Technical Signals of VN-Index

During the morning trading session on November 26, 2025, the VN-Index experienced a slight uptrend, forming a Doji pattern while testing the 50-day SMA.

The MACD indicator continues to rise and may cross above the zero line in upcoming sessions. If this signal occurs, the short-term outlook could improve.

Technical Signals of HNX-Index

In the morning session on November 26, 2025, the HNX-Index halted its decline after testing the previous low of 256-258 points.

However, the index remains below the Middle line of the Bollinger Bands, indicating lingering volatility risks.

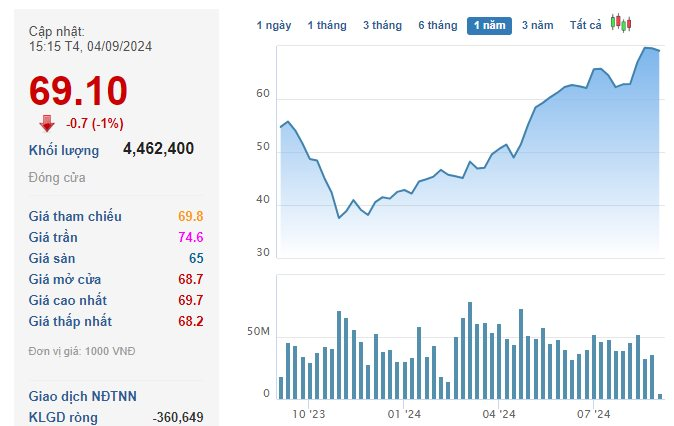

VPB – Vietnam Prosperity Joint Stock Commercial Bank

In the morning session on November 26, 2025, VPB shares rose, accompanied by a small-bodied candlestick pattern and increased trading volume, reflecting investor optimism.

The VPB price continues to oscillate around the Middle line, while the Bollinger Bands narrow.

Additionally, the ADX indicator is in the gray zone (20 < adx < 25), suggesting weak momentum. VPB is likely to experience continued sideways movement with alternating up and down sessions in the near term.

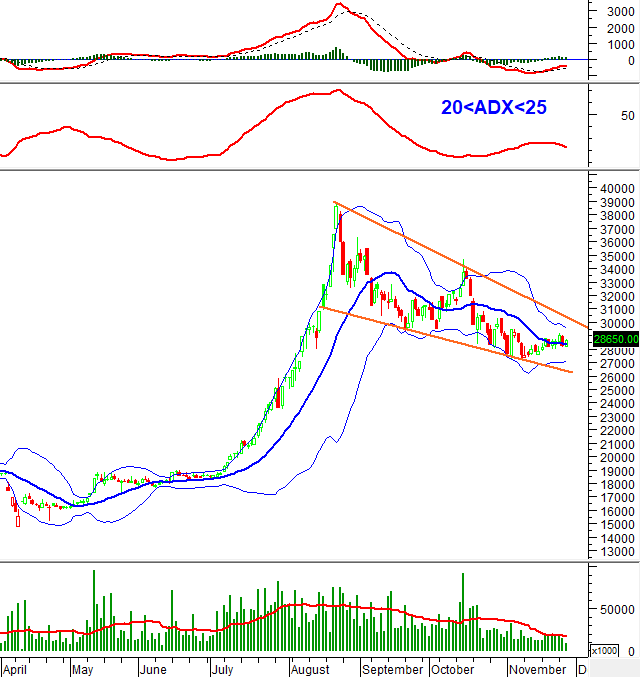

VSC – Vietnam Container Corporation

On November 26, 2025, VSC shares rose with increased trading volume, expected to surpass the average by session close, indicating bullish investor sentiment.

The MACD indicator continues to rise, approaching the zero line after a buy signal, despite the stock’s medium-term downtrend. This suggests VSC’s recovery faces challenges ahead.

Furthermore, the Death Cross between the 50-day SMA and 100-day SMA reinforces the negative medium-term outlook.

(*) Note: This analysis is based on real-time data as of the morning session close. Signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:00 PM, November 26, 2025

Market Pulse November 25: Heavy Pressure from Financial and Real Estate Sectors Pushes VN-Index Below Reference Level

As the trading session concluded, sellers executed a decisive move, pulling the index below the reference level. The VN-Index closed today at 1,660.36 points, down nearly 8 points. Meanwhile, the HNX-Index dropped by 4 points, settling at 257 points.

Vietstock Daily 26/11/2025: Is the Wind Shifting?

The VN-Index reversed its course, dipping after testing the 50-day SMA, signaling persistent selling pressure as it nears a critical resistance level. The Stochastic Oscillator shows early signs of weakening, and if a sell signal reemerges alongside the index closing below the 50-day SMA in upcoming sessions, the likelihood of a renewed corrective phase significantly increases.

Derivatives Market Update 26/11/2025: Bulls Losing Steam

On November 25, 2025, most VN30 and VN100 futures contracts declined during the trading session. The VN30-Index reversed its trend after three consecutive up sessions, forming a small-bodied candlestick pattern accompanied by increased trading volume that surpassed the 20-session average. This suggests a less optimistic sentiment among investors.

Afternoon Technical Analysis, November 25: Consistently Low Trading Volume

The VN-Index is experiencing modest growth, fluctuating around its 50-day SMA, while trading volumes remain consistently low. Meanwhile, the HNX-Index has entered its sixth consecutive losing session, with the MACD indicator signaling a renewed sell-off.