SBSI Offers 166 Million Shares for Sale

Stanley Brothers Securities Corporation (SBSI, stock code: VUA) has recently approved a resolution to implement a private placement of shares, as decided at the first extraordinary shareholders’ meeting in 2025.

Accordingly, SBSI will issue 166.1 million shares at a price of 10,000 VND per share. These privately placed shares will be subject to a one-year transfer restriction. The issuance is expected to take place in Q4/2025 or Q1/2026.

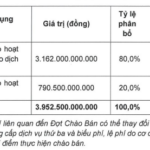

With the anticipated proceeds of 1.661 trillion VND from this offering, SBSI plans to allocate 1.2 trillion VND to supplement capital for proprietary trading, 411 billion VND for margin lending, and 50 billion VND for investment in information technology systems. The disbursement is scheduled for 2026.

Upon completion of the offering, Stanley Brothers Securities will increase its outstanding shares from 33.9 million to a maximum of 200 million, equivalent to a chartered capital of 2 trillion VND, a 5.8-fold increase.

ROX Group Affiliates Participate in the Offering

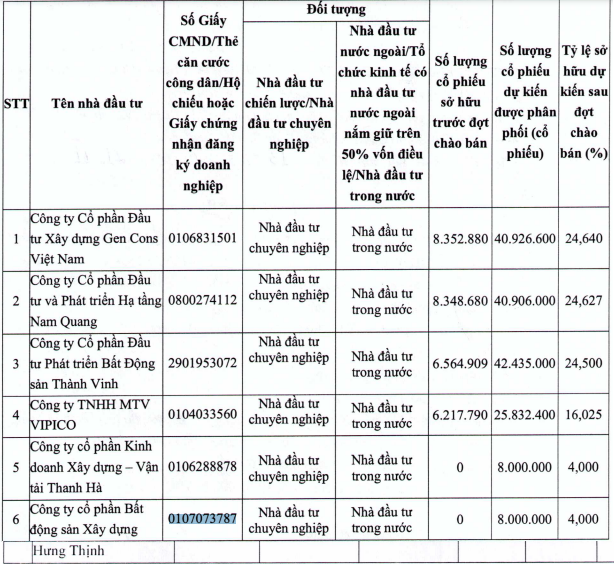

SBSI has announced a list of six investors participating in this private placement. Nam Quang Infrastructure Investment and Development JSC plans to purchase 40.9 million shares, Thanh Vinh Real Estate Development JSC will buy 42.4 million shares, Gen Cons Vietnam Construction Investment JSC intends to acquire 40.96 million shares, and Vipico LLC will purchase 25.8 million shares.

List of Investors Participating in SBSI’s Private Placement

In addition to the four existing shareholders, two new investors are also participating: Thanh Ha Construction and Transportation JSC and Hung Thinh Real Estate JSC, each planning to purchase 8 million shares.

Notably, all these investors have close ties to the ROX Group, led by businesswoman Nguyen Thi Nguyet Huong.

Four of these investors jointly acquired shares in SBSI in August 2025. Specifically, Nam Quang Infrastructure Investment and Development JSC (TNI Nam Quang) holds 24.627% of VUA’s chartered capital. Vipico LLC acquired over 6.2 million VUA shares, holding 18.34% of SBSI’s capital;

Thanh Vinh Real Estate Development JSC increased its ownership to 19.37%, and Gen Cons Vietnam Construction Investment JSC raised its stake to 24.64% of SBSI’s capital.

First, TNI Nam Quang is the developer of several industrial zones, including Nam Sach (62.42 ha), Phuc Dien (82.88 ha), Tan Truong (198 ha), and Gia Loc in Hai Duong province (now part of Hai Phong city), covering 198 ha.

Beyond industrial zones, TNI Nam Quang also develops residential real estate projects. In May 2019, it was selected as the investor for the Urban Development Project 7A in Song Hien Ward, Cao Bang City, Cao Bang Province.

In June 2021, the company was chosen to develop two projects: Ba Co Urban Housing Area and Cu Hang Urban Housing Area in Thanh Thuy Town, Thanh Thuy District (formerly), Phu Tho Province.

In September 2022, TNI Nam Quang was approved as the investor for the Block III Residential Area in Cao Loc Town, Cao Loc District (formerly), Lang Son Province.

TNI Nam Quang has also partnered with other group companies on various housing projects. It collaborated with My Real Estate JSC on the Thi Xa Nga Bay 2 New Urban Area and the Hoa Binh Town New Urban Area (formerly in Bac Lieu Province, now in Ca Mau Province).

