1. Long-Term Growth Opportunities for Individual Investors

The recent upgrade of Vietnam’s stock market to secondary emerging market status by FTSE Russell on October 8th is a positive signal for the entire financial ecosystem. More importantly, it reflects a sustainable development context.

The National Assembly has officially approved a GDP growth target of 10% per year for the period 2026-2030, a record high. To achieve this goal, Vietnam will need to mobilize all resources, with capital playing a crucial role. As the economy expands, the demand for capital to scale production and business operations among listed companies continues to grow, driving revenue and profit growth.

This creates a stable and direct link: investing in the Vietnamese stock market means investing in the country’s economic growth and believing in the “Era of National Ascendancy.”

2. Focus on Capital Markets: Securities Become a Reliable Asset Accumulation Channel

As capital markets become a strategic priority, the stock market will continue to receive stronger policy support. Improvements in legal frameworks, trading mechanisms, long-term investment incentives, and the introduction of new financial products will enhance market structure.

In terms of asset accumulation, securities are increasingly outperforming traditional channels. Low savings interest rates make bank deposits less attractive for long-term wealth creation. Real estate requires substantial capital and has low liquidity. Gold serves as a defensive asset but doesn’t generate sustainable value growth. In contrast, the stock market – closely tied to GDP growth and corporate performance – offers a more robust investment foundation.

The Dollar-Cost Averaging (DCA) strategy is particularly well-suited to the Vietnamese market. Regular monthly or quarterly investments help investors mitigate timing risks, cultivate financial discipline, and capitalize on the economy’s long-term growth. As the market becomes more transparent, stable, and well-regulated, stock accumulation strategies yield notable results, appealing to both busy young professionals and long-term investors.

|

3. Solutions for New Investors: Lowering Barriers, Enhancing Long-Term Efficiency with YSsaving

Despite the market’s opportunities, individual investors – especially newcomers – face three common barriers: lack of time, knowledge, and risk management experience. This often prevents them from confidently engaging with the market.

|

Addressing this trend, the YSsaving wealth accumulation product is designed to help investors approach the market in a simple, scientific, and sustainable manner. YSsaving operates on an automated periodic investment model, allowing clients to regularly invest in high-quality stocks without constant market monitoring. This method reduces short-term volatility impacts while optimizing profits during mid to long-term market growth.

YSsaving offers key benefits:

- Fully automated monthly investments, saving time and reducing market monitoring pressure

- Benchmark stock portfolio comprising leading stocks and ETFs, aligned with sustainable growth goals

- Emotion-free decision-making, eliminating common errors driven by sentiment

- Accessible to all income levels, enabling wealth accumulation starting from just 1 million VND monthly

As Vietnam’s stock market enters a phase of high-quality, sustainable growth aligned with the economy, solutions like YSsaving become essential tools for individual long-term wealth building. Now is the opportune moment to begin a structured investment journey, partnering with Vietnam’s rising stock market in the coming decade.

- Explore YSsaving Wealth Accumulation Solution: https://nentang.yuanta.com.vn/tich-luy-tai-san-yssaving

- Open a Yuanta Vietnam Securities Account: https://taikhoan.yuanta.com.vn/?broker_id=9000&utm_source=pr&utm_medium=banner&utm_campaign=accopeningtk01&utm_content=YSsaving

Services

– 10:45 25/11/2025

Where Are the Nearly 650 Trillion VND in Securities Investment Trusts Allocated by the Fund Management Industry?

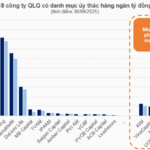

As of Q3/2025, the total assets under management (AUM) in the trust portfolio of the fund management industry surpassed 648 trillion VND, predominantly held by companies backed by major insurance players. The portfolio compositions vividly reflect the distinct philosophies of each firm within the sector.

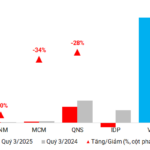

Dairy Industry Boosts Promotions in Q3

Profits in the dairy industry for Q3/2025 have stagnated as major players ramp up promotional spending to maintain market share.

Stock Market Week 17-21/11/2025: Tug-of-War Continues

The VN-Index trimmed its losses in Friday’s session after retesting the Middle Band of the Bollinger Bands, a critical support level essential for sustaining its short-term recovery momentum. Amid cautious investor sentiment and limited demand breadth, the market is likely to remain volatile and range-bound in the upcoming sessions.