Domestic Market Expected to Recover in the Final Quarter

Recently, Rong Viet Securities (VDSC) released an updated report on the Q4 business outlook for Hoa Phat Group (stock code: HPG).

For Q4/2025, VDSC anticipates a gradual recovery in the domestic market, which is expected to boost construction steel output as construction activities intensify (supported by the real estate market and public investment projects) and peak construction season begins.

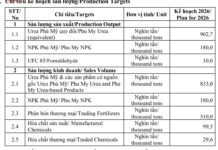

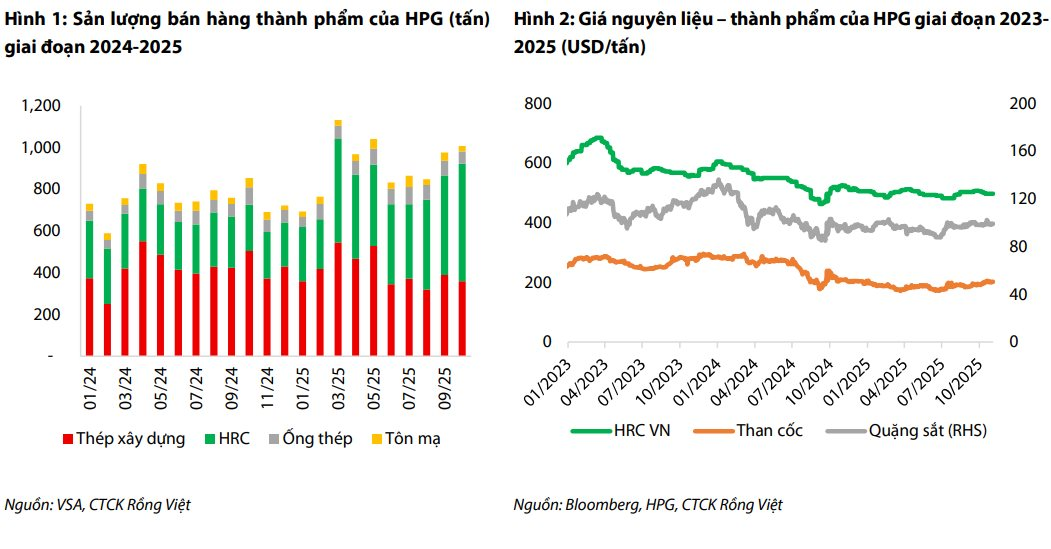

Notably, the analyst team forecasts a significant increase in HRC consumption volume, reaching 1.65 million tons in Q4 (+38% year-on-year). This growth is attributed to the full operation of the DQ02 plant (with October’s HRC output estimated at 560 thousand tons, +18% month-on-month).

The Hoa Phat Dung Quat 2 Steel Complex, spanning 280 hectares with a total investment of VND 85 trillion, is designed to produce 5.6 million tons of high-quality hot-rolled coil (HRC) annually. This project is considered a major strategic move by billionaire Tran Dinh Long.

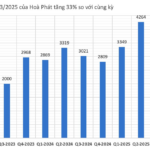

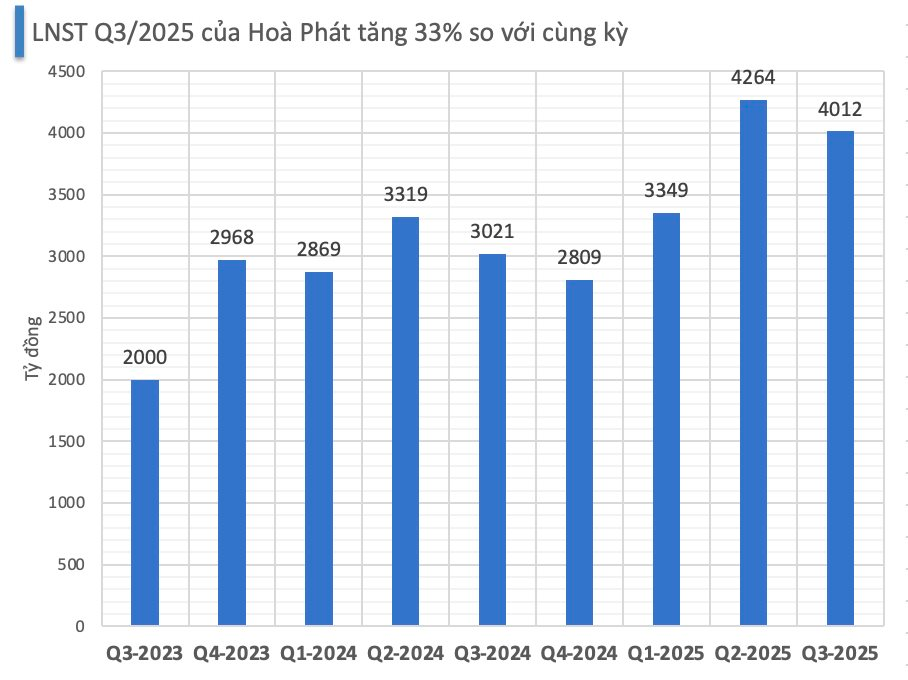

In terms of profitability, VDSC projects a substantial increase in HPG’s net profit, reaching approximately VND 5.7 trillion (+103% year-on-year).