TNI Nam Quang and Viet Han Trading – Advertising – Construction – Real Estate JSC jointly developed projects such as the Tay Bac II Urban Area in An Lac Ward, Buon Ho Town (formerly), Dak Lak Province, and the Truong Dinh Road and Adjacent Housing Area Phase 3.

Second, Vipico is known as the developer of the TNR The LegendSea Da Nang complex, featuring a commercial center, hotel, and apartments. The project is developed by Rox Signature JSC, with Roxcons Vietnam Construction JSC as the general contractor.

The project consists of two towers: a hotel block and an apartment block with 800 units. The total investment for housing construction is 2.352 trillion VND, with completion expected by Q4/2028.

Third, Thanh Vinh Real Estate is the developer of the TNR Stars Thai Hoa project within the Long Son Urban Area in Long Son Ward, Thai Hoa Town (formerly), Nghe An Province.

TNR Stars Thai Hoa is part of a 28.96 ha project with a 44% construction density. It features shophouses, shopvillas, townhouses, and villas, divided into Long Son and Thien Long sub-zones.

Fourth, Gen Cons Vietnam was established in April 2015 as TNCons Vietnam Construction Investment JSC.

In December 2023, the company changed its name to Rox Cons Vietnam Construction Investment JSC. In the most recent update in March 2025, it was renamed Gen Cons Vietnam Construction Investment JSC.

Sao Kim Investment, Trading, and Services LLC (a subsidiary of Rox Group) is a founding shareholder of Gen Cons Vietnam.

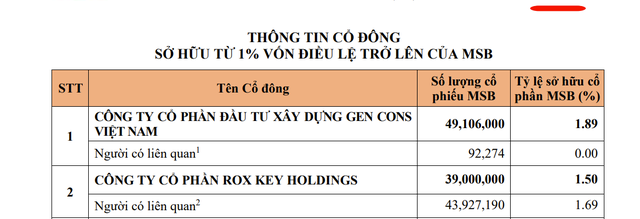

According to MSB’s shareholder disclosure (updated based on VSDC data as of July 31, 2025, provided on August 1, 2025, and shareholder information as of August 11, 2025), Gen Cons Vietnam holds over 49.1 million MSB shares, equivalent to 1.89% of the bank’s chartered capital.

Source: MSB

Among the two new investors, Thanh Ha Construction and Transportation JSC was established in August 2013, headquartered at TNR Tower, 54A Nguyen Chi Thanh, Lang Thuong Ward, Dong Da District (formerly), Hanoi.

In May 2021, the company increased its chartered capital from 60 billion VND to 170 billion VND. Currently, Mr. Le Duc Dong serves as the Director and legal representative.

Hung Thinh Construction and Real Estate JSC was established in October 2015, located in the Hanoi – Dai Tu Industrial Zone, Sai Dong Ward, Long Bien District (formerly), Hanoi.

As of May 2021, the company had a chartered capital of 160 billion VND. Mr. Doan Van Phuong (born 1991) is the Director and legal representative.

According to sources, as of June 2022, Hung Thinh Construction held 2.5 million shares in TNI Nam Quang. Additionally, Hung Thinh Construction partnered with My Real Estate JSC to operate 9,172.8 m² of commercial and office space in the HH building of the TNR Gold Seasons project (47 Nguyen Tuan, Hanoi).

Đạt Phương Group Gears Up to Raise Capital for Da Nang Resort Project

Following approval from the Annual General Meeting of Shareholders in late October, the Board of Directors of Dat Phuong Group (HOSE: DPG) has resolved to execute a private placement of nearly 17.8 million shares.

JVC Invests in New Pharmaceutical Venture

The Board of Directors of Vietnam Investment and Pharmaceutical Joint Stock Company (HOSE: JVC) has approved the establishment of a subsidiary with a chartered capital of 250 billion VND. Named Vietnam Pharmaceutical Investment and Trading Joint Stock Company, this subsidiary will primarily focus on pharmaceutical trading. JVC will hold a 98% stake in the new entity.

VCI Sets Private Placement Price at VND 31,000, Attracting Foreign Institutions Willing to Invest Hundreds of Billions

The Board of Directors of Vietcap Securities Corporation (HOSE: VCI) has recently passed a resolution to issue 127.5 million private placement shares, aiming to increase its charter capital to VND 8,501 billion. The offering has attracted significant interest, with 69 investors, including both institutions and individuals, expressing their intent to purchase tens of millions of shares.