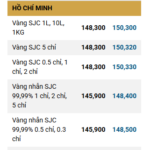

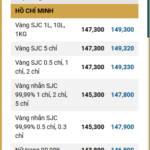

As of this afternoon’s survey, the price of gold rings at Bao Tin Minh Chau is listed at 149.9 – 152.9 million VND per tael, an increase of 500,000 VND per tael since opening. SJC has also adjusted the price of gold rings to 148.5 – 151 million VND per tael with a similar increase.

Meanwhile, PNJ and DOJI maintained their prices at 148.7 – 151.7 million VND per tael.

The price of gold bars across various brands has also been adjusted upward by approximately 500,000 VND per tael compared to this morning. Bao Tin Minh Chau lists gold bars at 151.4 – 152.9 million VND per tael, while PNJ, DOJI, and SJC are trading around 150.4 – 152.9 million VND per tael.

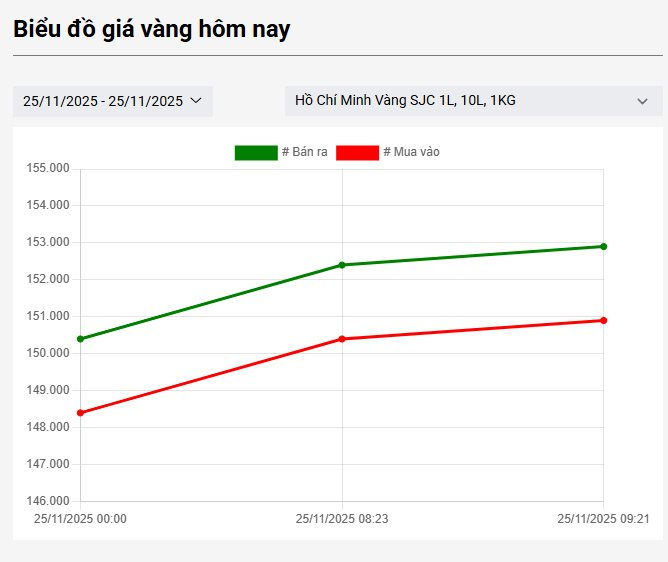

Today’s gold bar price fluctuations at SJC.

–

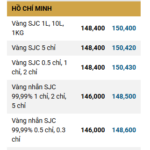

This morning, Bao Tin Minh Chau listed the price of gold rings at 149.5 – 152.5 million VND per tael, a 2 million VND increase from yesterday’s close. SJC adjusted the price of gold rings to 148 – 150.5 million VND per tael with the same increase.

Meanwhile, PNJ and DOJI raised their gold ring prices to 148.7 – 151.7 million VND per tael, an increase of 2.6 million VND. Gold bar prices at these companies also rose by approximately 2 million VND per tael, with buying prices ranging from 150.4 to 150.9 million VND per tael and selling prices around 152.4 million VND per tael.

In the global market, spot gold prices surged to $4,136 per ounce, up $91 from yesterday morning.

Global gold price movements over the past 24 hours. (Source: Kitco News)

The gold market continues to test the resistance level around $4,100 per ounce as investment demand remains high. However, a market strategist warns that increased volatility in stocks and cryptocurrencies could pose downside risks for the precious metal.

Although gold has fallen about 6% from its near-record high of nearly $4,360 per ounce last month, this adjustment is much milder compared to Bitcoin. The cryptocurrency, currently testing the $85,000 support level, has dropped by 31% from its recent peak.

Despite strong investment demand, Standard Chartered cautions that gold could face downward pressure if stock and cryptocurrency markets continue to experience deep volatility. “Gold doesn’t necessarily benefit when equities are under pressure due to tech-led corrections or weakness in cryptocurrencies,” said Suki Cooper, Managing Director of Global Commodity Research at Standard Chartered, in the latest report.

Gold is also struggling to find new upward momentum amid growing uncertainty surrounding the U.S. Federal Reserve’s monetary policy. Cooper noted that Standard Chartered expects the Fed to hold rates steady at its next meeting. “The Fed minutes clearly show caution about rate cuts, and November’s jobs data will be released after the meeting,” she said.

While gold’s downside potential is increasing, Cooper pointed out that the risks are limited due to strong and widespread investment demand. The record-breaking surge in October was driven by historic inflows into gold ETPs (Exchange-Traded Products). Although ETP inflows have slowed, Cooper noted that the physical gold market remains stronger than expected despite record-high prices.

She added, “Traditional gold investors who began reducing their holdings post-pandemic, from Q2 2021, show that ETP flows can be more flexible. However, this time, veteran ETP investors, including pension funds, continued to increase their gold allocations in Q3 2025, though holdings haven’t returned to previous peaks. The sustainability of these new inflows remains untested, but market observations indicate that many new investors are still below their target gold allocations.”

Cooper also noted that trade flows show investors are becoming more comfortable with prices above $4,000 per ounce. “Short positions in the largest gold ETP fell sharply by 36% in the last two weeks of October compared to mid-month, reaching the lowest level since February. The reduction in short-selling during gold’s correction from its peak suggests the market is growing accustomed to prices stabilizing in this range,” she said.

Gold Bar and Ring Prices Rebound on November 22nd Morning

This morning, the price of SJC gold bars surged by 600,000 VND per tael across major gold retailers, compared to yesterday’s closing session. Similarly, the price of gold rings at Bao Tin Minh Chau and SJC Company also saw a 600,000 VND per tael increase in both buying and selling rates.

Gold Prices Plummet by 1.7 Million VND per Tael on the Afternoon of November 18th

Global gold prices experienced a significant decline during Monday’s trading session (November 17) and continued to drop today (November 18). Domestically, the prices of gold rings and gold bars have both fallen, with reductions ranging from 0.2 to 1.7 million VND per tael compared to the end of yesterday.