International Experience: Walking on Two Feet to Survive

Globally, leading credit rating agencies (CRAs) rarely rely solely on rating services. Instead, they adopt a “two-pillar” business model, where ancillary services play an equally vital role.

Consider one of the global giants: Moody’s Corporation. The company divides its operations into two nearly equal revenue segments. The traditional CRA segment, Moody’s Investors Service (MIS), generated $3.8 billion in revenue in 2024. Moody’s Analytics (MA), specializing in data, software, and risk research, contributed $3.3 billion. Clearly, non-rating services are as crucial as the core business in ensuring the corporation’s overall performance.

This “two-pillar” model is also prevalent in Asia. In India, CRISIL, majority-owned by S&P Global, derives only 28% of its revenue from rating services. The remaining 72% comes from research, analysis, and solutions.

Similarly, at ICRA, another Indian company majority-owned by Moody’s, rating services account for 59% of revenue, while research and analysis contribute the remaining 41%.

In Malaysia, RAM Holdings, the nation’s first CRA, reports that rating and monitoring services contribute 59.5% of revenue. The rest comes from subsidiaries specializing in sustainability consulting, strategic solutions, and data provision.

These figures highlight a clear reality: to survive and grow, CRAs must develop ancillary business segments. The “left foot” business not only supplements profits but sometimes sustains the “right foot,” which requires significant investment and strict regulatory compliance.

The “Money-Burning” Story in Vietnam

At a credit rating market seminar held on November 12, 2025, leaders of two top domestic CRAs shared candidly about their challenges.

Mr. Nguyễn Quang Thuân, Chairman of FiinRatings, revealed that the company had “burned through over $2 million” and expressed uncertainty about profitability by the time he retires.

Mr. Trần Lê Minh, CEO of VIS Rating, acknowledged that the company is “losing as planned,” indicating that initial losses were anticipated.

Mr. Thuân recounted that when he planned to establish FiinRatings, a major shareholder owning over 35% of FiinGroup opposed it. Based on their experience in Japan, CRAs typically take seven years to become profitable.

According to Mr. Trần Lê Minh, the 2022 corporate bond turmoil set back market development and significantly impacted the company’s business.

Mr. Thuân noted that FiinRatings‘ CRA segment accounts for only 40% of total revenue. The remainder comes from other activities, such as green bond verification services. “If we relied solely on credit ratings, we’d likely go bankrupt,” he said.

The Small Pie and New Players

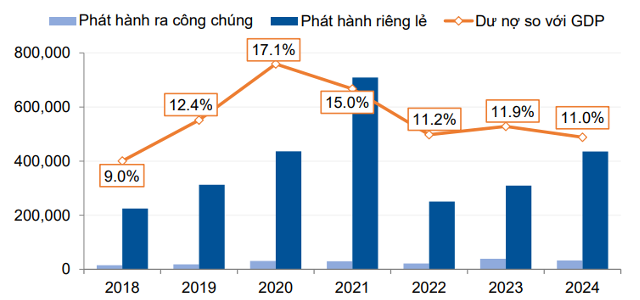

Market size is the biggest challenge. As of October 2025, total corporate bond issuance was approximately VND 482 trillion, with 90% issued privately.

Assuming an average rating fee of 0.1% of issuance value, the total industry revenue would be VND 482 billion (around $18 million). Even at an optimistic 0.2% fee, the figure remains below VND 1 trillion.

Most corporate bonds are issued privately. Source: VBMA.

|

Vietnam’s CRA market is even smaller than estimated, as not all bonds are rated before issuance.

According to the Ministry of Finance, rated corporate bond issuance in 2024 totaled VND 216.6 trillion, or 46.3% of the year’s total. In the first ten months of 2025, rated bond issuance reached VND 287.4 trillion. Domestic CRAs have rated approximately 144 companies in real estate, securities, energy, and manufacturing.

Decree 245/2025/NĐ-CP (effective September 11, 2025), amending Decree 155/2020/NĐ-CP, mandates that only public corporate bond issuances require independent CRA ratings, except for bonds issued by credit institutions or guaranteed by them.

This regulation allows issuers to choose between rating the issuer or the bond. Many opt for issuer ratings to apply the result to multiple bond issuances, reducing costs.

The regulation also excludes public issuances by credit institutions, a major issuer group in Vietnam.

For private bond issuances (90% of the total), Law No. 56/2024 (amending the Securities Law) permits individual professional investors to trade only rated bonds with collateral or guarantees from credit institutions. This provision takes effect on January 1, 2026, and does not mandate ratings for issuances involving only institutional investors, creating a revenue gap for CRAs.

Source: State Securities Commission

|

Vietnam now has five licensed domestic CRAs, alongside global giants S&P, Moody’s, and Fitch. Intense competition in a small market forces companies to diversify revenue streams while vying for market share.

The Importance of Credit Ratings

Despite challenges, the existence and growth of CRAs are essential for a healthy capital market.

Under Decision 1726/QĐ-TTg, Vietnam’s securities market development strategy to 2030 aims to enhance CRA roles and responsibilities, eventually mandating ratings for bond issuances to establish their use as a standard practice.

For large investors like pension and insurance funds managing billions of dollars, ratings are indispensable for investment decisions. These funds cannot independently assess hundreds of individual bond risks. Instead, they rely on independent CRA evaluations to allocate capital. A market without reputable CRAs struggles to attract significant professional investment.

Global Insights

How can Vietnam’s CRA industry overcome its challenges? International experience offers some suggestions.

In India, post-2006, the central bank mandated a 100% risk weight for unrated debt instruments in bank capital adequacy calculations. This compelled issuers to seek ratings to reduce risk weights, enabling access to bank funding at reasonable costs. This indirect “mandatory” approach proved highly effective.

The emergence, struggle, and potential failure of CRAs are natural business dynamics. Regulators should not stifle competition but should tighten entry requirements for capital and governance to ensure only serious, capable players enter the market.

Regulators could also permit (or simply not prohibit) CRAs to offer related services (e.g., macro research, risk consulting, data provision) to sustain themselves during early stages, provided these activities remain separate and independent.

If the capital market is a living organism, CRA services are like independent blood test results, providing objective financial health indicators for optimal decision-making by investors and issuers. Despite early challenges, building a reliable “testing” system is crucial for safe, sustainable market development.

Who Controls the Credit Rating Playground?

– 12:00 24/11/2025