Mr. Nguyen Tien Minh, Deputy Director of Hanoi Tax Department

At the forum “Vietnam Gold Market: Opportunities and Challenges in the New Phase,” organized by Kinh tế & Đô thị Newspaper on the afternoon of November 24th, Mr. Nguyen Tien Minh, Deputy Director of Hanoi Tax Department, revealed that Hanoi currently hosts 844 businesses dealing in gold, jewelry, and precious stones, along with 51 individual gold traders. The tax revenue has surged by over 50% compared to the previous year, rising from VND 800 billion in 2024 to VND 1,251 billion since the beginning of 2025. While this growth is positive, it also demands stringent tax control and transaction transparency in a sector prone to risks.

Following directives from the Government, the Ministry of Finance, and the General Department of Taxation, the Hanoi Tax Department implemented several support measures for businesses during 2024–2025. A notable advancement is the guidance and implementation of electronic invoices generated from cash registers, enabling businesses to issue invoices more swiftly and conveniently than standard electronic invoices. This system also ensures real-time data connectivity with tax authorities. Continuous training sessions have been conducted to ensure businesses comply with regulations.

Concurrently, the Hanoi Tax Department has intensified inspections, collaborating closely with market management, police, customs, the Government Inspectorate, and other legal bodies to cross-check invoice data and promptly address violations.

A critical requirement emphasized by the Hanoi Tax Department leadership is that businesses must record the citizen identification number or tax code of gold buyers on outgoing invoices. For gold purchased from individuals, businesses must maintain detailed records of the seller’s personal information. This is essential for ensuring transaction transparency, particularly for high-value deals.

However, actual inspections have revealed several errors, such as incorrect tax calculation, incomplete declaration of costs related to raw gold, and inconsistent accounting procedures.

Mr. Minh stated that these violations have been promptly addressed to prevent budget shortfalls.

Notably, collaboration with banking inspection and supervision agencies has uncovered numerous personal accounts with unusually large, inconsistent cash flows relative to declared business activities.

“Through investigations, cases with indications of illegal gold trading have been identified and referred to investigative agencies. Signs of gold smuggling exist, but the tax authority lacks the investigative capacity to pursue these cases thoroughly. This is a significant bottleneck in management,” emphasized Deputy Director Nguyen Tien Minh.

Based on practical management experience, the Hanoi Tax Department representative proposed three key solutions.

First, harmonize the legal framework among three core pillars: gold management, tax management, and payment management.

The gold market is currently overseen by multiple agencies, including banks, tax authorities, market management, police, and customs, but data sharing remains fragmented, hindering risk detection. Real-time data sharing would enable faster and more accurate identification of irregular transactions.

Second, establish an inter-agency risk control mechanism based on electronic invoice and payment data. This would mandate that gold transactions be conducted through banks, linked to the full identification details of both buyers and sellers. Systems for purchasing gold from individuals should integrate with input invoice data to trace origins and reduce fraud risks.

Third, enhance public awareness of rights and obligations regarding invoices and documents in gold transactions.

According to Mr. Minh, many individuals still engage in cash transactions without obtaining invoices, creating loopholes for tax evasion and smuggling. Raising awareness and requiring invoices for gold purchases are crucial steps to address these gaps.

“The tax authority can only analyze cash flows, cross-check documents, and refer cases with violation indications. To effectively combat gold smuggling, specialized enforcement units and a cohesive legal system are essential,” Mr. Minh stressed.

How Does the Elimination of Presumptive Tax Impact Online Businesses?

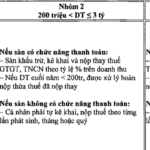

The rise of online sales, social media platforms, and livestreaming has revolutionized commerce, giving birth to new roles like influencers (KOLs) and key opinion consumers (KOCs). Starting in 2026, the lump-sum tax system will be discontinued, with significant adjustments targeting e-commerce-related businesses.

Eliminating Lump-Sum Tax: Business Households Grapple with Input Invoice Declaration

As of January 1, 2026, the lump-sum tax will be officially abolished, requiring business households to declare taxes or transition to a corporate model. The Hanoi Tax Department has provided detailed guidance addressing key concerns, including input invoice declarations and inventory management, even for goods purchased from individuals.

Gold Trading Floors Are Not Overnight Magic Wands for All Financial Equations

The State Bank is exploring the establishment of a gold trading platform in the near future. Experts anticipate this move will create a new marketplace, enabling businesses and individuals to trade gold more conveniently while narrowing the price gap between domestic and international gold markets.