Ending the Gold Import/Export Monopoly: A Necessary Step

Speaking at the forum “Vietnam’s Gold Market: Opportunities and Challenges in the New Phase,” organized by Kinh tế Đô thị Newspaper on November 24th, Dr. Lê Xuân Nghĩa, a member of the Prime Minister’s Policy Advisory Council, revealed that Vietnam’s official gold imports are surprisingly low, estimated at only 5 tons annually, equivalent to over $5 billion. This pales in comparison to imports of other consumer goods. Dr. Nghĩa highlighted that cosmetics imports reach $11 billion annually, while dairy products and derivatives are close to $5 billion.

“Why is gold importation considered so critical when cosmetics and dairy imports are double or triple that amount, yet receive less attention?” Dr. Nghĩa questioned.

Dr. Lê Xuân Nghĩa, Member of the Prime Minister’s Policy Advisory Council.

Explaining the consistent rise in gold prices over the years, Dr. Nghĩa attributed it to the limited annual increase in global gold production (1.2-1.5%) compared to the faster growth of the global money supply (3.5-4.5%). “When money supply outpaces gold production, gold prices naturally rise. It’s only logical for people to hold gold,” he stated, emphasizing that blaming citizens for buying gold is counterproductive.

The key issue, according to Dr. Nghĩa, is why Vietnamese consumers pay higher gold prices than Americans or Europeans, despite significantly lower incomes. He blamed the monopoly on gold bar imports for distorting the market and harming consumers.

“When regulators fail to facilitate official imports, citizens are forced to buy smuggled or substandard gold. Market management cannot rely solely on restrictive measures while ignoring consumer rights,” Dr. Nghĩa stressed.

He argued that ending banks’ monopoly on gold bar imports is crucial for market transparency, aligning domestic gold prices with global rates, reducing smuggling, and protecting consumers.

The gold import licensing mechanism, introduced in 2010, remains incomplete. “Prolonging this system pits legal imports against smuggled gold, forcing low-income Vietnamese to pay more than foreigners—an unacceptable situation,” Dr. Nghĩa noted.

Drawing parallels to past import quotas for motorcycles and cars, he warned of similar negative consequences: creating privileged enterprises, distorting markets, and failing to benefit the state or businesses.

“Quotas won’t stop smuggling. The same will happen with gold if this system persists,” Dr. Nghĩa cautioned.

He urged expanding import/export rights to qualified businesses, establishing a physical gold trading platform, adopting global pricing standards, and combating smuggling through professional enforcement rather than supply restrictions. “Quotas are temporary. The ultimate goal is a transparent, fair market where Vietnamese don’t pay more for gold than foreigners,” he concluded.

Investigating Gold Transactions for Tax Evasion

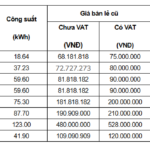

Nguyễn Tiến Minh, Deputy Director of Hanoi Tax Department, reported that Hanoi has 844 gold trading businesses and 51 individuals engaged in gold/jewelry processing. Tax revenue from this sector grew over 50%, reaching 1,221 billion VND in 2025 (up 53.1% year-on-year), compared to 800 billion VND in 2024.

Collaborating with the Banking Inspectorate, tax authorities identified large cash flows linked to individuals, indicating potential illegal gold trading or tax evasion. These cases have been referred to investigators.

“However, tax agencies lack authority to fully investigate gold origins or quality, creating significant management challenges,” Mr. Minh explained.

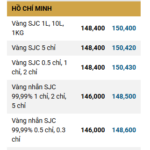

Global Gold Prices and Domestic Ring Gold Rates Continue to Drop on November 24th

Today’s trading session opened with a unanimous decline in both domestic and global gold prices, extending the downward trend observed in recent days.

Illegal Gold Smuggler Caught Transporting 440g of Gold Worth Over $60,000 in Da Nang

A man from Da Nang City was caught smuggling over 440 grams of gold from Laos into Vietnam at the border crossing.