At the conference held on the afternoon of November 25th, HAG announced plans to IPO International Investment HAGL (formerly known as Hung Thang Loi Gia Lai) in Q2/2026. Bầu Đức confidently stated, “This is an exceptionally strong company.”

“Initially established for trade, the company now plays a pivotal role in driving the group’s profits and revenue. It owns prime land and plantations of durian, banana, and coffee, positioning it for significant growth,” Bầu Đức emphasized.

Mr. Doàn Nguyên Đức (Bầu Đức) – Chairman of HAGL

|

Bầu Đức revealed that just a few years ago, listing International Investment HAGL wasn’t on the agenda. “However, after reviewing its impressive performance, we decided to pursue an IPO in Q2/2026.”

Preliminary data shows International Investment HAGL has a charter capital of VND 1,685 billion, equity of VND 3,700 billion, total assets exceeding VND 11 trillion, and credit debt of VND 3,400 billion. The company manages over 7,000 hectares of durian, coffee, and banana plantations (currently harvesting) in Laos.

True to form, HAG’s Chairman made bold commitments. He pledged a 30% annual profit growth, with 50% of profits distributed as cash dividends over three consecutive years, and the remainder reinvested.

“This could be a significant investment opportunity. I promise consistent cash dividends over the next three years, even up to five years, totaling 50% of profits. For instance, if profits reach VND 2 trillion, VND 1 trillion will be distributed, with the rest reinvested,” Bầu Đức assured.

HAG has multiple subsidiaries eligible for listing, but International Investment HAGL was chosen for its “compelling profitability, strong cash flow, and thriving plantations.” The 2026 timeline aligns with Vietnam’s projected high economic growth (over 8%, potentially double-digit), boosting financial markets.

