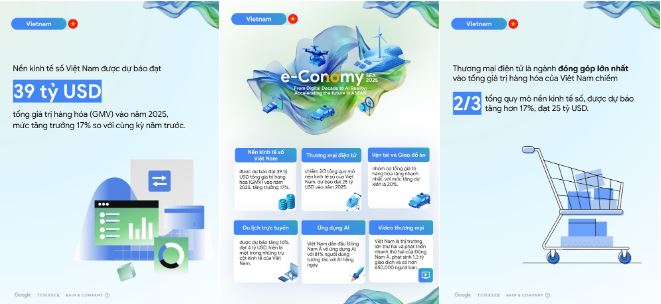

According to the tenth annual Southeast Asia Digital Economy Report (e-Conomy SEA 2025) released on November 25 by Google, Temasek, and Bain & Company, Vietnam’s digital economy is projected to reach a gross merchandise value (GMV) of $39 billion by the end of 2025.

With a 17% year-on-year growth, Vietnam emerges as the second-fastest-growing digital economy in Southeast Asia.

Double-digit growth across key sectors

The report highlights double-digit growth across all core sectors of the digital economy. E-commerce remains the largest contributor to Vietnam’s GMV, accounting for two-thirds of the total digital economy and is expected to grow by 17%, reaching $25 billion by the end of 2025.

The digital economy’s growth is not solely driven by e-commerce. The Transport and Food Delivery sector continues to be the fastest-growing in terms of GMV in Vietnam, with a projected 20% increase to $5 billion in 2025. Vietnam is also witnessing a rapid transition to electric vehicles (EVs), fueled by government incentives and demand from delivery platforms.

Online media is experiencing a significant acceleration compared to previous years, with an expected growth of over 16% to reach $6 billion. This sector encompasses Advertising, Online Gaming, Video-on-Demand, and Music Streaming.

A key growth driver is the Online Gaming sector, where Vietnam significantly contributes with three game developers ranking among the global top 15 in downloads.

Online travel is also forecasted to grow by 16%, reaching $4 billion. Tourism is a cornerstone of Vietnam’s economy, with robust growth from 2024 extending into 2025. This impressive performance reflects both the recovery of international visitors, particularly from Asia and Europe, and the resilience of domestic tourism, supported by favorable visa policies and international promotion strategies.

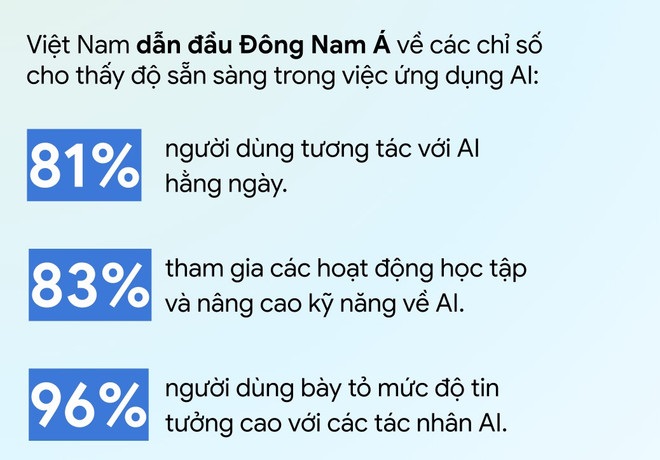

The report also positions Vietnam as a leader in Southeast Asia regarding user readiness and trust in AI. This is evidenced by three key indicators: 81% of users interact with AI tools and features daily; 83% engage in AI learning and skill enhancement activities; and notably, 96% are willing to share data access with AI agents.

User engagement with AI is demonstrating significant commercial impact, with revenue from AI-integrated applications increasing by 78% year-on-year as of mid-2025. Users are primarily drawn to AI for three reasons: saving time in information search and comparison (44%); accessing 24/7 customer support (35%); and reducing costs through better deals (30%).

In terms of funding, Vietnam is home to over 40 active AI startups, with private investment in AI reaching $123 million in the past year. This figure represents 5% of the total AI investment in the region during the same period. Additionally, 79% of investors anticipate continued growth in capital inflows into Vietnam, particularly in software, services, AI, and deep tech sectors.

“With the positive growth rate of the digital economy and the highest level of AI adoption in the region, Vietnam has become one of the most critical markets in Southeast Asia’s digital technology development, enhancing productivity and creating value across multiple sectors,” said Marc Woo, Managing Director of Google Vietnam.

New drivers for comprehensive growth

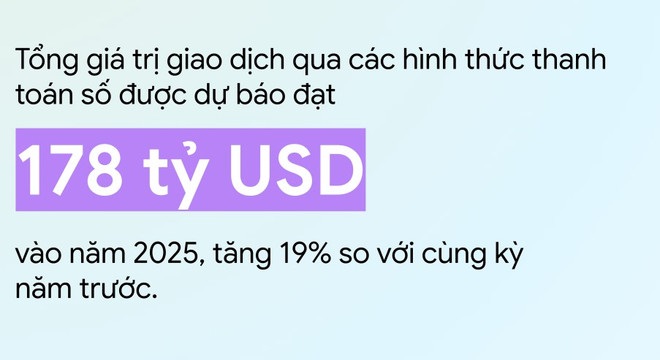

Digital Financial Services (DFS) in Vietnam are emerging as a key growth area, driven by the government’s push for cashless payments.

The total value of digital payment transactions is projected to reach $178 billion in 2025, reflecting the increasing adoption of digital platforms in the market.

Within DFS, online lending services are showing strong momentum, ranked as the second-fastest-growing financial segment in the region with a compound annual growth rate of 22% during 2024-2025.

There are approximately 30 million active e-wallet accounts nationwide, contributing to the promotion of cashless payments and VietQR transactions. This progress aligns with the goal of achieving 80% cashless e-commerce transactions by 2030. Furthermore, the QR payment system has been integrated with Thailand and Cambodia, opening new opportunities for cross-border trade and tourism.

Commercial video in Vietnam is becoming a prominent driver of digital growth, ranking second in scale and growth rate in Southeast Asia. Transaction volumes and the number of sellers have both increased by 60% year-on-year, indicating rapid consumer adoption of video-based shopping and commercial content.

During the same period, commercial video generated 1.3 billion transactions and engaged 650,000 sellers, showcasing the expanding market scale. This robust growth underscores the importance of video commerce as a key development direction for the digital economy, offering new business opportunities and expansion models for companies nationwide.

Minh Sơn

– 12:52 25/11/2025

Shopee 9.9: Fueling Explosive Growth for Sellers and Brands

Experience the ultimate shopping and entertainment extravaganza with Shopee’s “9.9 Super Shopping Day”! This highly anticipated event offers a wide array of exciting programs, exclusive deals, and irresistible promotions from top brands and sellers, making it the perfect opportunity for shoppers to indulge in a thrilling and rewarding experience.

The Digital Wallet Wars: Banks and E-Wallets Battle it Out for User Verification Supremacy

As per the State Bank of Vietnam’s insights, cashless payments have witnessed a remarkable surge, with over 182 million personal accounts facilitating such transactions. Notably, several banks now process more than 95% of their transactions through digital channels, a testament to the country’s evolving digital landscape.

The Secret to Converting Online Sales: Unveiling the Monthly Order Numbers of Vietnamese Shoppers

The average Vietnamese consumer shops online four times a month, and the country’s e-commerce and digital economy sectors are poised for even more robust growth.