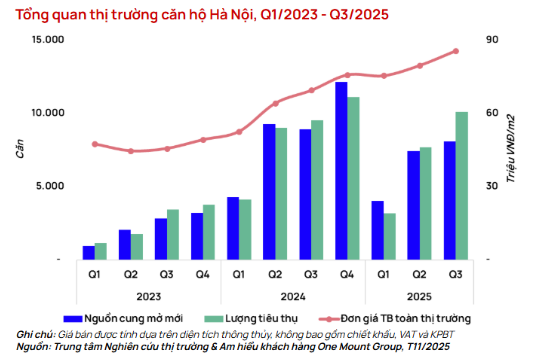

The first nine months of 2025 reveal a clear divergence between Vietnam’s two largest property markets, both reflecting a recovery trend. In Hanoi, the apartment supply remained high, with approximately 20,000 new units launched, and total transactions reaching 21,200 units. Absorption rates for high-end and luxury segments stayed above 90%, even as selling prices increased by 23% year-on-year.

According to Mr. Tran Minh Tien, Director of Market Research and Customer Insight at One Mount Group, “This trend indicates strong and stable real demand, highlighting the leading role of major projects in the East, West, and North districts.”

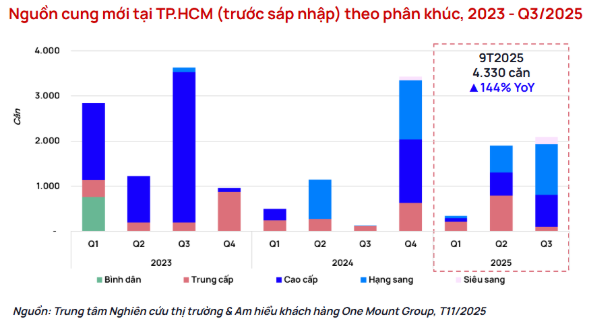

In contrast, Ho Chi Minh City (HCMC) showed a faster and more pronounced recovery. After numerous legal hurdles were resolved, the supply in the first nine months surged to 15,410 units, a 252% increase year-on-year; consumption reached 16,240 units, up 114%. Central projects, despite primary prices ranging from 130–140 million VND/m², recorded strong sales, indicating a significant improvement in market sentiment after a period of stagnation.

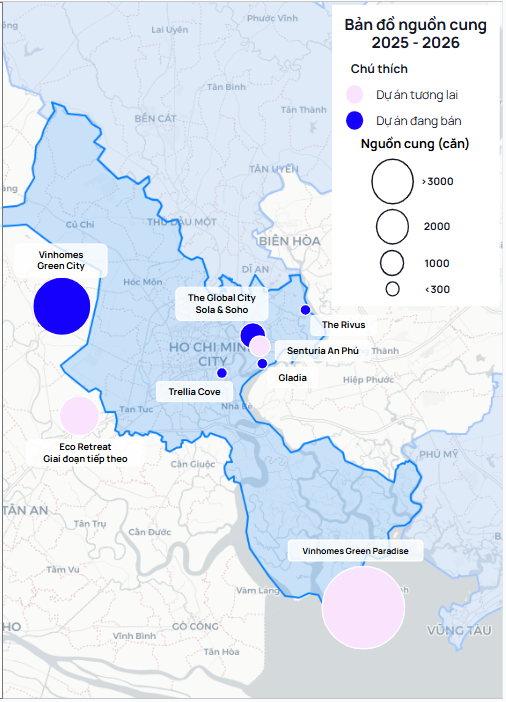

Entering Q4 2025, the outlook remains positive. Hanoi is expected to maintain stability, while HCMC will accelerate with major projects like The Global City and Vinhomes Green Paradise set to launch.

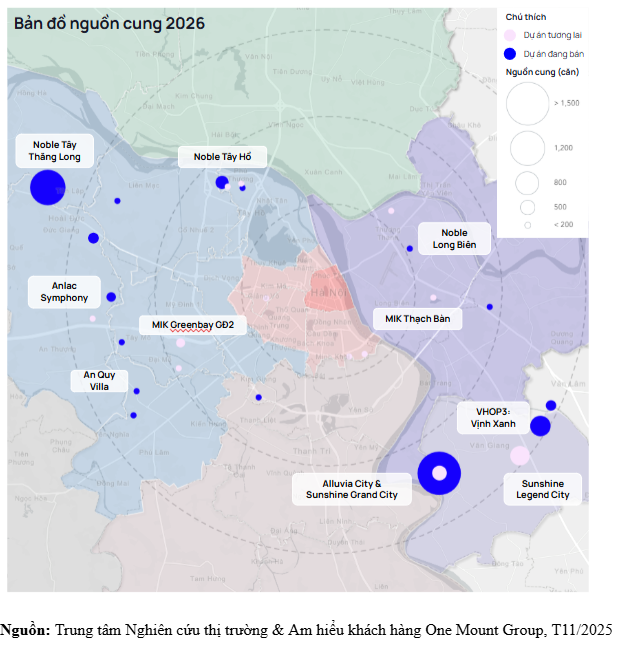

The 2026 outlook further solidifies this growth. Hanoi is projected to welcome around 35,000 apartments, all in the high-end and luxury segments, primarily from leading developers such as Masterise Homes, Sunshine, and MIK. Prices are expected to rise steadily, with differentiation by area, driven by a high proportion of genuine buyers.