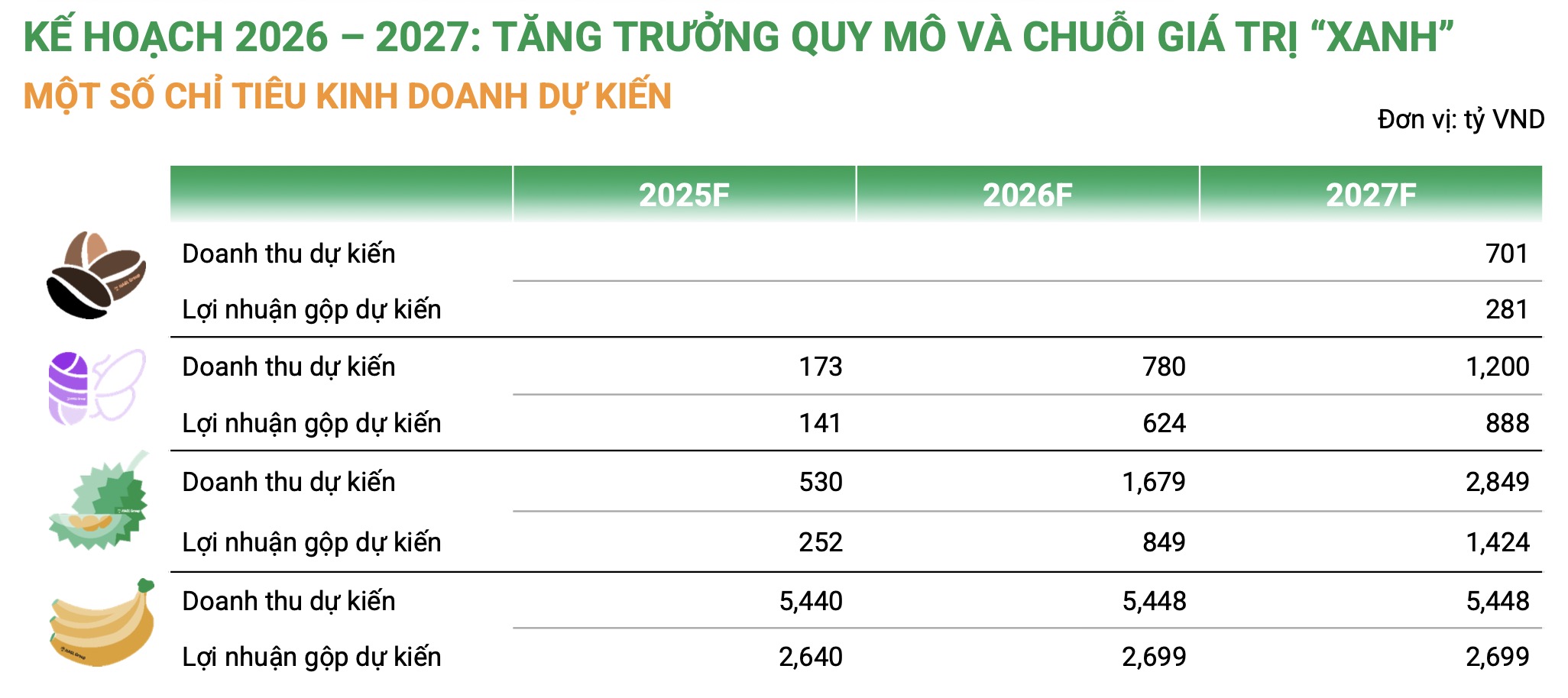

Bầu Đức cited the company’s durian plantations, entering peak production, as the basis for his ambitious profit forecasts: VND 2 trillion in 2026 and nearly VND 2.8 trillion in 2027. He expressed confidence in exceeding these targets.

“It’s hard to believe a VND 1.6 trillion company could yield VND 2.7–2.8 trillion in profits. However, HAG focuses on crop agriculture, where the biggest risk is land scarcity. Today, planting a hectare of coffee or durian costs VND 2–3 billion just for land. HAG already owns the land,” he explained.

Formerly Hung Thang Loi Gia Lai LLC, International Investment Hoang Anh Gia Lai was renamed on November 18, 2025.