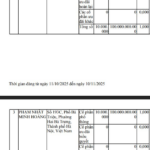

In December, HPG will conduct an IPO for its subsidiary, Hoa Phat Agricultural Development JSC (HPA, in which HPG currently holds 95% of shares).

The company plans to offer 30 million common shares, all newly issued, at a price of VND 41,900 per share. The total expected proceeds are VND 1,257 billion, and post-issuance, HPG’s ownership in HPA will decrease to 85%.

Following the transaction, although HPG will not recognize financial revenue on the consolidated financial statements (as HPA remains a subsidiary), the parent company will gain additional cash flow to focus on developing high-quality steel production. This includes the Ray Steel and Special Steel Plant in Dung Quat (designed capacity of 700,000 tons/year), scheduled to break ground in December 2025.

Strong Steel Consumption Growth in Q3

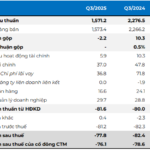

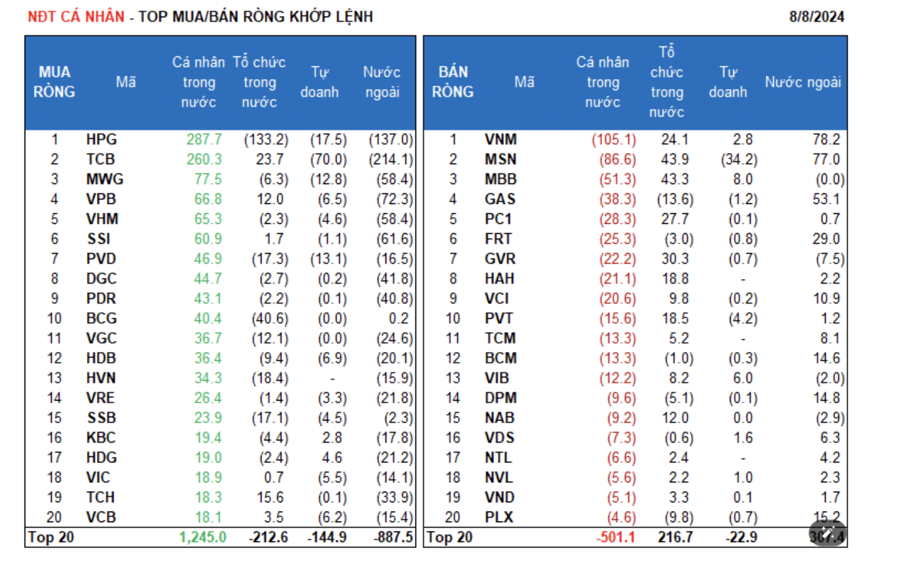

In Q3/2025, HPG reported revenue of VND 36.4 trillion (-2% year-on-year), with a consumption volume of 2.4 million tons (+26% year-on-year), including:

Construction steel output reached 1.08 million tons, equivalent to Q3/2024, while HRC output hit 1.3 million tons (+71% year-on-year). Although construction steel volume decreased compared to Q2 (due to the rainy season, particularly in the North), it remained stable, indicating robust domestic demand.

HRC output stood out, reaching a record high in recent quarters, demonstrating that the company has fully commercialized HRC from the DQ02 plant (both phases). The plant is expected to operate at a relatively high efficiency (~70%) in the coming quarters.

However, Q3 revenue did not reflect corresponding growth due to lower steel prices compared to Q3/2024.

Gross profit margin in Q3 remained high at 16.7% (higher than in 2023-2024), driven by stable finished product costs and a significant decline in raw material prices (iron ore, coke). The DQ02 plant also optimized input materials, primarily by reducing coke consumption.

After deducting expenses, HPG recorded a Q3 net profit of VND 4,012 billion (+33% year-on-year). Inventory levels remained high, with an average inventory turnover of 142 days and inventory value at VND 45.6 trillion. This indicates that the company is maintaining raw material stocks for DQ02 operations, especially with both phases becoming fully operational in Q4.

Vinmetal in Motion: Billionaire Pham Nhat Vuong Appoints Top Executives from Pomina Steel and The Gioi Di Dong to Key Leadership Roles

Do Tien Si has been appointed as the CEO and Legal Representative of Vinmetal Production and Business Joint Stock Company, a member of Vingroup (HOSE: VIC).