Cotton Prices Face Challenges, but Vietnam Remains China’s Top Supplier of Cotton Yarn – Illustrative Image

|

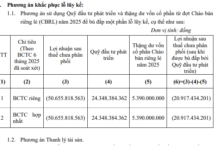

According to VDSC’s comprehensive report, the global cotton market lacks growth momentum: oversupply has persisted for over 40 years, while production adjustments keep supply stable, leaving prices primarily demand-driven. The 2021-2022 period was an exception, with prices surging due to COVID-19-induced global supply chain disruptions.

|

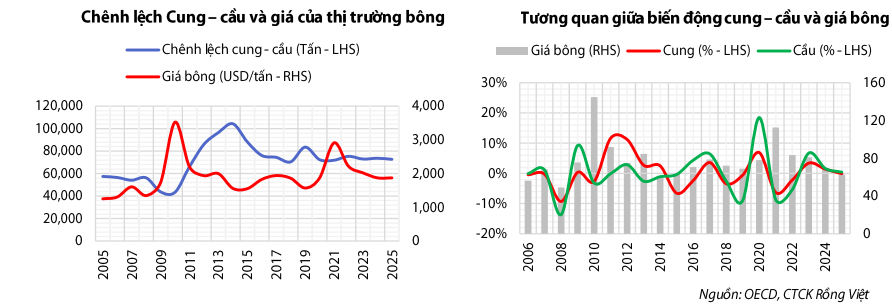

OECD reports that the shift toward synthetic fibers continues to pressure demand for natural cotton, limiting price recovery potential in the coming years. Global cotton demand is projected to grow slowly, reaching approximately 27 million tons by 2026 and 28.3 million tons by 2030, with a compound annual growth rate (CAGR) of around 1.2%.

|

Cotton Yarn Growth Slows as Consumers Shift to Synthetic Fibers

VDSC notes that the global cotton yarn market is growing slowly due to changing apparel consumption habits. Cotton’s share of raw materials has dropped from 37.6% in 2005 to 18.6% in 2025 and is expected to fall to 16.5% by 2030, as synthetic fibers gain popularity for their competitive pricing, stable supply, and suitability for sportswear, durability, abrasion resistance, and wrinkle-free properties.

Over the past five years, cotton prices have averaged 30% higher than semi-synthetic fibers and 140% higher than polyester, prompting manufacturers to favor synthetic alternatives. Textile Exchange forecasts global cotton production to grow at just 1.2% annually from 2025 to 2030, reflecting sluggish demand.

Outlook for Vietnam’s Raw Cotton Yarn Exports to China

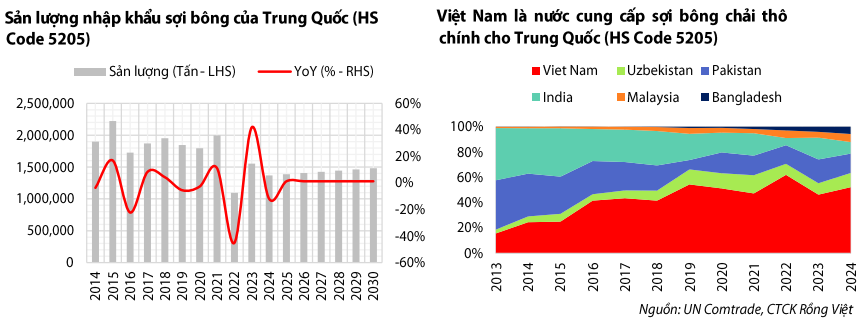

Based on China’s cotton import demand, VDSC projects Vietnam’s raw cotton yarn exports to China to grow at a CAGR of 2% from 2026 to 2030, reaching 692 thousand tons in 2026 and 729 thousand tons in 2030.

China’s import demand has declined by an average of 3% annually from 2014 to 2024 due to the shift to synthetic fibers and the Uighur Forced Labor Prevention Act (UFLPA), which boosted domestic supply. However, China still requires imported cotton to meet standards for textile exports to the US and EU. VDSC expects cotton imports to rebound, growing at a CAGR of 1.2% from 2026 to 2030, reaching 1.4 million tons in 2026 and 1.5 million tons in 2030.

|

Vietnam Maintains Position as China’s Largest Supplier

Over the past decade, Vietnam has become China’s top exporter of raw cotton yarn. In 2024, exports reached 670 thousand tons, accounting for 49% of China’s total imports. This position is strengthened by Vietnam’s geographic advantages, low logistics costs, and the trend of Chinese companies relocating production to Vietnam to avoid trade barriers.

VDSC expects Vietnam’s 49% market share to remain stable during the forecast period, matching the 2022-2024 average after the UFLPA took effect in mid-2022.

“Raw cotton and cotton yarn are upstream in the textile supply chain, playing a foundational role in final product quality. Despite entering a slow-growth phase due to stable supply and modest demand fluctuations, these materials remain strategically vital in the global textile value chain,” VDSC concludes.

– 13:34 26/11/2025