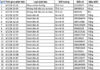

According to the Customs Authority, Vietnam’s total import-export turnover reached USD 761.4 billion by the end of October, marking a 17.5% increase (USD 113.2 billion) compared to the same period last year. Exports totaled USD 390.1 billion, up 16.3%, while imports reached USD 371.3 billion, rising 18.7%. Notably, taxable export turnover hit nearly USD 133 billion, a USD 5.9 billion increase year-over-year, directly bolstering budget revenue.

Within this landscape, taxable imports emerged as a key driver of revenue growth. Businesses increased imports of raw materials, machinery, equipment, and components for production, accounting for nearly half of total taxable import turnover and adding approximately VND 17,240 billion to the budget.

The automobile market remained vibrant, with whole vehicle imports rising 20.1% in volume and 30.2% in value, contributing VND 10,589 billion to budget revenue. Fertilizers also stood out, with a 140% value increase, adding VND 1,216 billion. Additionally, value-added tax (VAT) from small-value goods, expanded consumption, and production needs generated an extra VND 1,258 billion.

Strong growth in machinery, equipment, and component imports for production boosted budget revenue by VND 17,240 billion.

Processed seafood, consumer goods, electronic components, household appliances, and textiles/footwear production materials also saw import growth, significantly contributing to revenue. While taxable export turnover dipped 7.5% to USD 5.7 billion, robust taxable import growth offset this, adding over VND 32,383 billion to the budget.

Remarkably, this revenue increase coincided with widespread business support policies. VAT reductions saved businesses VND 28,200 billion, and other measures cut import-export taxes by VND 1,783 billion.

As the year-end approaches, the Customs Authority will intensify risk management, post-clearance inspections, and efforts to combat origin fraud, valuation manipulation, and illegal transshipment to ensure a fair and transparent trade environment.

Locally, customs offices must closely monitor market and commodity shifts, assess geopolitical impacts, and develop tailored strategies. Priorities include aggressive tax debt recovery, violation handling, and strict compliance with audit findings. With current growth trends, import-export budget revenue is expected to surpass the VND 411 trillion target.

Deputy Prime Minister Le Thanh Long: Public Debt Significantly Below Regulatory Limits; Development Investment to Account for 40%

Deputy Prime Minister Le Thanh Long announced a significant shift in Vietnam’s state budget allocation. The current term prioritizes development investment, allocating 32-33% of the budget, compared to 28% in the previous term. Concurrently, recurrent expenditures have been reduced to 57-58%, down from 63.2%. Looking ahead, the 2026-2030 plan aims to further increase development investment to 40%, while recurrent spending is projected to decrease to approximately 50.7%.

Nearly $870 Million in FDI Poured into Nghe An Province

In the first nine months of the year, Nghe An province approved investment policies and issued Investment Registration Certificates for 55 projects, while also adjusting 147 project instances. The total foreign direct investment (FDI) capital reached nearly 870 million USD.

Mass Exodus: Over 8,000 Tax Officials Resign

Mr. Dang Ngoc Minh, Deputy Director of the Tax Department, revealed that this year, the tax sector is implementing two major organizational restructuring phases, resulting in a reduction of over 8,000 personnel across the industry. Despite this significant downsizing, the workload continues to grow exponentially.