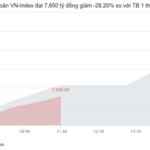

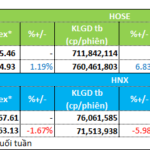

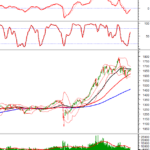

During the trading week from November 17 to November 21, Vietnam’s stock market witnessed a cautious recovery. The VN-Index closed the week at 1,654.93 points, up 19.47 points or 1.19% from the previous week. The VN30 index also rose by 1.51%, reaching 1,899 points, just shy of the psychological resistance level of 1,900 points.

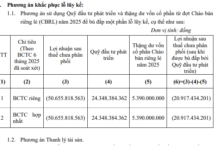

Despite the improvement in indices, liquidity remained a significant concern, with trading volumes staying low (approximately 42.7% of the 20-week average), reflecting investor skepticism. Foreign investors continued to exert pressure, net-selling nearly VND 1.9 trillion on HOSE.

The market found support from the real estate sector (notably Vingroup stocks: VIC, VHM) and technology, while banking stocks (VCB, TCB, BID) faced adjustment pressures, causing the index to fluctuate around the 1,640-point support level.

Viettel, securities, fertilizer-chemical, and oil and gas stocks continued to adjust, while small-cap technology, telecommunications, real estate, seafood, and livestock sectors saw a resurgence as capital returned.

According to SHS Securities, increased liquidity indicates a shift in capital between sectors. Investors are favoring fundamentally strong stocks with positive business results, while highly speculative stocks continue to face profit-taking pressure. A notable downside is that foreign investors have net-sold for 17 consecutive weeks, totaling over VND 1.897 trillion on HOSE. However, SHS anticipates that the net-selling trend may soon stabilize, as foreign trading volume now accounts for only about 15% of the total market.

VN-Index closes the week with a second consecutive gain, surpassing the 1,650-point mark

Mr. Nguyen Tan Phong, Analyst at Pinetree Securities, notes that while the VN-Index has shown a recovery trend in recent weeks, the market remains in a “recovery with skepticism” phase. Low liquidity indicates hesitation from external capital, while existing shareholders await better prices to cut losses. During this recovery, capital has primarily flowed into sectors previously overlooked since the beginning of the year, such as oil and gas, technology, and industrial real estate.

Pinetree forecasts that the VN-Index will continue to accumulate within the 1,580 – 1,680 point range after adjusting from the near 1,800-point peak. Negative global stock market dynamics, concerns about AI bubbles, U.S. inflation risks, or the Fed maintaining interest rates could pressure the domestic market to decline early next week before entering a more stable upward phase.

Mr. Phong advises investors to avoid chasing purchases at this time to minimize FOMO risks. “Patience is key; wait for a breakout session above 1,680 points with substantial liquidity. Also, avoid bottom-fishing in banking, securities, and real estate sectors, as their downward trends are not yet complete and require more accumulation time,” he said.

SHS further cautions that for portfolios targeting stocks benefiting from Vietnam’s market upgrade, investors should thoroughly evaluate corporate fundamentals and 2026 operational prospects rather than chasing short-term expectations.

Regarding long-term prospects, Ms. Thieu Thi Nhat Le, CEO of UOBAM Vietnam Fund Management, believes that positive macroeconomic indicators in the first 10 months and projections for 2025 provide a solid foundation for the market. Listed companies’ profits in 2026 are expected to grow by 16–20%, offering significant growth potential for the stock market. Therefore, individual investors should prioritize mid to long-term strategies rather than being overly concerned with short-term adjustments.

Market Pulse 24/11: Divergence Persists as Vingroup Stocks Continue to Shine

At the close of trading, the VN-Index climbed 13.05 points (+0.79%) to reach 1,667.98, while the HNX-Index dipped 1.91 points (-0.73%) to 261.22. Market breadth tilted toward decliners, with 370 stocks falling and 298 advancing. The VN30 basket saw red dominate, as 18 constituents declined, 10 rose, and 2 remained unchanged.

Vietstock Daily 25/11/2025: Cautious Growth on the Horizon?

The VN-Index has resumed its upward trajectory, approaching the 50-day SMA. A decisive break above this level, coupled with trading volume surpassing the 20-day average, would confirm the bullish momentum. The MACD indicator continues its ascent following a buy signal, and a crossover above the zero line in upcoming sessions would further strengthen the short-term outlook.

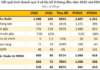

Seafood & Food Stocks Lead the Week in Attracting Investment

Liquidity trends diverged between the Ho Chi Minh City Stock Exchange (HOSE) and the Hanoi Stock Exchange (HNX) during the trading week of November 17–21. Investor sentiment remained cautious, with a selective focus on specific sectors. Notably, the seafood and food stocks emerged as the week’s favorites, attracting significant capital inflows.