNX) during the trading week of November 17–21. Investor sentiment remained cautious, with a selective focus on specific sectors. Notably, the seafood and food stocks emerged as the week’s favorites, attracting significant capital inflows.