Techno Commercial Securities Corporation (TCBS, stock code: TCX, listed on HoSE) has recently announced the minutes of the ballot and the resolution of the General Meeting of Shareholders (GMS) regarding amendments to the company’s charter and the dividend payment plan for 2024. The approval was obtained through written consent from shareholders.

Out of 1.92 billion voting shares, representing 83.22% of the total eligible voting shares, shareholders approved the 2024 dividend distribution plan.

Specifically, TCBS plans to distribute a total dividend of 25% for 2024, comprising 5% in cash (equivalent to VND 500 per share). The cash dividend will be sourced from the undistributed after-tax profit as per the audited financial statements as of December 31, 2024.

Following its IPO, TCBS currently has over 2.3 billion shares outstanding, equivalent to a charter capital of VND 23,133.08 billion. The company is expected to allocate approximately VND 1,155.6 billion for cash dividend payments.

Additionally, TCBS plans to distribute a 20% stock dividend, equivalent to issuing 462.2 million new shares. The ratio for this stock dividend is 5:1, meaning for every 5 shares held, shareholders will receive 1 new share. All dividend shares will be unrestricted and fully transferable.

The dividend distribution is scheduled to be completed by June 30, 2026.

Upon completion of the stock dividend issuance, TCBS anticipates increasing its charter capital to over VND 27,735 billion.

Shareholders also approved amendments to the company’s charter, focusing on enhancing shareholder rights, meeting convening procedures, and GMS invitation protocols.

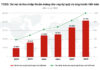

In Q3/2025, TCBS reported operating revenue of VND 3,164 billion, a 71% increase year-on-year.

All business segments demonstrated robust growth. Proprietary trading led revenue contributions with VND 1,171 billion, 2.4 times higher than the same period last year.

Interest income from loans and receivables reached VND 1,015 billion, up 44% year-on-year. Underwriting and securities issuance services contributed VND 421 billion, a 37% increase.

Brokerage services generated VND 318 billion in revenue, soaring 137% year-on-year. In Q3/2025, TCBS ranked 3rd among the top 10 securities firms by brokerage market share on HoSE, with a 7.75% share, up from 7.47% in the first half of 2025.

Operating expenses for the quarter totaled VND 403 billion, 2.8 times higher than the same period last year. TCBS reported pre-tax profit of VND 2,024 billion and after-tax profit of VND 1,620 billion, up 84% and 85% year-on-year, respectively.

For the first nine months of 2025, TCBS recorded operating revenue of VND 7,852 billion, a 36% increase, and pre-tax profit of VND 5,067 billion, up 31% year-on-year, achieving 88% of the annual target.

As of September 30, 2025, TCBS’s total assets stood at VND 81,773 billion, an increase of over VND 28,500 billion since the beginning of the year.

Margin loans and advance payments for securities sales reached a record high of VND 41,713 billion, up nearly VND 16,000 billion year-to-date and VND 8,000 billion quarter-on-quarter.

The Available-for-Sale (AFS) financial assets portfolio totaled over VND 27,000 billion, an increase of more than VND 9,400 billion since the beginning of the year. This includes VND 14,000 billion in unlisted bonds, VND 7,200 billion in certificates of deposit, VND 4,200 billion in listed bonds, and VND 1,700 billion in unlisted equities.

On the funding side, short-term borrowings amounted to nearly VND 30,375 billion. Additionally, TCBS has short-term bond liabilities of VND 4,368 billion and long-term bond liabilities of nearly VND 1,000 billion.

TPBank Emerges as Vietnam’s Leading Strong and Stable Bank with Superior Financial Performance

TPBank has solidified its position as a market leader, with CASA driving growth and expanded credit fueled by technological innovation. The bank’s consistent profitability is further bolstered by its optimized cost-to-income ratio and increasing non-interest income streams. Despite market pressures, TPBank maintains robust capital adequacy and liquidity, laying a strong foundation for sustainable growth.

VNDirect Launches Public Offering of VND 2.000 Billion in Bonds

VNDirect is offering a total of 20 million bonds, divided into two lots, with a face value of VND 100,000 per bond, aiming to raise up to VND 2,000 billion.

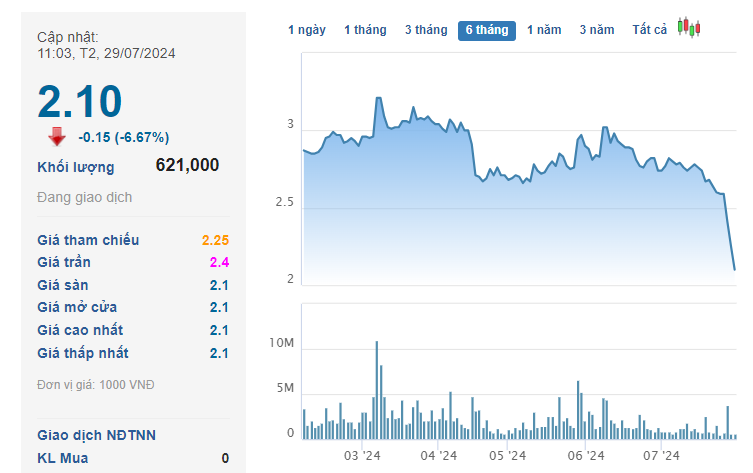

Electric Vehicle Company’s Stock Takes an Unexpected Turn

The stock’s dramatic surge follows a steep decline below par value, marking its lowest point since late last year.