The iShares Bitcoin Trust ETF witnessed a staggering $2.2 billion in outflows during November (as of November 24), according to FactSet data. This figure is nearly eight times the $291 million net outflow recorded in October of the previous year, marking the second-worst month since the fund’s launch in early 2024.

Net Flows into the iShares Bitcoin Trust ETF

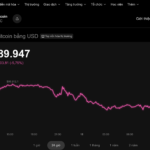

This mass exodus coincides with Bitcoin’s precipitous decline. The world’s largest cryptocurrency is currently trading around $87,907, down over 20% in the past month and more than 40% from its October peak of $126,000. November has become Bitcoin’s worst month since June 2022, when prices plummeted by 39%.

“There’s no question that hot money has come out significantly,” said Jay Hatfield, CEO of Infrastructure Capital Advisors. “This correction has really focused on the speculative part of the market… and Bitcoin is the poster child for that.”

Investors are fleeing Blackrock’s fund in favor of safe-haven assets like gold amidst growing economic uncertainty and deteriorating market sentiment.

A recent University of Michigan survey revealed consumer sentiment nearing record lows. Investors are now awaiting crucial data from the September retail sales report and the Producer Price Index, scheduled for release on November 25. The CME FedWatch Tool indicates traders are pricing in an over 80% probability of a Fed rate cut in December, though nothing is certain.

Amidst this turmoil, Bitcoin continues its downward spiral. Investors in spot Bitcoin ETFs, particularly newer entrants, are facing immense pressure. According to Frank Chaparro, Head of Content at cryptocurrency trading firm GSR, selling pressure may persist in the short term.

“In an uncertain macro environment, investors tend to de-risk, often reducing exposure to cryptocurrencies and risk-sensitive stocks,” Chaparro explained. “For those who entered through ETFs, any downturn can trigger anxiety, leading to swift selling, just as they bought quickly.”

However, Joshua Levine, Chairman of Bitcoin treasury firm OranjeBTC, offers a more nuanced perspective. While spot Bitcoin ETFs have attracted many retail investors who may panic during market volatility, they have also drawn in long-term investors like financial institutions, who are more likely to weather the storm.

“These institutional investors will help curb sharp declines and moderate upward momentum, ultimately reducing Bitcoin’s volatility,” Levine noted.

– 10:26 25/11/2025

Experts Highlight Key Signal Indicating VN-Index’s Imminent New Wave, Anticipated Sectors Poised to Attract Investment

In the accumulation phase, this is an opportune moment for investors to rebalance their portfolios, prioritizing allocations to companies with strong fundamentals, clear growth prospects, and significant undervaluation relative to their intrinsic worth.

Today’s Crypto Market, November 17: Investors in Panic Mode

Should Bitcoin swiftly regain its upward momentum and establish a higher low, certain analyses predict a potential new market recovery phase.