According to the Vietnam Aviation Authority, in the first nine months of 2025, the total market transport volume reached an estimated 64.1 million passengers and 1.1 million tons of cargo, marking a 10.7% and 18.7% increase, respectively, compared to the same period last year. Of this, 15.4 million international passengers were welcomed, a 21.5% rise year-on-year, with China, South Korea, and the United States leading the market.

Uong Viet Dung, Director of the Vietnam Aviation Authority, noted that this growth reflects the sustainable recovery of the aviation transport market, driven by open-door policies, the resurgence of international tourism, and the enhanced operational capacity of Vietnamese airlines.

Airlines: Strong Revenue but Declining Profits

Despite the increase in passenger and cargo volumes, airlines experienced significant profit declines in Q3/2025.

Vietnam Airlines (HOSE: HVN) reported a 14% rise in net revenue to VND 30,371 billion, yet net profit dropped by 20% to VND 617 billion, primarily due to higher operating and other expenses.

Similarly, Vietjet Air (HOSE: VJC) faced challenges, with net revenue falling by 7% to VND 16,931 billion and net profit plunging by 44% to VND 319 billion.

However, the nine-month results paint a brighter picture. Vietnam Airlines recorded VND 88,922 billion in revenue (up 11.5%) and VND 7,174 billion in profit (up 14.5%). Vietjet maintained stable revenue at VND 52,769 billion, with profit rising 14.9% to VND 1,614 billion.

Meanwhile, airport giant ACV delivered impressive Q3/2025 results, with net revenue of VND 6,476 billion and net profit of VND 3,207 billion, up 15% and 37%, respectively, year-on-year.

The primary growth drivers were the robust recovery of the international aviation market, a 26% surge in financial revenue to VND 370 billion, and a 95% drop in financial expenses to VND 40 billion.

For the first nine months, ACV achieved remarkable results, with net revenue nearing VND 19,200 billion and net profit exceeding VND 8,900 billion, completing 86% of the revenue plan and surpassing the pre-tax profit target by 5%.

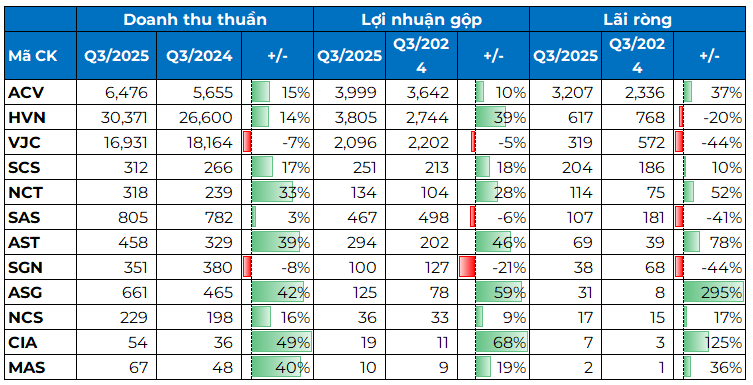

Q3/2025 Business Results of Aviation Companies

Unit: Billion VND

Source: VietstockFinance

|

Aviation Services: Clear Segmentation Post T3 Terminal Launch

The inauguration of Tan Son Nhat’s T3 Terminal in April 2025 has reshaped the aviation services landscape, leading to distinct segmentation among companies.

In the lounge, duty-free, and restaurant sectors, Taseco Air Services JSC (HOSE: AST) stood out with VND 458 billion in revenue and VND 69 billion in net profit, up 39% and 78%, respectively. This success highlights the effectiveness of expanding lounge and duty-free networks at the new terminal.

In contrast, direct competitor Tan Son Nhat Airport Services JSC (SASCO, UPCoM: SAS) struggled, with net profit falling 41% to VND 107 billion, despite a 3% revenue increase to VND 805 billion. Declining gross margins and financial revenue were the primary causes.

At the 2025 Annual General Meeting in June, SASCO Chairman Johnathan Hanh Nguyen anticipated intensified competition: “With airport expansions and the growth of non-aviation services, ACV’s strategy to involve more partners will impact SASCO’s future market share.”

In air cargo handling, Saigon Cargo Services JSC (HOSE: SCS) and Noi Bai Cargo Services JSC (HOSE: NCT) continue to thrive.

In Q3/2025, NCT reported nearly VND 318 billion in net revenue, a 33% increase, and a record net profit of over VND 114 billion, up 51%.

This impressive performance was driven by the vibrant air cargo market and significant financial gains. In Q3, NCT generated VND 32 billion in financial revenue, up 64%, with minimal financial expenses.

Similarly, SCS achieved VND 312 billion in revenue and VND 204 billion in profit, up 17% and 10%, respectively.

SGN Struggles After Losing Vietjet Contract

Saigon Ground Services JSC (SGN) is undergoing a challenging restructuring phase, with net profit falling 44% to VND 38 billion and revenue dropping 8% to VND 351 billion in Q3.

The primary reason is the loss of the full ground handling contract with Vietjet since April 2025. The company also incurred unusual expenses, including relocating to T3, customer acquisition costs, and losses from the newly established Saigon – Long Thanh subsidiary.

Other companies in the sector saw breakthroughs in Q3/2025. ASG’s profit quadrupled to VND 31 billion, while CIA reported a 125% profit increase to VND 7 billion. Noi Bai Catering Services JSC (NCS) achieved positive results, with VND 229 billion in revenue (up 16%) and VND 17 billion in profit (up 17%).

– 12:00 25/11/2025

Upgrading Can Tho Airport: Ministry of Construction’s Vision for Enhancement

The Ministry of Construction has recently submitted a document to the People’s Committee of Can Tho City, urging the prompt implementation of investment and upgrades for Can Tho International Airport. As per the master plan, the airport is projected to handle a capacity of 7 million passengers annually by 2030, escalating to 12 million passengers by 2050.

Ho Chi Minh City Real Estate Boom: Flood of Listings, But Crowded Market Doesn’t Guarantee Sales

As the year draws to a close, the real estate market enters its peak season, unsurprisingly flooding the scene with a wave of new projects. Yet, in an era where savvy buyers reign supreme, a bustling marketplace no longer guarantees sales success.