According to data from Phu Quy Jewelry Joint Stock Company, silver prices remained stable today, with 999 silver priced at 1,912,000 VND/tael (buy) and 1,971,000 VND/tael (sell). The precious metal has lost nearly 1% over the past week.

Meanwhile, 1kg 999 silver bars are priced at 50,986,539 VND/bar (buy) and 52,559,869 VND/bar (sell), updated at 08:22 on November 24th.

In the global market, silver is trading at $49.8 USD/ounce.

Silver fell below $50 USD/ounce since Friday (November 21st), marking its second consecutive session of decline amid expectations that the U.S. Federal Reserve will not cut interest rates in December as policymakers navigate economic uncertainties.

The delayed U.S. Nonfarm Payrolls report released on November 20th showed mixed signals, with job growth accelerating in September but the unemployment rate rising to 4.4%, the highest in four years.

This report will serve as the final labor market data before next month’s FOMC meeting, as the BLS announced they would skip the regular October jobs release and incorporate those figures into the delayed November report. Additionally, Fed Governor Michael Barr cautioned that the central bank must proceed cautiously with further rate cuts, as inflation remains above target.

CME’s FedWatch tool now places the probability of a 25-basis-point cut to the 3.50% – 3.75% range at just 35.5%.

If rates remain unchanged, this will pose a significant headwind for non-yielding assets like silver and gold. As the market awaits clearer signals from the Fed, silver prices are expected to trade within a narrow range, though downside risks persist if macroeconomic pressures intensify.

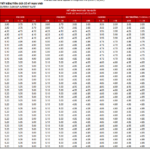

Techcombank Maxes Out Savings Interest Rates

Techcombank (Vietnam Technological and Commercial Joint Stock Bank) has recently updated its deposit interest rates effective from November 20, 2025, with notable increases across various terms. Specifically, the interest rate for deposits under 6 months has been raised to the maximum allowable limit of 4.75% per annum, exclusively for Private customers utilizing online banking channels.