In terms of impact, VPL is the most positively influential stock, contributing 1.46 points to the VN-Index. Closely following are GEE and VPB, adding a combined 1.9 points to the index. Conversely, VIC has the most negative impact, deducting 2.75 points from the index.

| Top 10 Stocks Most Impacting VN-Index on the Morning of November 26, 2025 (Measured in Points) |

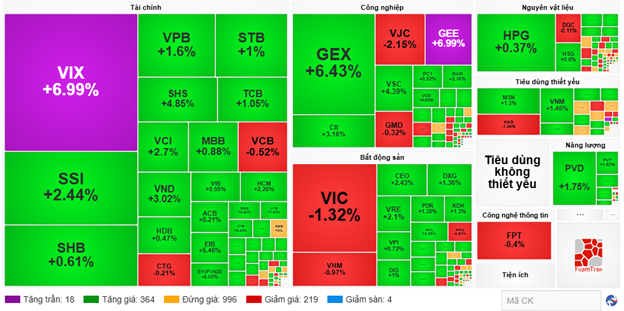

Across sectors, green dominates most stock groups. The non-essential consumer sector leads with a positive 1.83% increase, driven by stocks like VPL (+4.29%), FRT (+1.55%), HUT (+1.83%), MSH (+1.02%), PET (+2.08%), and HTM (+13.19%).

Financial and industrial sectors also show strong liquidity with notable performers such as VIX hitting the ceiling, SSI (+2.44%), VPB (+1.6%), SHS (+4.85%), VCI (+2.7%), VND (+3.02%), GEX (+6.43%), CII (+3.16%), VSC (+4.39%), HAH (+2.16%), and GEE reaching its upper limit.

Meanwhile, real estate lags, with selling pressure concentrated on two leading stocks: VIC (-1.32%) and VHM (-0.97%). The rest maintain positive gains, including VRE (+2.1%), KSF (+2.15%), KDH (+1.3%), PDR (+1.38%), DXG (+1.36%), and CEO (+2.43%).

Source: VietstockFinance

|

Foreign investors continued strong net selling, totaling over 229.59 billion VND across all three exchanges. Selling pressure focused on VIC with 191.27 billion VND and VCB with 109.38 billion VND. Conversely, VIX led net buying with 101.57 billion VND.

| Top 10 Stocks with Strongest Foreign Net Buying/Selling on the Morning of November 26, 2025 |

10:30 AM: Buyers Dominate

As of 10:30 AM, the VN-Index rose by over 10.8 points, trading around 1,671 points. The HNX-Index increased by more than 4.3 points, trading around 261 points.

The VN30 group shows green dominance. Specifically, VIC contributed 1.81 points, LPB 1.6 points, MWG 1.33 points, and HPG 1.26 points. Conversely, only VJC and VHM faced selling pressure, deducting over 1.2 points from the index.

Source: VietstockFinance

|

Securities and banking stocks turned green after the previous decline. Notably, VIX rose 6.77%, SSI 2.89%, TCB 1.2%, and VCI 3%.

Real estate stocks also turned positive, with standout performers like CEO (+3.24%), DXG (+1.36%), DIG (+2%), and KDH (+1.16%).

The industrial sector maintained its recovery, with stocks like GEX (+5.1%), CII (+3.75%), GEE (+6.99%), and VSC (+4.39%).

Compared to the opening, buyers dominated with 388 rising stocks versus 166 declining stocks.

Source: VietstockFinance

|

Opening: Financial Stocks Recover Early

At the opening on November 26, by 9:30 AM, the VN-Index fluctuated around 1,666 points after an initial surge. Similarly, the HNX-Index rose slightly by over 1 point, trading around 258 points.

Green dominated all sectors, reflecting recovery after the previous adjustment. Financial stocks led early recovery with VIX (+1.97%), SHS (+1.46%), and VCI (+0.9%).

Real estate stocks also contributed to the green trend, with VIC (+0.62%), NVL (+0.33%), VRE (+0.75%), and DIG (+0.25%).

Large-cap stocks like VNM, HPG, and MSN also supported the index.

– 11:50 AM, November 26, 2025

Technical Analysis Afternoon Session 26/11: Doji Emerges

The VN-Index experienced modest growth, forming a Doji pattern as it tested the 50-day SMA. Meanwhile, the HNX-Index halted its downward trend after retesting the previous support level of 256-258 points.

Vietstock Daily 26/11/2025: Is the Wind Shifting?

The VN-Index reversed its course, dipping after testing the 50-day SMA, signaling persistent selling pressure as it nears a critical resistance level. The Stochastic Oscillator shows early signs of weakening, and if a sell signal reemerges alongside the index closing below the 50-day SMA in upcoming sessions, the likelihood of a renewed corrective phase significantly increases.