According to the latest announcement, Tran Cong Thanh, Chairman of the Board of Directors at Hoa Binh Takara, has sold 2.8 million CTP shares, equivalent to 92% of his holdings, from October 23 to November 20. This transaction reduces his ownership from 3 million shares (~24.79%) to a mere 200,000 shares (~1.65%).

Simultaneously, Duong Van Tinh, Board Member and CEO, completed the sale of 1.9 million shares, decreasing his stake from 16.26% to 0.56% (68,000 shares). Both transactions concluded by November 21, leaving neither executive as a major shareholder.

Both leaders cited portfolio rebalancing as the reason for the sales. Notably, no block trades occurred during this period, meaning all shares were sold via open market orders.

This marks the second divestment attempt by the duo in just over a month. Their previous attempt (September 18 – October 13) failed due to unmet price expectations.

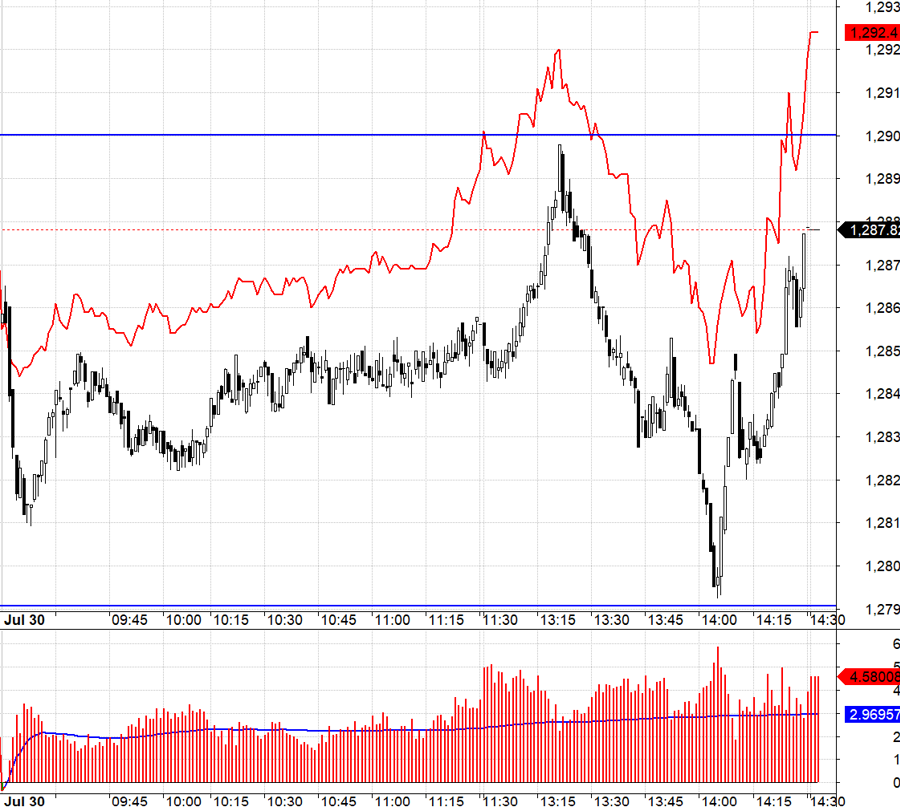

Amid these leadership sales, CTP shares surged to their daily limit on November 25, closing at VND 11,300 with nearly 900,000 shares traded. However, this rally barely offsets the stock’s 73% year-to-date decline.

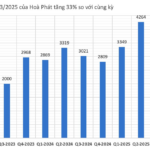

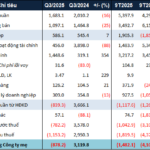

Financially, Q3/2025 results show continued struggles. Revenue fell 25% year-over-year to VND 15 billion, while rising costs shrunk gross profit to VND 224 million (–64%). Net income reached VND 166 million (–56% YoY).

Year-to-date, net profit totaled VND 497 million (+100% YoY), achieving 76% of the annual target. However, this remains modest relative to capitalization and investor expectations.

Separately, CTP incurred VND 450 million in tax penalties post-audit (2017–2024) for VAT and CIT discrepancies, including fines, back taxes, and late fees.

Formerly Minh Khang Capital Trading Public, Hoa Binh Takara (est. 2010 as Commercial Coffee JSC in Quang Tri) exited coffee production in 2019, rebranding to focus on real estate and construction materials, though coffee remains a core segment.

How Did Industrial Real Estate Businesses Perform in Q3?

The third quarter proved to be another lucrative period for industrial park developers, with numerous businesses reporting remarkable profit growth.

Novaland Posts Fourth Consecutive Quarterly Loss as Financial Costs Surge

The widening forex gap, amounting to a staggering 712 billion VND, has sent No Va Land Investment Group Corporation’s (HOSE: NVL) financial costs soaring. As a result, the company reported yet another quarterly loss in Q3 this year, marking the fourth consecutive quarter of negative results since Q4 2024.