Slower than the index, yet these stocks offer a “sense of security”

As of November 21, 2025, BMP recorded a 29.69% increase, while NTP rose by 24.51%. These figures are still lower than the VN-Index‘s 30.68% growth. However, concluding the performance of these two plastic industry stocks based solely on their 2025 year-to-date gains doesn’t fully capture the allure of this dual race in the plastics sector.

BMP, despite a nearly 30% increase, trails behind the VN-Index. (As of the close of trading on November 21)

|

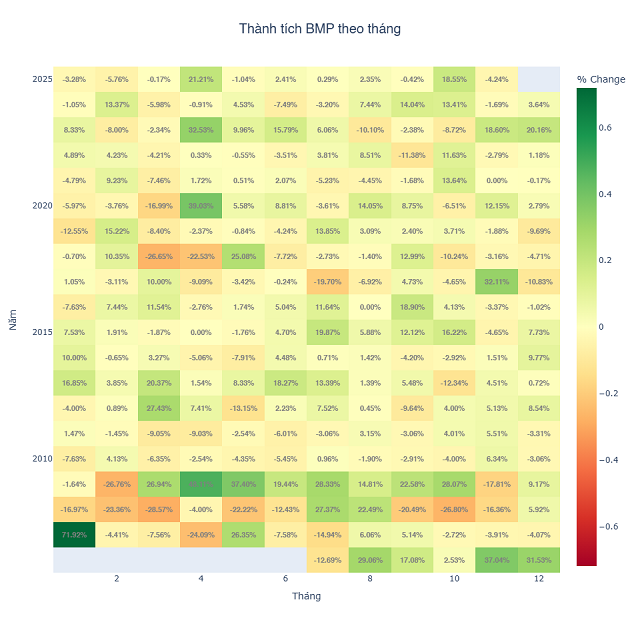

When extending the timeframe, the picture flips entirely. BMP is entering its 5th consecutive year of price growth, a rare streak for a mid-cap company to maintain throughout both favorable and challenging economic cycles.

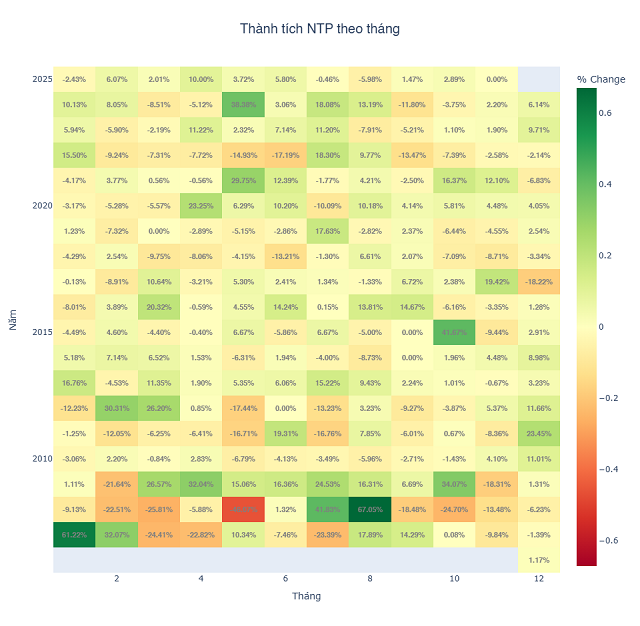

NTP, meanwhile, is in its 3rd consecutive year of growth, though it continues to strive to compete and reclaim market share from BMP.

In 2025, both stocks have consistently set new price records. BMP even reached an all-time high in early November 2025, surpassing 173,000 VND per share. Notably, this occurred during a period when many blue-chip stocks experienced significant declines from their peaks.

Overall, neither BMP nor NTP has caused the kind of “shocking volatility” that forces investors to sell off or cut losses, as seen with other hot stocks. Their moderate price fluctuations, coupled with a long-term upward trend, provide investors with a “sense of security”—a trait favored by fundamentally-driven investors.

Built on the foundation of the plastics industry’s growth

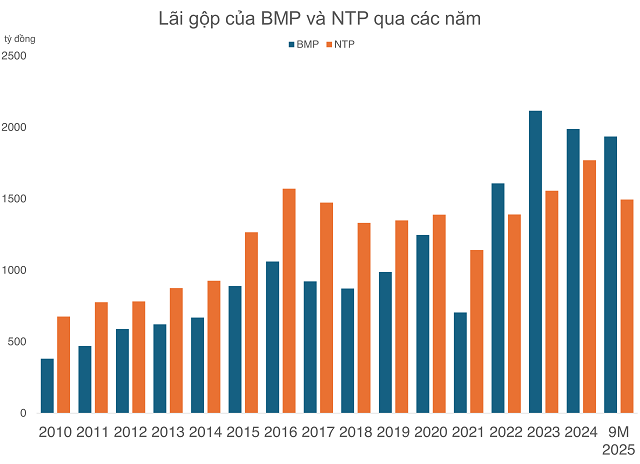

Since 2022, NTP has consistently outpaced BMP in revenue. In the first nine months of 2025, NTP achieved nearly 4.9 trillion VND in net revenue, surpassing BMP‘s 4.3 trillion VND.

However, in the business race, NTP is actually the “chaser.”

To expand its market share, NTP must compete aggressively and attract customers by offering larger discounts. At times, it sacrifices some profit margins to maintain sales volume.

BMP, leveraging its raw material advantage from the SCG ecosystem, maintains the highest gross margins in the industry. Consequently, BMP‘s gross profit has consistently outpaced NTP over the past four years.

BMP maintains superior efficiency despite NTP reclaiming market share.

|

Despite the competition, the construction plastics sector paints a favorable picture.

In a recent report by FPTS Securities, analysts noted that consumption volume in Q3 2025 increased by 21.2% year-on-year, with Q4 2025 expected to surge by 15% year-on-year, driven by three factors: rising demand for housing construction, peak public investment disbursement, and increased promotional programs from both BMP and NTP.

With PVC prices remaining low due to reduced Chinese supply, both BMP and NTP stand to benefit. Profit margins are expected to expand in the final quarter, as selling prices remain stable and additional short-term promotions are implemented to boost demand.

Specifically, plastic resin input prices may stabilize or slightly decrease due to growing oversupply and lackluster consumption. Crude oil prices are also projected to remain flat in Q4 2025.

According to FPTS projections, 2025 could be a record-breaking year for the two plastics giants: NTP is forecast to achieve over 6.7 trillion VND in revenue and more than 1 trillion VND in post-tax profit.

BMP, meanwhile, is expected to reach over 1.3 trillion VND in post-tax profit.

This means that, despite their different approaches, BMP and NTP are jointly contributing to a stable, resilient, and long-cycle growth narrative for Vietnam’s construction plastics industry.

– 10:00 25/11/2025

BSC: Binh Minh Plastic Loses Market Share, Forced to Raise Sales Discounts to 5-Year High

Recognizing elevated discount levels and selling expenses over the past five years in response to market share fluctuations, Binh Minh Plastic Joint Stock Company (BMP) has sustained robust profitability, driven by reduced input material costs. Concurrently, the company continues to uphold its policy of distributing cash dividends to shareholders.

Unveiling the Hidden Buying Power in Investment Fund Transactions

During the week of November 17–21, 2025, investment funds predominantly shifted towards selling activities as the VN-Index fluctuated between 1,620 and 1,650 points, coinciding with the expiration of the VN30 futures contract. Trading volumes from these funds remained relatively low, with individual orders ranging from tens to hundreds of thousands of shares.