This divestment is part of VIF‘s strategy to strengthen its financial position, streamline its non-core portfolio, and focus on core operations as outlined in its 2021-2025 restructuring plan.

Established in 2008 and headquartered in Hanoi, SFS has maintained a modest chartered capital of 2 billion VND since its corporatization. VIF‘s stake in SFS was once valued at just 126 million VND and has been fully provisioned for impairment.

Despite its small capital, SFS boasts a notable ownership structure: 51.65% is held by Viet Han Construction – Real Estate – Advertising – Trading JSC, a real estate firm with assets totaling tens of trillions of VND.

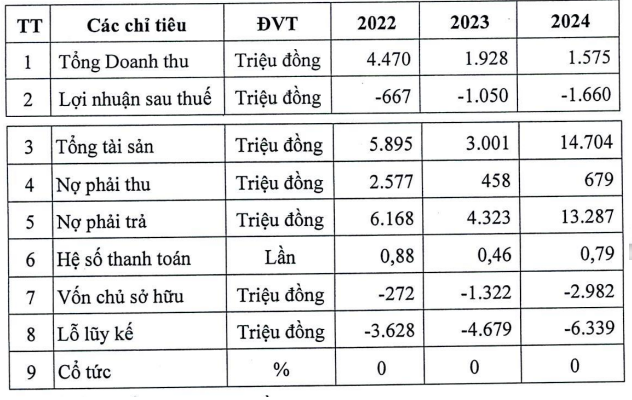

Over the past three years, SFS’s business performance has steadily declined. Revenue plummeted from 4.4 billion VND in 2022 to less than 1.6 billion VND in 2024. Post-tax losses escalated from 667 million VND to over 1.6 billion VND. By late 2024, total assets stood at 14 billion VND, but equity was negative by nearly 3 billion VND, with accumulated losses exceeding 6.3 billion VND.

The acquisition of a loss-making company with negative equity for over 58 billion VND raises questions about the intangible value behind the deal.

Despite consistent losses, SFS fetched VIF over 58 billion VND, while its chartered capital remains at 2 billion VND. Source: VIF

|

SFS’s assets surged 4.6 times in 2024 due to a revaluation of its Dien Bien orchard. The company also manages substantial land holdings in Hanoi and Dien Bien, including 2,800m² at 204 Ho Tung Mau, over 1,000m² of non-agricultural land in Dien Bien Phu City, 18,300m² of nursery land, and nearly 3,600m² of production forest land.

Another 160ha plot in Nam Po district remains largely uncompensated, unmanaged, and is undergoing return procedures to local authorities.

VIF has repeatedly urged SFS to halt its losses, but with the controlling shareholder group holding over 51%, VIF lacks operational control. The company also highlights legal risks associated with the Ho Tung Mau land, which lacks a land title certificate, while the Dien Bien Tax Department is demanding nearly 484 million VND in land rent, forcing SFS to borrow funds for payment.

The Ministry of Agriculture and Rural Development (now the Ministry of Agriculture and Environment) approved VIF‘s full divestment from SFS in 2017, citing its non-alignment with core business, low efficiency, and high risk exposure.

Thanh Vinh Real Estate, the auction winner, is part of the TNR Holdings Vietnam ecosystem, known for its TNR Stars projects nationwide. Meanwhile, Viet Han Real Estate, SFS’s parent company, is a consortium member developing large-scale urban projects in Lam Dong province.

Concurrently, VIF announced its exit from Vinafor Tay Nguyen on November 19, 2025. Over 836,000 shares, representing 68.5% ownership, were transferred to Mr. Vu Van Luyen for approximately 8.5 billion VND.

VIF, formerly Vietnam Forestry Corporation, was corporatized in 2016 with a chartered capital of 3.5 trillion VND. The Ministry of Finance holds 51%, while T&T Group owns 40%. Beyond SFS, VIF‘s portfolio includes dozens of joint ventures, with its largest investment being a 30% stake in Yamaha Motor Vietnam, valued at over 220 billion VND.

As of Q3 2025, VIF‘s total assets reached 5.4 trillion VND, with equity nearing 5 trillion VND and bank deposits exceeding 2 trillion VND. Nine-month revenue grew 22% to 225 billion VND, but net profit fell 40% to 197 billion VND due to declining profits from associates. This represents roughly 60% of the annual target.

Thanh Vinh Real Estate raises 500 billion VND in bonds

Viet Han Real Estate’s profit drops over 40%, burdened by nearly 10 trillion VND in bonds

Consortium member of Nam Da Nhim New Urban Area reports 6 billion VND profit in 2023

– 12:14 25/11/2025

Hodeco Leadership Injects Capital into Convertible Bond Purchase

Mr. Le Viet Lien and Mr. Doan Huu Thuan have recently registered to exercise their rights to purchase convertible bonds issued to the public by Hodeco (HOSE: HDC), the Housing Development Corporation of Ba Ria – Vung Tau.

Exclusive Acquisition: Phát Đạt Secures Billion-Dollar Project in the Heart of Ho Chi Minh City

Through its acquisition of a 50% stake in AKYN, Phat Dat Real Estate has announced plans to develop a multi-billion-dollar project.