These stocks are meticulously selected based on technical analysis signals, liquidity, and investor interest. The following analyses can serve as valuable references for both short-term and long-term investment strategies.

AGG – An Gia Investment and Development JSC

On November 21, 2025, AGG’s stock price experienced a tug-of-war, with a Doji pattern emerging during the trading session.

Trading volume remained significantly below the 20-day average, indicating investor caution following the Death Cross of the 50-day SMA and 100-day SMA earlier in November 2025.

The previous low from April 2025 (equivalent to the 14,200-15,500 range) is expected to provide support in the upcoming period.

DPM – PetroVietnam Fertilizer and Chemicals JSC

DPM’s stock price declined on November 21, 2025, after testing the 38.2% Fibonacci Retracement level.

Additionally, the price fluctuated while testing the 50-day SMA and 100-day SMA. These levels will continue to act as resistance in the near future.

The Stochastic Oscillator indicates a strong sell signal, increasing short-term risks.

HDB – Ho Chi Minh City Development Commercial Joint Stock Bank

HDB’s stock price was in a stalemate on November 21, 2025. Foreign investors’ reduced net selling has stabilized investor sentiment in the short term.

The price has consistently tested the 50-day SMA in recent trading sessions and is currently close to this level.

The MACD indicator has also reversed strongly, providing a buy signal.

KHG – Khai Hoan Land Group JSC

During the November 21, 2025 trading session, KHG’s stock price continued to be in a stalemate, with trading volume significantly below the 20-day average.

Both the MACD and Stochastic Oscillator have issued strong sell signals and are continuing to decline, indicating substantial risks.

The author expects the 50-day SMA and 100-day SMA to provide effective support for KHG, similar to the situation in October 2025.

NLG – Nam Long Investment Corporation

On November 21, 2025, NLG’s stock price halted its decline, despite continued net selling by foreign investors.

The Stochastic Oscillator has reversed and issued a sell signal, increasing risks.

The previous low from October 2025 (equivalent to the 34,000-36,000 range) will provide support in the upcoming period.

MWG – Mobile World Investment Corporation

MWG’s stock price formed a Hammer-like candlestick pattern on November 21, 2025, and remains below the 50-day SMA.

Trading volume surged, exceeding the 20-day average.

The MACD indicator abruptly reversed and issued a strong sell signal, making the short-term outlook quite negative.

SSB – Southeast Asia Commercial Joint Stock Bank

SSB’s stock price rose slightly on November 21, 2025. The average regular selling volume exceeded the average buying volume, suggesting continued stalemate and fluctuations.

The previous low from January 2025 (equivalent to the 16,500-17,000 range) will provide strong support in the near future. Buying when the price tests this range is recommended.

TPB – Tien Phong Commercial Joint Stock Bank

TPB’s stock price continued to test the 50-day SMA and 100-day SMA on November 21, 2025.

However, both the Stochastic Oscillator and MACD have issued buy signals, indicating that risks are not excessive.

Strong net buying by foreign investors has stabilized investor sentiment in the short term.

VCB – Vietcombank

On November 21, 2025, VCB’s stock price declined and is currently below key moving averages, increasing risks.

Additionally, the Stochastic Oscillator has just issued a sell signal, indicating potential further declines.

The previous low from October 2025 (equivalent to the 58,500-61,000 range) will continue to provide strong support.

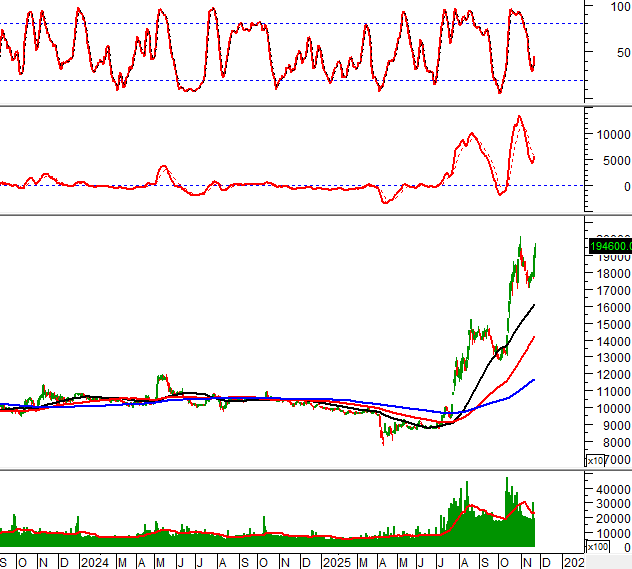

VJC – Vietjet Aviation Joint Stock Company

VJC’s stock price continued to rise on November 21, 2025.

The Stochastic Oscillator has just issued a buy signal. Meanwhile, the MACD indicator has reversed and may issue a buy signal in the short term.

The likelihood of surpassing the previous high from October 2025 (equivalent to the 200,000-201,200 range) is quite high in the near future.

Technical Analysis Department, Vietstock Advisory Division

– 08:58 24/11/2025

Derivatives Market Update: Investor Sentiment Continues to Strengthen on November 25, 2025

On November 24, 2025, both the VN30 and VN100 futures contracts surged in a synchronized rally. The VN30-Index marked its third consecutive day of gains, closing above the 50-day SMA, signaling sustained investor optimism.

Market Outlook for Warrant Trading Week 24-28/11/2025: A Mix of Green and Red Trends

As the trading session closed on November 21, 2025, the market witnessed a mixed performance with 91 stocks advancing, 160 declining, and 37 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of VND 3.57 billion worth of shares.