Bầu Đức discusses International Investment Hoang Anh Gia Lai. Photo: TM

|

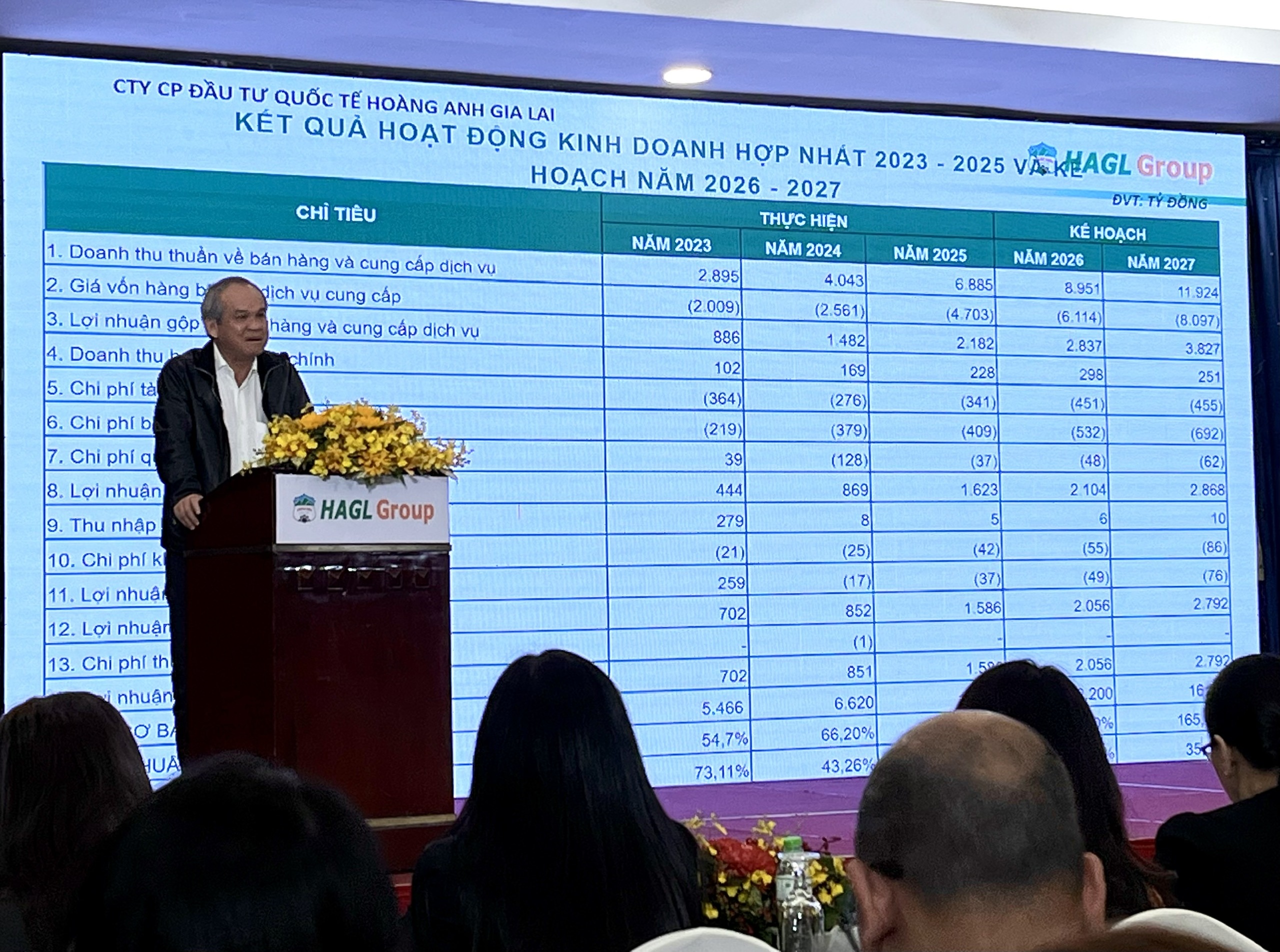

HAG’s 2025 profits projected to surpass targets by 80%, aiming for VND 5 trillion by 2027

During the session, HAG announced HAGL Group’s 2025 estimates: VND 7.7 trillion in revenue and VND 2.8 trillion in post-tax profit, exceeding the 2025 AGM targets by 9% and 80%, respectively.

Having overcome cumulative losses, Bầu Đức now targets VND 2 trillion in annual profits, with ambitions of VND 5 trillion by 2027.

“HAG’s VND 5 trillion goal by 2027 seems far-fetched, but over the past five years, Bầu Đức’s predictions have been accurate. I’m confident this trend will continue,” he stated.

Source: HAG

|

Bầu Đức attributed this to bananas currently leading in revenue and profit. However, within two years, coffee will take the lead, followed by durian, mulberry, and bananas. HAGL cultivates 10,000 hectares of coffee, 70% of which is high-value Arabica, grown above 1,000 meters.

Addressing shareholder concerns, Bầu Đức highlighted HAGL’s risk management. For natural disasters, HAGL operates in flood-free regions like Gia Lai, Laos, and Cambodia. Drought is mitigated using Israeli drip irrigation, reducing water usage by 80%. Pest control employs advanced technology, including drones.

Bầu Đức is confident in HAG’s plans and the International Investment HAGL IPO

|

Regarding market risks, Bầu Đức stressed the importance of market control in agriculture. HAGL’s large-scale operations attract major clients from Thailand, South Korea, and China. Coffee, traded on NY and London exchanges, allows for futures selling and price locking.

With improved financials, HAGL plans to distribute dividends. Bầu Đức announced a 5% cash dividend (VND 500/share) in 2026, joking, “I’m pacing dividends to avoid shocking shareholders.”

– 22:42 25/11/2025

Afternoon Technical Analysis, November 25: Consistently Low Trading Volume

The VN-Index is experiencing modest growth, fluctuating around its 50-day SMA, while trading volumes remain consistently low. Meanwhile, the HNX-Index has entered its sixth consecutive losing session, with the MACD indicator signaling a renewed sell-off.

Record Dividend Announced by 911 Taxi Following Challenging Q3 Performance

{“is_finished”:false,”event_type”:”stream-start”,”generation_id”:”f50c4c80-7464-4ba0-9282-a86153c6068a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”9″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Group”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Corporation”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” (“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”H”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”OSE”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”:”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” NO”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”)”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” has”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” announced”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”4″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” cash”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” dividend”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” payout”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” of”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”%”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” (“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” V”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ND”}

Unlocking the $460 Million Secret: How Billionaire Trần Đình Long Doubles Profits in Pig, Cattle, and Poultry Farming

At an offering price of VND 41,900 per share, Hoa Phat Agriculture (HPA) is valued at nearly VND 10.7 trillion upon its market debut. Despite lower revenue compared to industry leaders, HPA’s profits are closely trailing, driven by its superior profit margins.