MST Investment Joint Stock Company (Stock Code: MST) has submitted a report to the State Securities Commission (SSC) detailing the results of its private placement of shares.

By the end of the offering on November 24, 2025, MST successfully distributed 30 million shares, equivalent to 100% of the total shares offered, to 9 domestic professional investors.

With an average selling price of 10,000 VND per share, MST raised 300 billion VND from this private placement.

It’s important to note that shares sold in this private placement to professional securities investors are subject to a one-year transfer restriction from the completion date of the offering. Exceptions include transfers between professional securities investors, court-ordered transfers, or inheritance as per legal provisions.

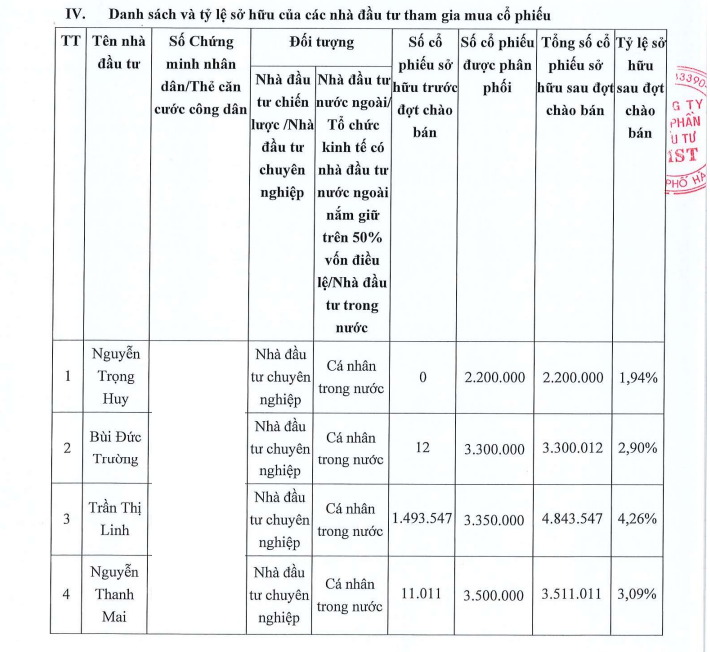

Investors participating in the private placement of 30 million MST shares. Source: MST

The plan to issue 30 million shares in a private placement to professional securities investors was approved during the second Annual General Meeting of Shareholders in May 2025.

According to the proposal presented to shareholders, MST intends to use the proceeds from this issuance to restructure its debt with credit institutions, enhance financial capacity, and supplement working capital for the company’s business operations. Specifically, the funds will be used to repay overdraft and credit line loans from the Thai Ha branch of the Bank for Investment and Development of Vietnam (BIDV), as per the credit agreements between BIDV Thai Ha and MST.

Earlier in November 2025, the MST Board of Directors also approved a loan of up to 300 billion VND from the Ha Dong branch of Saigon Hanoi Commercial Joint Stock Bank (SHB).

The purpose of this loan is to supplement working capital and issue guarantees to support the company’s production and business activities.

The MST Board of Directors agreed to implement collateral measures, using assets owned by the company and/or third parties accepted by SHB, in compliance with legal regulations and SHB’s policies.

For 2025, MST has set a target of 2,118.9 billion VND in total revenue and 68.22 billion VND in after-tax profit, representing increases of 166% and 398%, respectively, compared to 2024.

Vingroup Plans to Issue VND 1.000 Billion in Bonds for Debt Restructuring

Vingroup is set to issue VND 1,000 billion in 36-month asset-backed bonds, aimed at restructuring its debt portfolio.

Penalties for Private Stock Offering and Sale Violations Can Reach Up to 1.5 Billion VND

The Vietnamese government has issued Decree No. 306/2025/NĐ-CP, effective November 25, 2025, amending and supplementing several provisions of Decree No. 156/2020/NĐ-CP on administrative penalties in the securities and stock market sector. Notably, the decree introduces a significant fine ranging from VND 1 billion to VND 1.5 billion for offenses such as forging documents or providing false certifications to meet the conditions for offering or issuing shares.

ROX Group Investors Eye 166 Million Individual Shares of SBSI in Potential Acquisition

SBSI is set to issue 166.1 million shares, catapulting its chartered capital by 5.8 times to a staggering VND 2,000 billion. Notably, all six investors participating in this offering share strong affiliations with the ROX Group.