Chairman of CRV – Mr. Do Huu Ha

|

In a notice dated November 24th, CRV announced plans to offer 16.81 million shares at a price of VND 26,000 per share. The rights issue ratio is set at 40:01. The subscription period will run from December 15th, 2025, to January 8th, 2026.

According to the company, the capital raised will be used to finance the construction of a new urban area (Hoang Huy New City – II) along the extended Do Muoi Road and its surrounding areas in Thuy Nguyen District, Hai Phong City.

CRV is part of the ecosystem of Hoang Huy Financial Investment Services JSC (HOSE: TCH) and has been listed on the HOSE since October 2025. As of September 5th this year, over 89% of CRV‘s shares are held by five institutions, including its parent company TCH and other affiliated companies. Mr. Do Huu Ha, Chairman of TCH, also serves as Chairman of CRV.

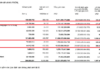

During its initial days on the market, CRV‘s stock price experienced significant volatility, surging to VND 40,900 per share before plummeting to VND 30,700 per share as of the close on November 24th. The stock’s trading liquidity remains low due to its concentrated ownership structure. In the most recent month, the average daily trading volume of CRV was only 6,376 shares.

| Trading performance of CRV since its HOSE listing |

– 19:15 November 24th, 2025

An Giang Rice Export Giant Unveils Bold New Move

Two residential projects by An Giang Agricultural and Foodstuff Export JSC (AFIEX, stock code: AFX) are expected to be included in the pilot program under Resolution No. 171 in An Giang province.

The Strategic Move by Chairmen of Bà Rịa – Vũng Tàu’s Top Two Real Estate Giants

Mr. Doan Huu Thuan, Chairman of the Board of Directors at Ba Ria – Vung Tau Housing Development JSC, plans to invest approximately VND 49 billion in acquiring over 492,000 HDC bonds. Meanwhile, Mr. Nguyen Hung Cuong, Chairman of DIC Corp’s Board of Directors, will purchase 6.7 million newly issued shares of DIG.

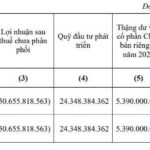

Ladophar Aims to Utilize Investment Fund and Surplus Capital to Address Accumulated Losses

At the upcoming extraordinary shareholders’ meeting, Ladophar will present a plan to utilize its development investment fund and surplus share capital from the 2025 private placement to reduce accumulated losses from nearly VND 50.7 billion to over VND 20.9 billion.

VPS Appoints New CEO Post-IPO, Reveals Major Shareholders List

Following its high-profile IPO, VPS Securities promptly removed Mr. Nguyen Lam Dung from his position as CEO to comply with legal regulations for publicly traded companies. The post-IPO list of major shareholders has also been disclosed, revealing Saigon Capital as the largest stakeholder with 39.9% ownership, while Mr. Nguyen Lam Dung retains an 8.7% stake.