SSI Securities Corporation (stock code: SSI, listed on HoSE) has announced that it will close the shareholder list on December 9th to execute the rights issue of additional shares, as per the Public Offering Registration Certificate No. 445/GCN-UBCK issued by the State Securities Commission on November 21, 2025.

Accordingly, SSI will offer 415.18 million shares at a price of VND 15,000 per share. As of the morning of November 25, 2025, SSI shares were trading at around VND 33,750 per share. Therefore, the offering price is only half of the current market price of SSI shares.

The rights issue ratio is 5:1, meaning shareholders holding 5 shares will be entitled to purchase 1 newly issued share. The shares are unrestricted for transfer.

The registration and payment period for the purchase is from December 17, 2025, to January 8, 2026. The transfer of rights will take place from December 17 to 30, 2025.

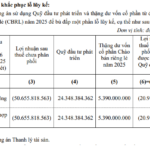

SSI expects to raise VND 6,227.7 billion from this offering. Of this amount, VND 3,114 billion will be used to supplement capital for deposit certificate activities, and VND 3,113.7 billion will be allocated for margin lending.

Upon completion of the offering, SSI’s chartered capital will increase from over VND 20,779 billion to nearly VND 24,932 billion, reclaiming its position as the leader in chartered capital within the securities industry.

In terms of business performance, SSI reported a standalone financial statement for Q3/2025 with operating revenue of VND 4,081 billion, up 107% year-on-year.

Half of the revenue was contributed by the proprietary trading segment, with profits from financial assets measured at fair value through profit or loss (FVTPL) reaching VND 2,011 billion, a 103% increase.

As of September 30, 2025, SSI’s FVTPL portfolio had a cost price of over VND 50,013 billion, an increase of more than VND 7,700 billion compared to the beginning of the year.

Within this, SSI invested VND 15,377 billion in bonds, up VND 200 billion from the start of the year; deposit certificates accounted for VND 31,627 billion, an increase of approximately VND 6,900 billion over nine months.

Investments in stocks and other listed securities totaled nearly VND 300 billion, down more than VND 1,000 billion from the beginning of the year. The company is experiencing slight losses on stocks such as HPG, MBB, ACB, and VNM, while stocks like VHM, VRE, and MWG are currently profitable.

Lending activities contributed VND 1,006 billion to revenue, up 83% year-on-year. The report recorded outstanding margin loans and advances on SSI sales at over VND 39,231 billion, a record high for the company. This figure increased by more than VND 17,000 billion from the beginning of the year and by over VND 6,000 billion in one quarter.

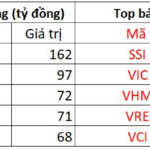

Brokerage revenue reached VND 922 billion, up 171% year-on-year. In Q3/2025, SSI held an 11.02% market share in brokerage on HoSE, an increase of 1.35% from the first half of 2025, maintaining its position as the second-largest brokerage firm in the Top 10.

Profits from held-to-maturity investments contributed VND 100 billion to revenue, up 64%. In the asset structure, SSI holds VND 6,081 billion in term deposits.

During the period, operating expenses were recorded at VND 1,576 billion, up 155% year-on-year. As a result, SSI reported pre-tax profit up 90% year-on-year.

For the first nine months of 2025, SSI generated VND 9,097 billion in operating revenue, up 48%; pre-tax profit was VND 3,943 billion, up 37% year-on-year, completing 96% of the annual plan.

As of September 30, 2025, SSI’s total assets stood at VND 99,678 billion, an increase of more than VND 27,000 billion from the beginning of the year.

In terms of capital, SSI’s total liabilities were nearly VND 69,366 billion. Of this, short-term borrowings accounted for over VND 65,419 billion, an increase of VND 20,000 billion primarily from bank loans. Over nine months, the company paid VND 1,772 billion in interest expenses, up 61% year-on-year.

LDP Chairman Persists in Divestment Ahead of $280 Billion Capital Increase

During the period from November 27 to December 25, Mr. Pham Trung Kien, Chairman of the Board of Directors of Lam Dong Pharmaceutical Joint Stock Company (HNX: LDP), registered to sell 809,600 shares with the purpose of restructuring his investment portfolio.

CRV Group’s Stock Price Drops 25% from Peak as Entrepreneur Do Huu Ha Finalizes Rights Offering for 16.8 Million Shares

CRV Real Estate Group Joint Stock Company (CRV) announces a rights issue to existing shareholders, offering an opportunity to invest in the company’s latest venture, the Hoàng Huy New City – II project. This strategic move aims to secure funding for the development, ensuring its successful execution.

DSC Securities Shareholder Shakeup Post-IPO

Following the completion of the offering of 35.3 million shares to existing shareholders, DSC Securities has welcomed a new major shareholder, while Chairman Nguyen Duc Anh and NTP Investment Corporation have reduced their holdings.