In Q3, the fund management industry (FMI) recorded a total revenue of nearly VND 1.1 trillion, a 28% increase compared to the same period last year. This growth was primarily driven by fund management and investment portfolio management (trust) activities. Trust services continued to dominate, accounting for nearly 44% of total revenue, further solidifying their pivotal role in the FMI’s business operations.

As of the end of Q3 2025, the total assets under management (AUM) in the FMI reached over VND 648 trillion, a 5% increase from Q2 and an 11% rise since the beginning of the year. This growth is understandable given the dynamic performance of Vietnam’s stock market, which has attracted a significant influx of capital.

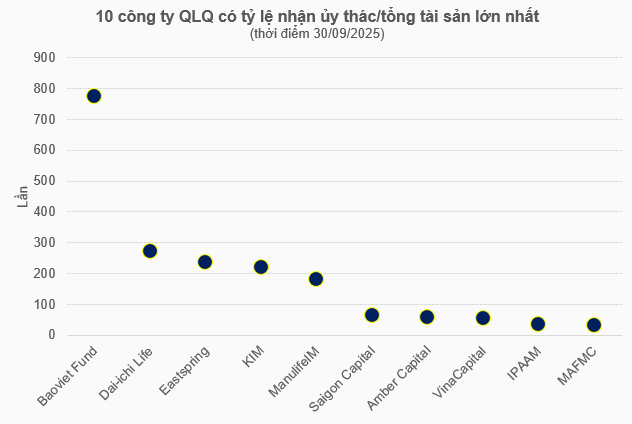

Compared to total assets, the value of trust contracts is 55 times higher. Some companies, such as Baoviet Fund, Dai-ichi Life Vietnam, Eastspring Investments, KIM Vietnam, and Manulife Investment Vietnam (ManulifeIM), have trust contract values hundreds of times greater than their total assets.

Eighteen companies in the industry manage trust portfolios exceeding VND 1 trillion, totaling over VND 640 trillion, representing nearly 99% of the entire industry. Unsurprisingly, the top four positions are held by companies backed by major insurance providers.

Baoviet Fund leads with a portfolio of over VND 184 trillion, followed by Eastspring with VND 163 trillion, ManulifeIM with nearly VND 131 trillion, and Dai-ichi Life with nearly VND 61 trillion. Collectively, these companies manage over VND 539 trillion, accounting for approximately 83% of the industry, highlighting their significant advantage.

KIM and VinaCapital also have unique advantages, with 99% and 92% of their portfolios, respectively, sourced from foreign trusts. Apart from the four insurance-backed companies mentioned, no other domestic firms have larger portfolios than KIM and VinaCapital.

Source: Author’s compilation

|

Twenty-six companies experienced growth in their trust portfolios compared to the beginning of the year. SGI Capital saw the highest growth, increasing 524 times to over VND 451 billion, although the structure was not detailed. As of June 30, when the portfolio value was nearly VND 474 billion, customer funds were entirely allocated to stocks, primarily KBC, with additional investments in MWG, HPG, and PNJ.

Other notable growth cases include Viet Cat, LPBA (formerly Genesis), and PVI AM. LPBA allocated its entire portfolio to listed securities, while PVI AM, part of the PVI Holdings ecosystem, focused on bonds, which constituted 59% of its structure.

Large firms like Saigon Capital, MB Capital, and Dragon Capital Vietnam also saw significant trust portfolio growth, increasing by 84%, 78%, and 59%, respectively. Saigon Capital’s growth stemmed from new inflows of nearly VND 2.8 trillion into stocks, while MB Capital shifted resources to unlisted bonds, term deposits, and deposit certificates. Dragon Capital’s additional funds came from domestic individuals, though its portfolio structure remains undisclosed.

BVIM recorded new trusts of nearly VND 81 billion, with 93% allocated to unlisted stocks and the remainder to listed stocks.

Conversely, 14 companies experienced declines in trust portfolio values. Red Capital, LHC, and NTP AM had no trusts as of September 30, 2025. Vietinbank Capital saw a 57% reduction to VND 963 billion, primarily due to decreased listed stock investments. SSIAM and UOBAM Vietnam reduced their portfolios by 32% and 26%, respectively, shrinking both stock and bond holdings.

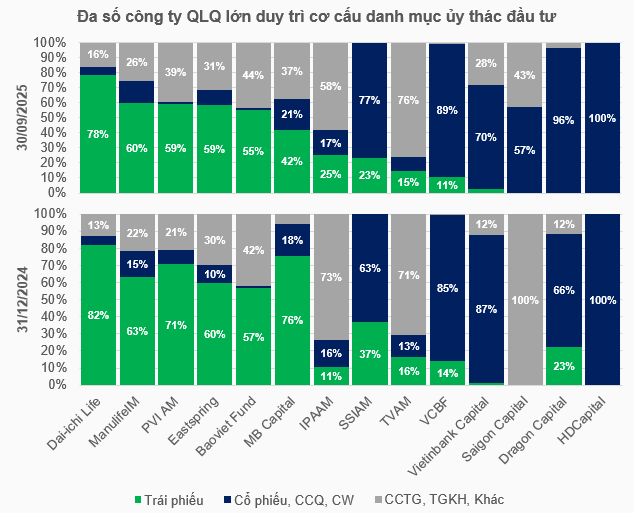

Overall, aside from the aforementioned companies with significant fluctuations, most market participants maintained stable trust portfolio structures, particularly those managing tens to hundreds of trillions. Companies like Dai-ichi Life, ManulifeIM, Eastspring, and Baoviet Fund prioritized bonds—a safe and stable investment channel suitable for their substantial insurance-backed capital. However, the bond proportion in their trust portfolios slightly decreased compared to the beginning of the year.

Source: Author’s compilation

|

– 08:00 25/11/2025

Stock Market Strengthens Position Ahead of Anticipated Upgrade to “Secondary Emerging Market” Status

The VIS Rating report reveals that Vietnam’s stock market is poised for sustained growth in the first nine months of 2025 (9M2025), fueled by robust capital-raising strategies, consistent profitability, and growing investor confidence.

Stock Market Week 17-21/11/2025: Tug-of-War Continues

The VN-Index trimmed its losses in Friday’s session after retesting the Middle Band of the Bollinger Bands, a critical support level essential for sustaining its short-term recovery momentum. Amid cautious investor sentiment and limited demand breadth, the market is likely to remain volatile and range-bound in the upcoming sessions.

Market Turmoil Unveiled: One Stock Defies Odds, Surges “Deep Purple” for Ten Sessions, Doubling in Value Within Two Months

The stock price has surged an impressive 115%, climbing steadily from just under 3,000 VND per share to a remarkable 6,740 VND.