Despite owning vast data reserves, many financial institutions today fail to unlock their full potential. Does having more data truly equate to greater value?

Illustrative image

The “Big Data Paradox”: Abundant Data, Scarce Value

The financial sector faces a stark paradox: data volumes surge, yet extraction value remains low. Enormous datasets—transactions, customer behavior, compliance reports—are collected every second. However, when business officers or branch managers seek specific insights, they often face delays, sometimes spanning days, due to heavy reliance on IT and data analysts.

Forrester Research reveals that businesses utilize only 27–40% of available data, leaving 60–73% untapped. McKinsey & Company reports that merely 18% of major banks fully leverage data analytics. These figures highlight a vast gap between potential and actual utilization, as most organizations focus on collection and storage rather than data-driven actions.

Consequently, data remains dormant in repositories, inaccessible to those who need it most—leaders, operational staff, and sales teams. This “treasure trove” of data becomes a “sleeping asset.”

Why Data Freezes: Technical and Mindset Barriers

The root causes extend beyond technology, encompassing operational practices:

First: Technical Hurdles – Traditional systems require SQL or complex BI tools for reporting, creating barriers for non-technical users like business and sales teams.

Second: Security and Access Challenges – Expanding data access risks security breaches. Granular permission management—ensuring users view only relevant data—is a governance challenge.

Third: Lack of Personalization – Users cannot customize or save frequent reports, forcing repetitive, time-consuming processes.

Thawing Data: The Role of AI and Intelligent Platforms

Data’s value lies not in terabytes stored but in its understanding and application. Instant access, tailored reports, and evidence-based decisions transform data into a competitive edge.

The issue isn’t data scarcity but its “frozen” state. To unlock value, organizations must shift from “report management” to “data democratization,” with AI as a key enabler.

AI enables natural language queries, allowing users—from executives to frontline staff—to ask questions like, “How has customer satisfaction trended recently?” Results appear instantly as charts or reports, accelerating decision-making.

Users can explore data dynamically, uncovering correlations and insights. The system’s limits now reflect user creativity and organizational access controls.

Empowering Users: A New Data Governance Approach

Organizations are moving from technical silos to user empowerment, enabling leaders, operational staff, and sales teams to access data independently.

Next-gen platforms, like Smart Report by DTSVN, leverage AI and natural language for intuitive querying. Users converse with the system as if consulting a data expert, while robust security ensures compliance.

Smart Report offers a comprehensive solution for banking data challenges. Natural language access, personalized reports, and row-level security balance flexibility with control, turning data into a strategic asset.

Conclusion:

As AI ushers in a new era of intelligent analytics, the question for banks shifts from “How much data do we have?” to “How much value do we extract?” Data’s true power lies in its ability to drive faster, more accurate, and actionable decisions.

Perhaps it’s time to awaken these “sleeping data repositories.”

Compiled by: DTSVN Team – Digital Transformation Solutions for Finance & Banking.

Sources: Forrester Research, Inc. Magazine (2023); McKinsey & Company, Analytics in Banking: Time to Realize the Value (2022)

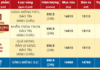

Unlocking Competitive Advantage: TPBank’s Smart Data Revolution

With a comprehensive approach—spanning people, systems, and legal frameworks—TPBank is steadily transforming data into an intelligent operational foundation. Here, every decision is grounded in deep insights rather than intuition. This is the tangible and sustainable competitive edge that defines a leading digital bank.