HCMC is forecast to launch approximately 17,200 apartments in 2026, concentrated in large-scale urban areas with completed legal frameworks. Masterise Homes is expected to account for over 50% of new supply, continuing its role as the primary market driver. Prices will maintain an upward trend, particularly in central areas where supply remains limited.

According to Mr. Tran Minh Tien, “2026 will see the parallel growth of the two major markets: Hanoi will remain stable, while HCMC enters a new acceleration phase.”

Market Drivers: Macro Stability, Legal Improvements, FDI Growth, and Healthy Credit

Beyond positive supply-demand dynamics, the market is supported by fundamental drivers.

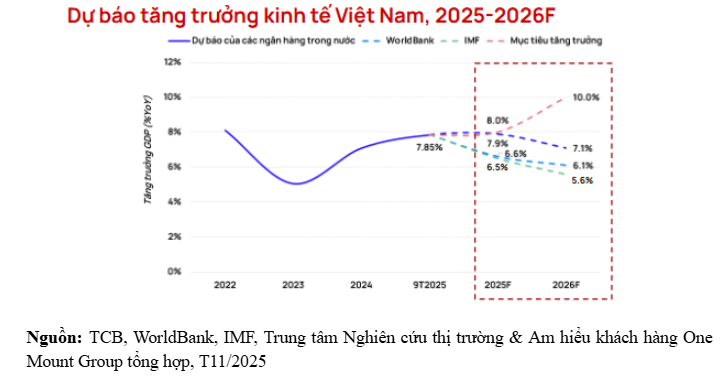

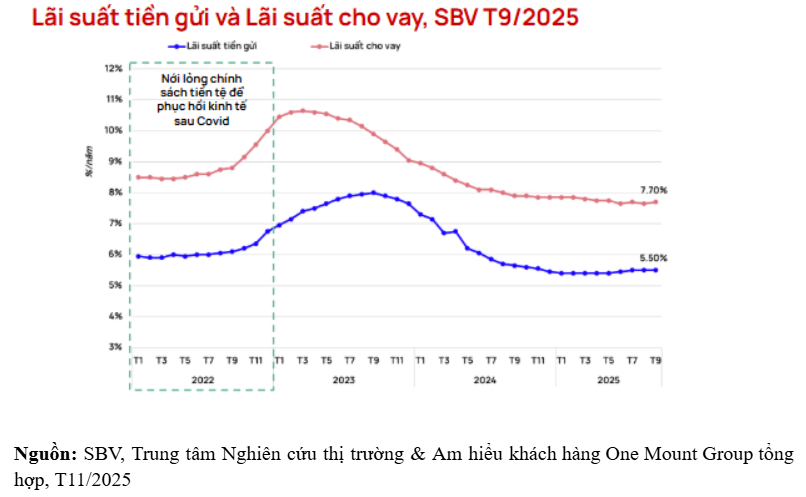

First, macroeconomic stability fosters buyer optimism. GDP growth is projected at 7.9% in 2025 and 7.1% in 2026, among the highest in the region. Stable interest rates since mid-2025 enable buyers to plan their medium- to long-term finances more effectively.

Additionally, legal reforms are the most critical factor driving the market. Amendments to laws on land, housing, and real estate business, along with guiding decrees and circulars, have “unlocked” many previously stalled projects. HCMC has benefited the most, with several large-scale projects cleared in Q3 and Q4 2025. In Hanoi, streamlined administrative procedures have facilitated smoother launches in the East, West, and North districts.

FDI growth also boosts real estate demand. As of October 2025, registered FDI reached $26.3 billion, up 4% year-on-year. Areas like East Hanoi, Thu Duc – District 9, Bien Hoa – Long Thanh, and Bac – Nam Tu Liem remain popular among foreign experts, increasing demand for mid- to high-end residential and rental properties.

Furthermore, legal reforms are the most critical factor driving the market. Amendments to laws on land, housing, and real estate business, along with guiding decrees and circulars, have “unlocked” many previously stalled projects. HCMC has benefited the most, with several large-scale projects cleared in Q3 and Q4 2025. In Hanoi, streamlined administrative procedures have facilitated smoother launches in the East, West, and North districts.

FDI growth also boosts real estate demand. As of October 2025, registered FDI reached $26.3 billion, up 4% year-on-year. Areas like East Hanoi, Thu Duc – District 9, Bien Hoa – Long Thanh, and Bac – Nam Tu Liem remain popular among foreign experts, increasing demand for mid- to high-end residential and rental properties.

Móng Cái Real Estate: The Ultimate Investment Destination

As Hanoi and other central urban areas grapple with overburdened infrastructure, rapid population growth, and shrinking land availability, real estate prices continue to soar. Consequently, investment capital is increasingly shifting toward promising provinces, with Mong Cai emerging as a standout destination.

Prime Fashion Streetfront on Chua Boc: For Rent, Still Commanding Over 1 Billion VND/m²

Chùa Bộc Street, Hanoi’s bustling fashion hub, boasts staggering property prices soaring above 1.2 billion VND per square meter.

The Emerald Garden View: Making Home Ownership in Ho Chi Minh City Effortless for Young Buyers

Amidst the soaring apartment prices in Ho Chi Minh City, reaching up to 87 million VND/m² in Q3/2025, many young individuals are struggling to find affordable housing. The Emerald Garden View emerges as a solution, offering units starting from 1.39 billion VND with flexible payment plans and a well-connected location. This presents an opportunity for homeownership, particularly for young singles earning 15–20 million VND per month.