Illustrative Image: Int

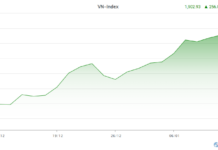

This improvement unfolds as Vietnam’s stock market anticipates an upgrade to “Secondary Emerging Market” status by FTSE Russell in September 2026.

ROAA Surges on Margin Lending and Equity Investments

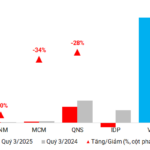

According to VIS Rating, the securities industry’s profitability significantly improved in the first nine months of 2025. The average return on average assets (ROAA) rose by 90 basis points quarter-on-quarter to 5.7% in 9M2025.

This enhancement primarily stems from margin lending and equity investment revenues, fueled by investor optimism as Vietnam nears its market upgrade.

Major securities firms, particularly bank-affiliated ones (e.g., VPB, TCX, VPS, MBS, SSI), leveraged their robust capital bases to accelerate margin lending and boost income from this segment.

Firms with substantial equity portfolios (e.g., VIX, SHS, VCI) recorded the strongest ROAA growth, averaging a 2.6 percentage point increase quarter-on-quarter to 11.6% in Q3/2025.

VIS Rating forecasts a full-year 2025 ROAA increase of 80 basis points year-on-year to 5.5%. However, profit growth may be constrained for firms without new capital plans (e.g., MASVN, KIS), as their margin lending exposure nears the regulatory cap of 200% of equity.

Asset Quality Remains Stable

Industry-wide asset risk is deemed stable, supported by several positive factors. VIS Rating notes that high-risk assets declined to 17% in 9M2025 from 19% in Q2.

This stability is attributed to a resilient bond portfolio and increased margin lending activity (e.g., VPBANKS, VPSS, VCBS, VIX) amid a vibrant stock market.

Robust retail investor trading helped mitigate margin lending risks by reducing large client concentration.

VIS Rating expects asset risk to remain stable in Q4/2025, driven by strong margin lending growth, high collateral ratios, and declining corporate bond defaults.

Capital Raises and Leverage: Expansion Strategies

VIS Rating highlights new capital raises as a core strategy for sustainable industry growth.

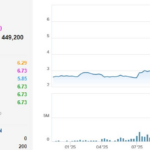

Industry leverage slightly increased to 2.7x in 9M2025, driven by short-term borrowing to support margin lending and equity investments (e.g., MBS, HCM, VCBS, VPBANKS, VPSS).

Announced 2025 capital raise plans total VND 97 trillion, triple the 2024 figure, stabilizing leverage and enabling business expansion.

Major firms (e.g., VCI, VND (A- Stable)) and smaller players (e.g., VIX, DSE, HDBS) have unveiled capital plans, with some nearly doubling equity. VPBANKS, VPSS, and MBS aim to complete raises in Q4/2025 to support margin lending.

Revised financial safety rules increased corporate bond risk weights by 10%. However, the impact on bond-focused firms (e.g., TPS (BBB Stable)) is limited, as new capital enhances risk absorption.

Capital and Liquidity Well-Managed

Industry liquidity remained stable in 9M2025, supported by new capital and robust liquid asset buffers (e.g., MBS, HCM).

Firms effectively accessed bank credit (e.g., VCBS) and raised long-term funds (e.g., ACBS, SHS).

Short-term borrowing for expansion lowered the cash flow ratio to 95% in 9M2025 from 100% in 1H2025.

Securities firms enhanced capital stability through long-term bond issuances (e.g., ACBS, SHS) and increased retail/institutional debt (e.g., VPBANKS, HCM, MBS, KAFI, HDBS, VCI, SSI, KIS).

The industry is proactively strengthening its capital base to support margin lending growth amid market optimism and upgrade expectations. Well-capitalized firms, especially bank-affiliated ones, are poised to lead 2026 profit growth.

Stock Market Week 17-21/11/2025: Tug-of-War Continues

The VN-Index trimmed its losses in Friday’s session after retesting the Middle Band of the Bollinger Bands, a critical support level essential for sustaining its short-term recovery momentum. Amid cautious investor sentiment and limited demand breadth, the market is likely to remain volatile and range-bound in the upcoming sessions.

What’s Happening to Vingroup, the Empire of Billionaire Pham Nhat Vuong?

Vingroup’s stock continues to soar, setting unprecedented records and consistently breaking new highs on the Vietnamese stock market.