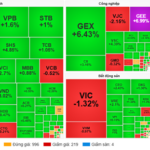

The stock market continued its volatile trend on November 25th. After an initial surge, selling pressure emerged, causing the VN-Index to reverse and close down 7.6 points (0.46%) at 1,660 points. Trading volume improved, with transaction values on HOSE reaching nearly 27 trillion VND.

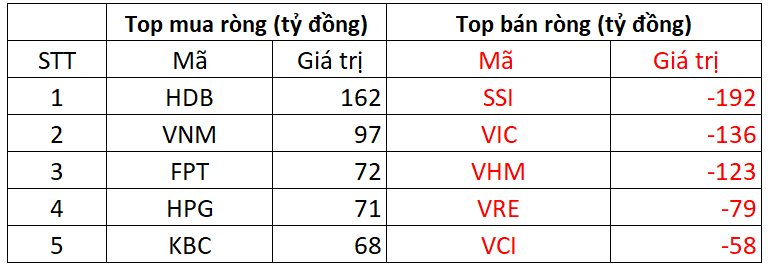

Foreign investors remained net sellers, offloading approximately 400 billion VND. However, this figure marked a significant decrease compared to the thousands of billions sold earlier in the week.

On HOSE, foreign investors net sold 356 billion VND

On the buying side, HDB led foreign purchases on HOSE with over 162 billion VND. VNM followed closely, attracting 97 billion VND. FPT and HPG also saw significant buying interest, with 72 billion VND and 71 billion VND respectively.

Conversely, SSI topped the selling list with 192 billion VND. VIC and VHM were also heavily sold, with 136 billion VND and 123 billion VND respectively.

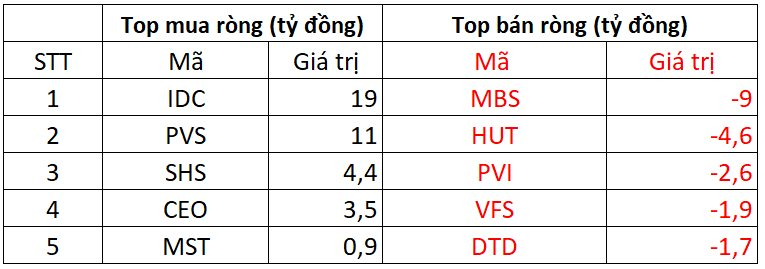

On HNX, foreign investors net bought 12 billion VND

IDC led HNX purchases with 19 billion VND. PVS followed with 11 billion VND. SHS, CEO, and MST also saw modest buying interest.

On the selling side, MBS faced the most pressure with nearly 9 billion VND sold. HUT followed with 4.6 billion VND, while PVI, VFS, and DTD saw smaller sell-offs.

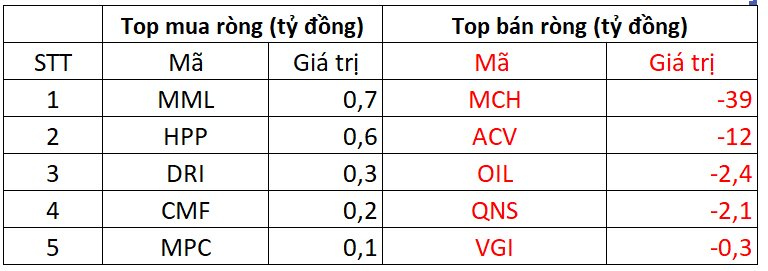

On UPCOM, foreign investors net sold 55 billion VND

MML led UPCOM purchases with 0.7 billion VND. HPP and DRI also saw modest buying interest.

Conversely, MCH saw the largest sell-off with 39 billion VND. ACV and OIL also faced selling pressure.

Market Pulse 26/11: VIC Weighs Down, VN-Index Narrows Gains

The VN-Index fluctuated around the 1,665-point mark during the final hours of the morning session. After peaking with a gain of over 15 points, the VN-Index narrowed its increase to approximately 7.3 points (+0.44%), closing the mid-session at 1,667.64 points. Similarly, the HNX-Index rose by 1.41%, reaching 260.92 points. Market breadth showed 382 advancing stocks, 223 declining stocks, and 996 unchanged stocks.

Agile Group Stock (HAG) Faces Uncertainty: What’s Next for Bầu Đức’s Shares?

HAG’s positive momentum was evident on the day of its Investment Roadshow, where the company unveiled its restructured strategy and highlighted investment opportunities within the group.