Currently, the Chairman holds over 898,000 shares of LDP, representing a 6.7% ownership stake. Following the transaction, Mr. Kiên will retain approximately 90,000 shares, reducing his ownership to 0.7%. The trade will be executed through both agreement and order matching methods.

In October and early November, Mr. Kiên registered to sell over 1 million shares of LDP. From October 9 to November 5, the LDP executive sold 275,400 shares, lowering his ownership to the current level. The reason for not selling the entire registered amount was due to unfavorable market conditions.

The upcoming transaction aims to offload the remaining shares that couldn’t be traded in the previous transaction.

On December 10, LDP will hold an extraordinary shareholders’ meeting to approve several agenda items, including: a plan to address accumulated losses, a rights issue for existing shareholders, and the addition of new business activities.

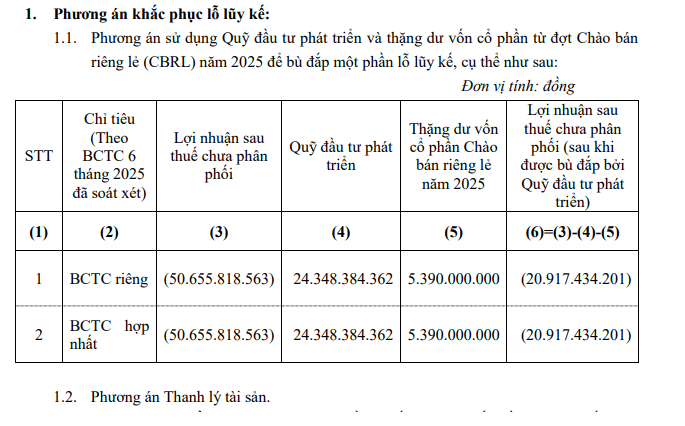

Regarding the plan to address accumulated losses, LDP stated that based on the company’s current operations, it is expected to take 4–5 years to fully eliminate the deficit. To rectify the accumulated losses without impacting operations or the LDP shares listed on the HNX, the company plans to utilize its development investment fund and capital surplus from the 2025 private placement to offset the losses. Additionally, the company will liquidate assets to cover the deficit.

|

Plan to Address Accumulated Losses of LDP

Source: LDP

|

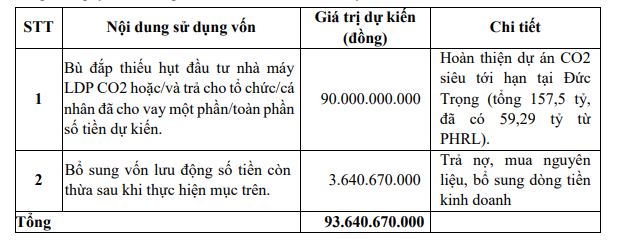

For the capital increase, LDP will offer shares to existing shareholders at a ratio of 2:1 (shareholders holding 2 shares can purchase 1 additional share) at a price of 10,000 VND per share. Following the recent private placement, LDP’s chartered capital will rise to 187.28 million shares. Consequently, the company will offer an additional 9.3 million shares to shareholders. The proceeds will be used to cover investment shortfalls in the LDP CO2 plant and to supplement working capital.

After this offering, the company’s capital will increase to nearly 281 billion VND.

|

Use of Capital from Rights Issue for Existing Shareholders of LDP

Source: LDP

|

Recently, LDP privately issued over 5.4 million shares to APC Holdings at 11,000 VND per share. The entire proceeds were allocated to the supercritical CO2 plant construction project, totaling 157.5 billion VND. The issuance reduced the company’s accumulated losses by approximately 20 billion VND after capital surplus reintegration and is expected to yield profits in Q4. The CO2 plant is projected to increase extraction capacity by 300%, enabling the company to launch new products in 2026.

– 09:25 26/11/2025

CRV Group’s Stock Price Drops 25% from Peak as Entrepreneur Do Huu Ha Finalizes Rights Offering for 16.8 Million Shares

CRV Real Estate Group Joint Stock Company (CRV) announces a rights issue to existing shareholders, offering an opportunity to invest in the company’s latest venture, the Hoàng Huy New City – II project. This strategic move aims to secure funding for the development, ensuring its successful execution.

DSC Securities Shareholder Shakeup Post-IPO

Following the completion of the offering of 35.3 million shares to existing shareholders, DSC Securities has welcomed a new major shareholder, while Chairman Nguyen Duc Anh and NTP Investment Corporation have reduced their holdings.

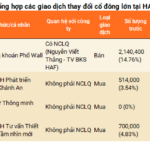

Major Food Company Continually Attracts New Major Shareholders Amid Prolonged Loss Streak

A series of off-market transactions at premium prices has propelled three entities into the ranks of major shareholders of Hanoi Foodstuff Corporation (UPCoM: HAF) within a single month. This development unfolds against the backdrop of the company reporting significant losses and preparing for an extraordinary general meeting of shareholders.

Ladophar Aims to Utilize Investment Fund and Surplus Capital to Address Accumulated Losses

At the upcoming extraordinary shareholders’ meeting, Ladophar will present a plan to utilize its development investment fund and surplus share capital from the 2025 private placement to reduce accumulated losses from nearly VND 50.7 billion to over VND 20.9 billion.