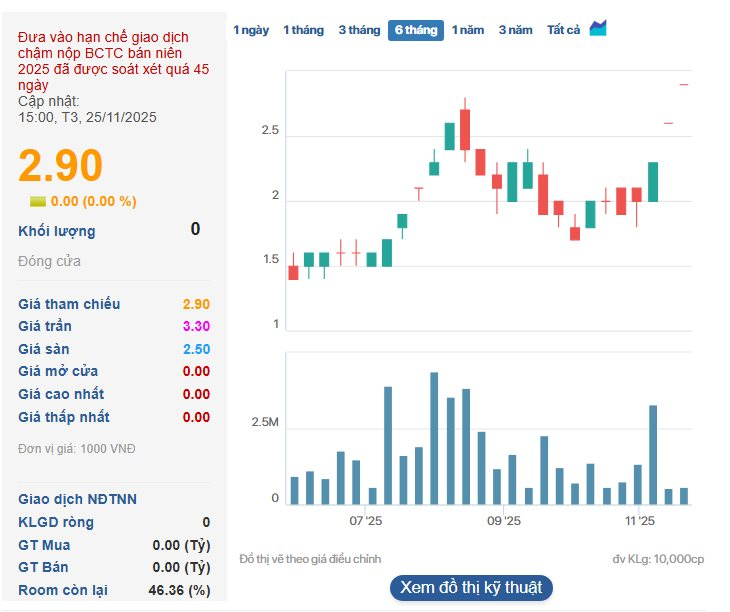

POM’s share price surged dramatically to VND 2,900 per share, accompanied by a significant spike in trading volume, marking an impressive recovery from its historic low of VND 1,500 recorded earlier in the year.

The primary catalyst for this surge stems from the announcement that VinMetal, a newly established subsidiary of Vingroup, has committed to providing Pomina with a zero-interest loan and guaranteeing the purchase of its steel output. However, a closer examination of Pomina’s Q3/2025 financial report reveals a company teetering on the brink of collapse, with Vingroup’s intervention acting as a crucial lifeline.

Pomina’s Q3/2025 performance continued to be mired in challenges, with net revenue plummeting to just over VND 202 billion, less than half of the VND 488 billion recorded in the same period last year.

For the first nine months of the year, cumulative revenue reached VND 1,694 billion. While cost-cutting efforts yielded a modest gross profit of nearly VND 4.7 billion in Q3 (compared to a gross loss of VND 32 billion in the same period last year), this pales in comparison to the staggering financial expenses burdening the company.

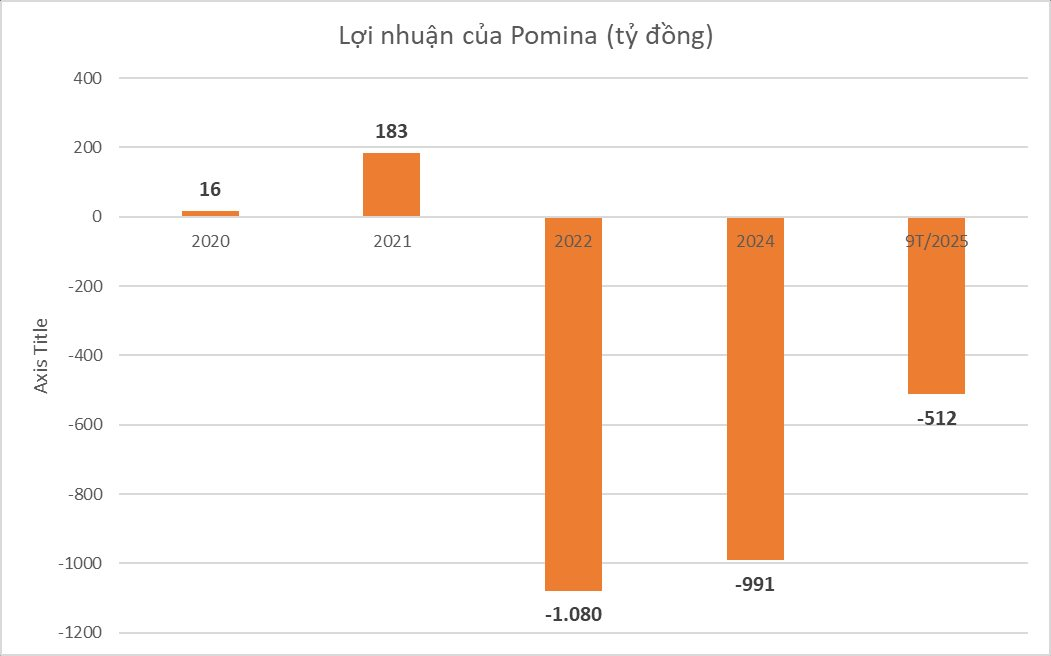

Historically, Pomina’s decline has been systemic. Following a profitable period in 2020-2021, the company spiraled into a record loss of over VND 1,000 billion in 2022, followed by another near-VND 1,000 billion loss in 2024.

The crushing weight of debt has been Pomina’s Achilles’ heel. In Q3/2025, financial expenses, though slightly reduced, still consumed VND 159 billion, with interest payments accounting for the lion’s share at nearly VND 159 billion.

Consequently, the company’s entire revenue is barely sufficient to cover bank interest payments, leaving no room for operational, management, or sales expenses. Unsurprisingly, Pomina reported a post-tax loss of VND 182.7 billion in Q3, bringing the total nine-month loss for 2025 to VND 512 billion.

As of September 30, 2025, Pomina’s accumulated undistributed losses on the balance sheet ballooned to over VND 3,050 billion. This staggering figure has completely eroded the owner’s equity, pushing the company’s equity into negative territory at nearly VND -187 billion. This is a stark warning sign regarding the company’s ability to continue operating without a fresh infusion of capital. At the beginning of the year, Pomina’s equity still stood at a positive VND 263 billion.

The financial health of this once-dominant player in the southern construction steel market, holding a 30% market share, is now severely imbalanced. While total assets as of Q3 exceeded VND 9,032 billion, total liabilities reached VND 9,219 billion. The pressure to repay short-term debt is immense, with short-term loans and financial leases totaling over VND 5,237 billion. In stark contrast, Pomina’s cash and cash equivalents stand at a mere VND 22 billion, a critically low liquidity ratio.

Although operating cash flow for the period was positive at VND 208 billion, this was primarily due to working capital adjustments through reduced receivables and increased payables, rather than core business efficiency. This cash flow imbalance led to Pomina’s repeated violations of information disclosure regulations and its forced delisting in May 2024. Previous attempts to secure foreign partners like Japan’s Nansei were unsuccessful due to legal complications, further exacerbating the company’s predicament.

In this context, VinMetal’s emergence and Vingroup’s zero-interest loan for two years are nothing short of a lifeline. This not only addresses Pomina’s urgent need for working capital to sustain production but also opens up new market opportunities by integrating Pomina into Vingroup’s ecosystem, supplying steel to VinFast, Vinhomes, and other major infrastructure projects. The return of Mr. Do Tien Si to the helm, now appointed as CEO of VinMetal, is expected to facilitate synchronized management between the two entities, gradually reviving this storied steel brand from the ashes of debt and losses.